HEDGE-FUND managers may be feeling quietly smug about their performance in 2017. They returned 6.5% on average, according to Hedge Fund Research, a data provider, their best year since 2013.

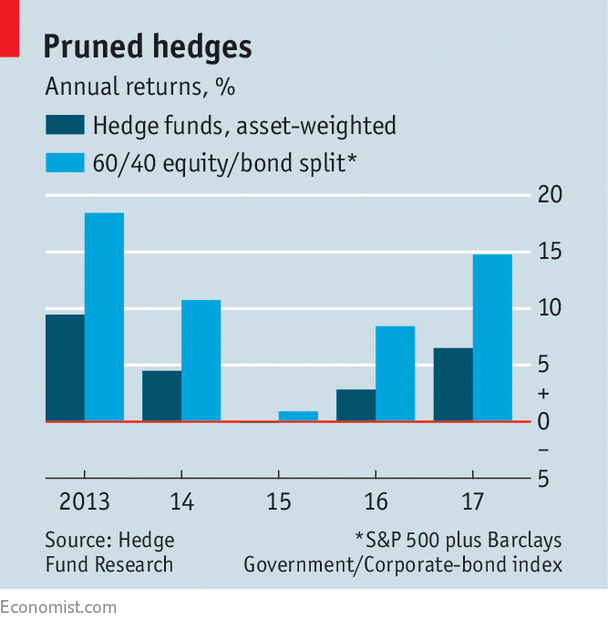

But those returns do not really suggest that they are masters of the investing universe. The S&P 500 index, America’s main equity benchmark, returned 21.8%, including dividends, last year. More tellingly, a portfolio split 60-40 between the S&P 500 and a mixture of government and corporate bonds (an oft-used benchmark for institutional portfolios) would have returned 14.8%. Last year was the fifth in a row when hedge funds underperformed the 60/40 split (see chart).

-

Are programs better than people at predicting reoffending?

-

How gender is (mis)represented in economics textbooks

-

Sri Lanka’s president is struggling to keep his promises of reform

-

Chechnya moves to silence Oyub Titiev, a courageous critic

-

The Bayeux tapestry is an intriguing symbol of post-Brexit co-operation

-

The rise and fall of bitcoin

That ought to be a salutary lesson for those institutions who think that backing hedge funds is the answer to their prayers. Despite the highs recorded by stockmarkets, many employers are struggling to fund their final-salary pension promises. In 2016 the average American public-sector plan was just 68%-funded, according to the Centre for Retirement Research at Boston College. In the private sector, multi-employer pension plans, covering workers in industries like mining and transport, have liabilities of $67.3bn and assets of just $2.2bn. Worse still, the insurance scheme established to back those schemes is on course to run out of money by 2025, according to the Pension Benefit Guaranty Corporation.

It is hard to cut workers’ benefits and painful to increase contributions. Schemes hope to square the circle by earning a high return from their assets; 7.5% is a common target. But bond yields are very low and equities are trading at very high valuations by historical standards. The temptation is to turn to “alternative assets”—a category that includes property, private equity and hedge funds.

The first two offer a genuine alternative. Property generates a stream of rental income and the hope that capital values will keep pace with inflation. Private equity is, in part, a bet that unquoted firms can generate higher returns than listed ones because they have more freedom to invest for the long term.

But what about hedge funds? A lot of funds specialise in equities or corporate bonds—the same assets that institutions own already. In some other categories, such as macro funds or merger arbitrage, returns are entirely dependent on the manager’s skill. Recent years do not suggest that hedge-fund managers display enough skill, on average, to offset their high fees.

Clients may think they will be able to pick the best hedge-fund managers, not the average ones. But one group of professionals—fund-of-fund managers—tries to do just that. They did manage to pip the average asset-weighted return of hedge funds in 2017, but failed to do so in any of the previous four years. If the experts cannot manage to pick the winners, why should a pension fund or endowment be able to manage the feat?

Another justification for placing money with hedge funds is that they are less likely to lose lots of money in a downturn. That argument was somewhat dented in 2008, when the average hedge fund lost 19%. In any case, pension funds and endowments are investing for the long term; they ought not to be that bothered by short-term volatility.

The Centre for Retirement Research conducted a study* of the effect of investing in alternative-asset categories on state and local-government pension-plan returns in the 2005-15 period. It found that schemes that placed an extra 10% of their portfolio in private equity and property had marginally increased the return on their portfolios (by around a sixth of a percentage point). But investing in commodities or hedge funds had reduced returns, with the latter knocking half a percentage point off the total.

Some investors have seen the light. CalPERS, a public-pension fund in California, announced that it was pulling out of hedge funds in 2014. But Preqin, an information provider, estimated last year that pension funds accounted for 42% of all money flowing into the global hedge-fund industry. North America provided the bulk of the money, with 776 pension schemes investing from that region alone.

Who knows what those schemes are trying to achieve? A few of them may be lucky enough to pick the best performers in the industry. But if they think, in aggregate, that their strategy will reduce their funding deficits, then they are suffering from a delusion.

* “A First Look at Alternative Investments and Public Pensions” by Jean-Pierre Aubry, Anqi Chen and Alicia Munnell, July 2017

Source: economist

The hedge-fund delusion that grips pension-fund managers