One week ago, a full buffet seemed to open up in front of Wall Street’s underfed bears.

Stocks in Europe and Japan, leaders all year, were in sharp pullbacks and Chinese growth numbers fell a bit short. Prices for high-yield corporate debt, a key support for equities, were sagging and their yields rising from historically low levels. And the stock market, already expensive and perhaps over-loved, had itself entered a cautious phase in November — smaller stocks lagging, bank shares struggling, defensive sectors holding up the indexes, more new lows littering the tape.

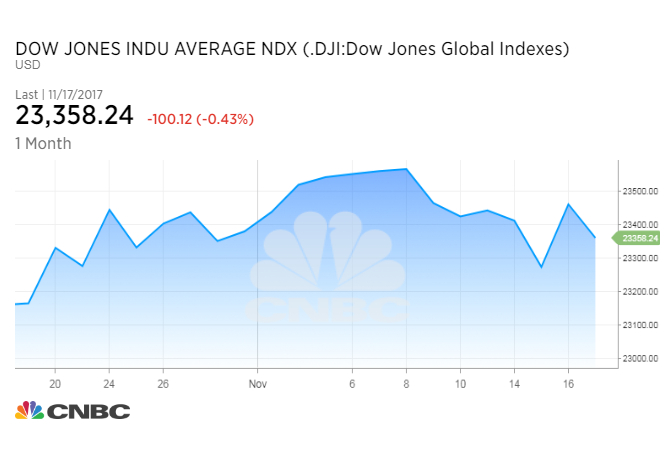

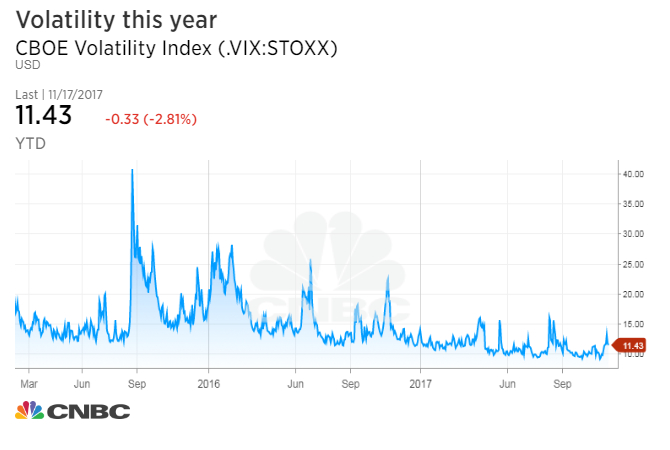

It all came together in some concerted selling that in most times would be a routine retreat from near record highs but in this calm, relentless rally passed for real downside drama: The Dow Jones industrial average fell more than 150 points two mornings in a row, the S&P 500 Volatility Index spurted to a three-month high and cash fled from the junk-bond ETFs that many watch as gauges of risk appetite and market equanimity.

Then, as quickly as the worry surged, it ebbed, with the bears managing no more than a morsel.

Wednesday, traders gorged on cheap upside bets to buy the dip, with more call options trading on the International Securities Exchange relative to puts than any time in the past five years, according to Dana Lysons of J. Lyons Funds Management. Thursday stocks and junk-debt bounced hard, the key indexes holding right at levels below which the chart folks would have started sounding alarms.

Why the bounce? Because it’s 2017 and that’s how the market acts this year. We’re on track to go an entire year without a 3 percent pullback for the first time since 1995. Economic data, especially on the industrial and housing fronts, came in strong. Overseas markets rebounded, banks got a lift as a hostile regulator exited, and Big Tech perked up again. Some of the bears’ favorite hunting grounds — old media and traditional retail — caught a furious bid on media-merger buzz and encouraging results from several big store chains.

So was that the bears’ last shot at a good feast for the year? It wouldn’t be surprising of this soft patch in the markets — less severe even than the stunted pullbacks of March and August — has run its course. Beginning this week, seasonal tendencies start turning in favor of stocks (though Thanksgiving week has been less strong during the current bull market). Sure, seasonal patterns haven’t been a great guide this year, but that’s mostly been when weakness is indicated, such as after May or in September and October.

And every study of prior market years that acted like 2017 leaves the benefit of the doubt with the bulls. Whenever the S&P 500 has made a record high in September, or posted seven straight months of gains, or been up at least 15 percent through October (all applicable now) the ensuing months of the year have a better-than-average tendency to rise more than the norm.

Veteran market technician Mark Newton of Newton Advisors, assessing the mid-week recovery, says, it “likely puts the near-term bearish case back on the back burner for now.” Newton has been emphasizing signs that the market could be vulnerable to waning momentum and other headwinds, but the market has refused so far to succumb. He now sees continued leadership from technology, and semiconductors in particular, as holding the key. The public seems to agree, for better or worse: Tech ETFs saw their two heaviest weeks of inflows the past two weeks.

One thing that has kept the market declines from gaining any momentum is that the market as a whole has not been blithely barreling higher. Correlations among stocks are near multi-decade lows, with many losers partially offsetting the winners. And the upside has been quite orderly and contained — the largest one-day gain this year of 1.38 percent is on track to be the smallest “best single day” of any year since 1964, according to Michael Batnick of Ritholtz Wealth Management.

Yet, even if last week was yet another fleeting wobble for stocks that quickly gives way to another run to record highs, the action showed how a real setback might unfold eventually. The tape grows ragged, with many stocks and sectors falling by the wayside as a narrower group of leaders rescue the indexes. Late-cycle characteristics surface here and there, such as pockets of souring corporate debt or profit-margin pressure from wage inflation. Overconfident investors get extended in a handful of trades and need to retrench. China gets the sniffles.

None of this might truly matter until 2018 corporate earnings forecasts are subjected to a true test. As long as the published projections of 11 percent further profit gains hold up for the first half next year and don’t start seeming to need the help of a big, immediate tax-cut effect, it’s tough to see the market failing in a dramatic way.

But fresh scrutiny might be cast on those 2018 expectations within the next few months, as a new Federal Reserve chair faces an economy running hot and financial conditions still inviting plenty of risk taking.

Source: Investment Cnbc

The bears may have missed their last chance to feast on 2017's stock market