Morgan Stanley reported third-quarter earnings Tuesday that topped expectations after its wealth management business posted strong results, while its fixed income and equities traders navigated a tough environment better than peers at firms such as JPMorgan.

The bank reported:

- Earnings per share of 93 cents versus 81 cents projected by analysts polled by Reuters.

- Revenue of $9.197 billion versus the expected $9.015 billion.

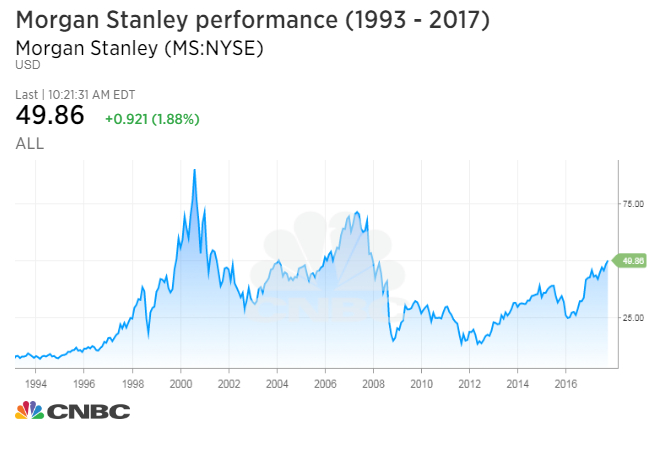

Shares jumped 2 percent to their highest since May 2008 after the report.

Morgan Stanley reported a nearly 9 percent increase in net wealth management revenue to $4.22 billion, slightly better than the $4.21 billion projected by FactSet.

Overall sales and trading revenue fell to $2.9 billion from $3.2 billion a year ago, an 8 percent decline.

Equities trading revenue was little changed. Fixed income trading revenues fell 21 percent to a slightly better-than-expected $1.2 billion from $1.5 billion. The bank attributed the decline to “subdued activity.”

In contrast, JPMorgan Chase reported an overall decline of 21 percent in trading revenue and a 27 percent drop in bond trading sales. Citigroup reported a 16 percent decline in fixed-income revenue, but a 16 percent increase in stock trading revenue. Bank of America posted a 22 percent drop in bond trading revenue.

Goldman Sachs reported earnings Tuesday that beat on both the top and bottom line. Fixed income, currency and commodities trading revenues fell 26 percent, better than feared.

“Our third quarter results reflected the stability our Wealth Management, Investment Banking and Investment Management businesses bring when our Sales and Trading business faces a subdued environment,” Morgan Stanley Chairman and CEO James P. Gorman said in a statement.

Gorman added in a conference call with analysts Tuesday that he doesn’t see significant gains ahead for the bank’s fixed income trading business. “We can’t project revenue outlooks for something that volatile,” he said. “We’ve got another quarter to go.”

Morgan Stanley also reported encouraging results within wealth management. The pretax margin rose to 26.5 percent from 23 percent in the third quarter last year.

Fee-based client account assets rose 4 percent to a record high of $1 trillion.

JMP Securities analyst Devin Ryan pointed out the increase in those accounts indicates the bank’s wealth management business will also grow in the fourth quarter.

It’s a “very good quarter despite the difficulties in the trading business and I think that says a lot about [the bank’s] resiliency and measures in their business model today,” Ryan said. He has an outperform rating on the stock.

Morgan Stanley shares are among the better-performing financial stocks in 2017. Shares are up almost 16 percent for the year and nearly 44 percent since the election.

Correction: This story has been updated to reflect Morgan Stanley’s fee-based client account assets rose to $1 trillion.

Source: Investment Cnbc

Morgan Stanley shares jump to 9-year high after earnings beat the Street on strong wealth management