The U.S. economy created 156,000 jobs in August, falling short of the 180,000 number economists expected, while the unemployment rate edged higher to 4.4 percent.

Despite the miss, markets were higher at the open on Friday, and according to hedge fund analytics tool Kensho, stocks could rally through the month of September.

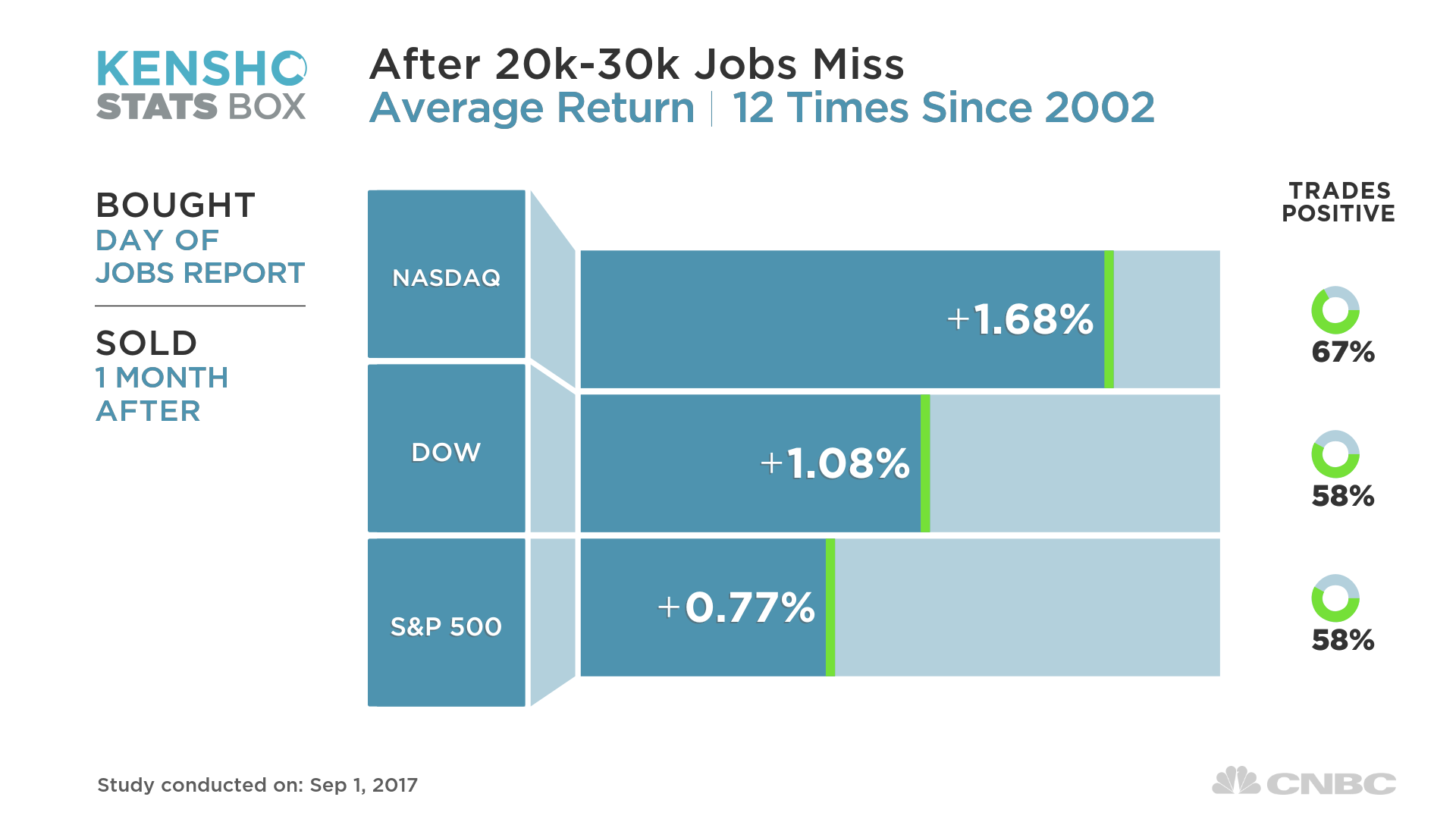

In the past, when the jobs report came up short of expectations in a range of 20,000 to 30,000 jobs, the Nasdaq tended to lead other indexes higher, gaining an average of almost 1.7 percent for the next month and trading positively 67 percent of the time. The jobs report has fallen short like this 12 times since 2002.

