The U.S. government shut down on Saturday, and that could spell trouble for investors this week, history shows.

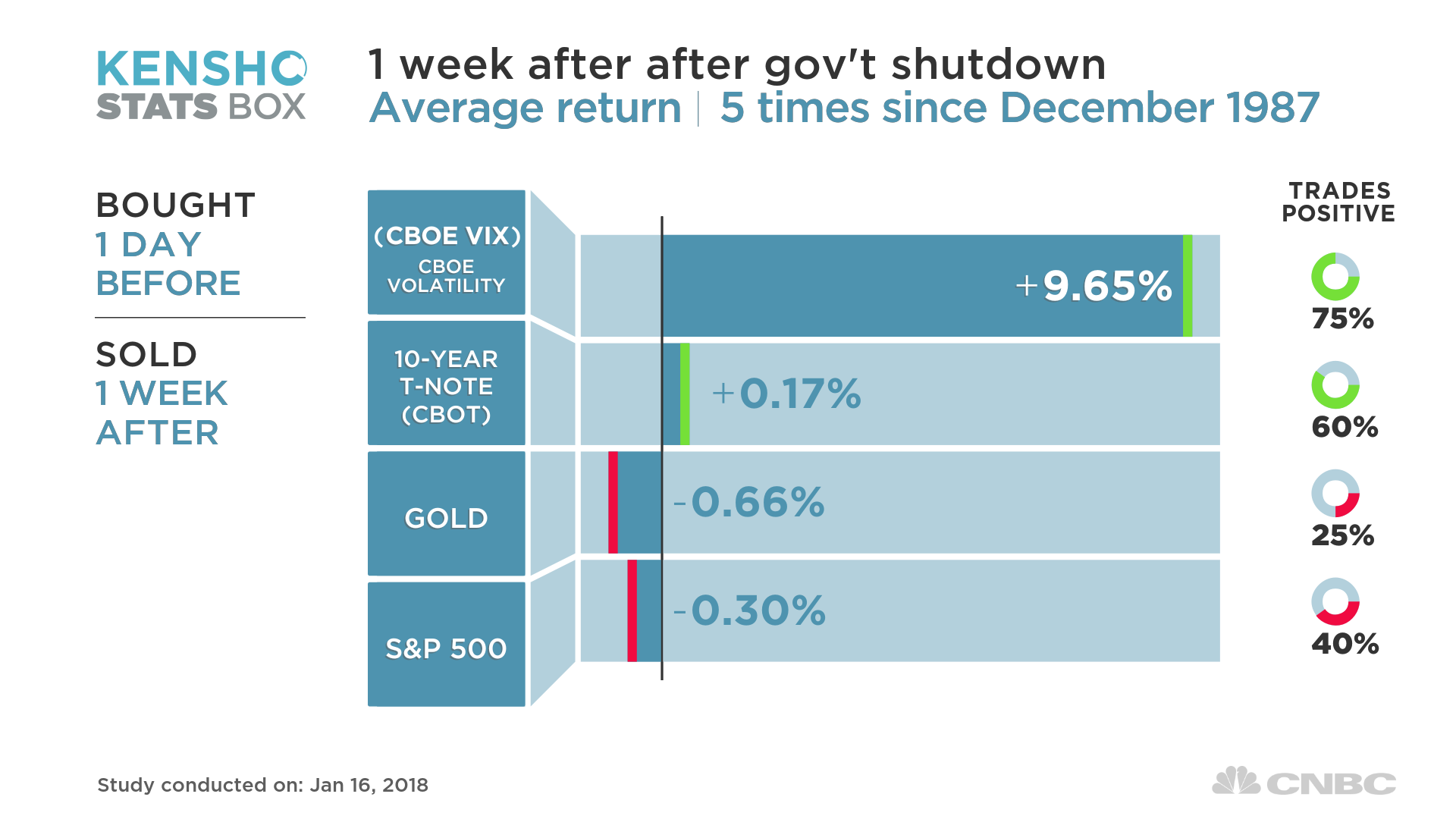

CNBC analysis using Kensho found that the S&P 500 fell an average of 0.3 percent one week after the government closed its doors. The benchmark index also traded positive just 40 percent of the time one week after a shutdown.

One of the best-performing assets one week after a shutdown has been the Cboe Volatility Index, also known as the VIX and considered the best gauge of fear in the market. It traded positive 75 percent of the time one week after a shutdown and averaged a return of 9.7 percent.

Stock futures pointed to a lower open on Monday. Dow Jones industrial average futures declined 49 points, while S&P 500 and Nasdaq 100 futures fell 1.5 points and 2 points, respectively.

Concerns of a shutdown increased volatility in stocks last week. Last Tuesday, the Dow erased a 283 point gain. The S&P 500 also saw its advances evaporate, closing 0.4 percent lower after rising as much as 0.8 percent in that session.

Congress needed to pass a spending bill by the end of Friday to avoid a government shutdown. A point of contention between Republicans and Democrats is an immigration bill that Democrats want to pass.

