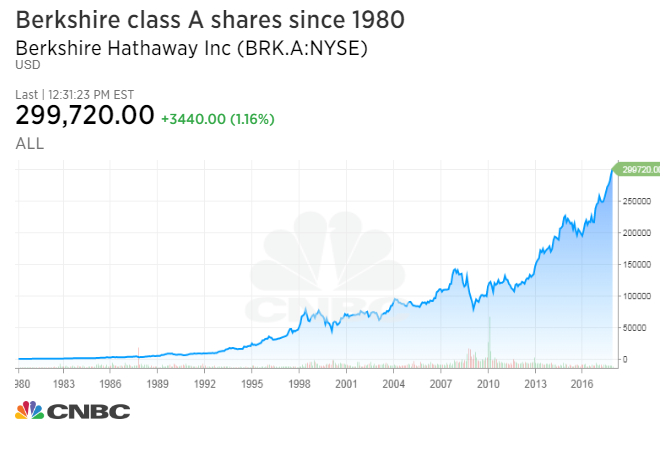

One “A” share of Warren Buffett’s Berkshire Hathaway will set you back about $300,000 as of Monday.

The conglomerate’s most expensive share class touched that milestone for the first time in the morning before dipping back. It closed trading on Monday at $299,360, up 1.04 percent. It has outperformed the S&P 500 this year — rising more than 22 percent versus the index’s 20 percent gain.

One share would get you roughly two of Tesla‘s most expensive car models available now.

If that lofty price makes you break out in hives, the company’s B shares closed trading at $199.34, also up around 22 percent for the year.

Buffett, the billionaire investor, has long refused to split Berkshire’s A shares, which are the world’s most expensive stock, saying he wanted long-term investors not short-term speculators. Earlier this year, CNBC reported that stock splits are on the decline lately.

Berkshire’s per-share book value rose 10.7 percent last year, the company told its shareholders in a letter earlier this year. Over 52 years, this measure has increased 19 percent annually.

Source: Investment Cnbc

Shares of Warren Buffett's Berkshire Hathaway hit 0,000 — each — for the first time