At the same time, the Dow Jones industrial average and S&P 500 tended to finish the next month higher 58 percent of the time, returning an average of 1.08 percent and 0.77 percent, respectively.

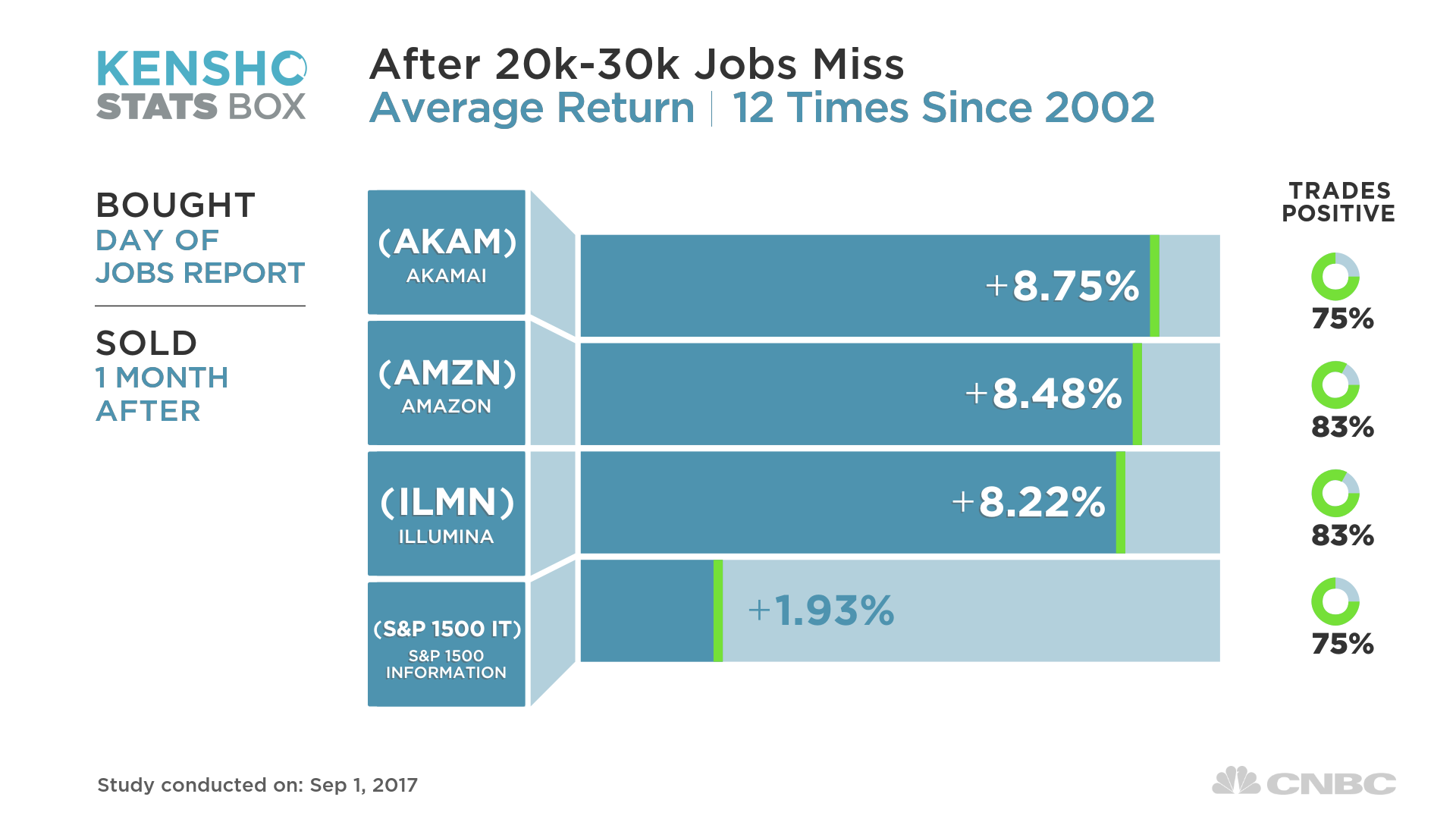

Tech stocks led the way higher during these periods, gaining 1.9 percent and trading positively two-thirds of the time. The top performing stocks in the Nasdaq 100 during these periods were Akamai, Amazon and Illumina.

Disclosure: NBCUniversal, parent of CNBC, is a minority investor in Kensho.

Source: Investment Cnbc

Friday's jobs miss could actually send stocks higher