On Sunday, however, Republican lawmakers were getting behind a plan that would keep the government funded through Feb. 8. Meanwhile, some Democrats are preparing to give immigration concessions to the GOP.

This is the first U.S. government shutdown since 2013.

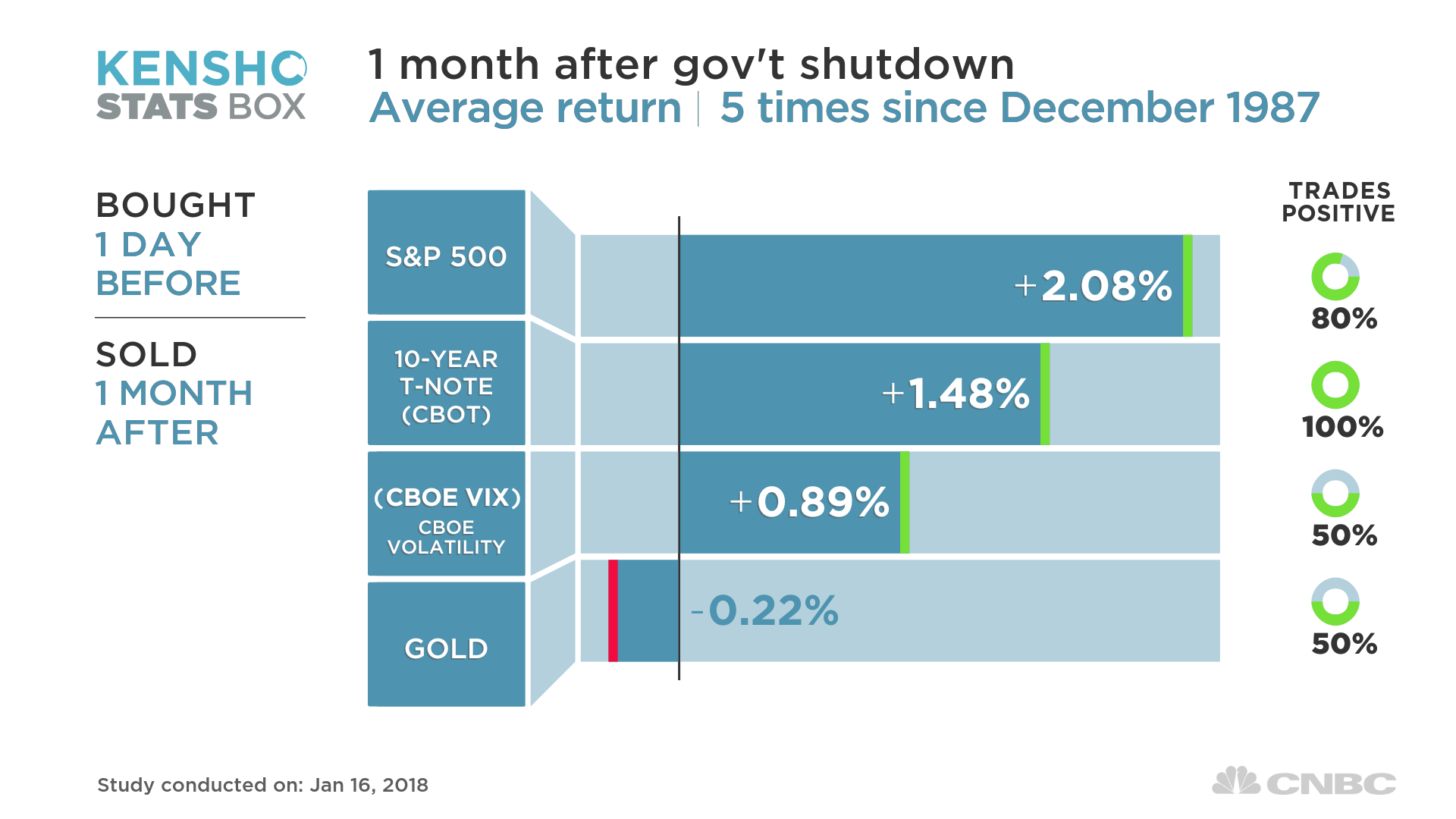

But the pullback in stocks after a government shutdown is often short-lived, history shows. The S&P 500 averaged a return of 2.1 percent a month after a shutdown and traded positive 80 percent of the time.

The VIX, meanwhile, averaged a return of just 0.9 percent a month after a government shutdown.

“Anyone with capital markets experience knows that US government shutdowns are largely meaningless in the context of financial asset values,” said Nicholas Colas, co-founder of DataTrek Research. “Getting sucked into a series of seemingly ominous headlines that smarter players already understand is a typical rookie trading mistake.”

Disclosure: NBCUniversal, parent of CNBC, is a minority investor in Kensho.

Source: Investment Cnbc

Shutdown could weigh on stocks this week, but then rally resumes, history shows