If Wall Street’s setback since January is indeed simply a routine correction in a still-vibrant bull market, the time is nearing for the market to prove it.

Last week’s resilient finish was a step in that direction, though the longer the process drags on the higher the bulls’ burden of proof.

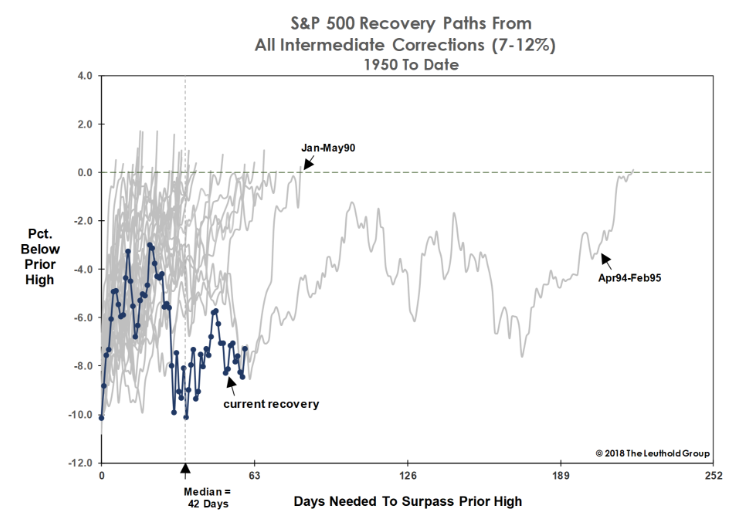

The drop from the Jan. 26 peak in the S&P 500 measured nearly 12 percent at its deepest and has now lasted almost three-and-a-half months. Monday is the 60th day since the the Feb. 9 low point, which qualifies as a long stretch for a mild correction to go without retaking most of the lost ground.

Shortly after the initial tumble that quickly followed January’s steep 7 percent surge, plenty of market observers pointed to a historical pattern showing that sharp drops from an all-time high tend to be recouped quickly. We’re a bit beyond the point of “quickly” by now.

Leuthold Group’s chief investment officer, Doug Ramsey, plotted the current path against other 7-percent to 12-percent declines in bull markets, which shows the sluggish, prolonged process still underway. “While old age alone may not kill a bull market, ‘morbidity’ climbs rapidly the longer a correction lingers,” Ramsey says.

The market has also worked itself into a corner, so to speak. The S&P 500 is now coiled tightly between lines running down from the January summit and the uptrend from the worst levels touched three months ago.

“Now we are reaching a point where something is going to have to give,” says Larry McMillan of the McMillan Analysis trading-advisory service.

This indecisive, stalled tape might be creating some suspense about whether something a bit more damaging is at work in this market retrenchment than a simple digestion of last year’s gains and a reset of valuations. Yet there are reasons to believe this choppy, churning phase will ultimately be resolved with a resumption of the market’s long-term climb.

For one thing, the rally that preceded this correction had generated near-record extremes to the upside, in terms of the technical “overbought” condition and frothy sentiment. It makes some sense that working off such excesses could take a bit more time than usual spent below the break-even line.

The one much longer-lasting modest correction on the above chart is possibly instructive. That was, like now, a period when the Fed was tightening and higher rates were working against strong corporate-earnings growth and improving consumer health. Many sectors, including small-caps, had a virtual bear market, but the major indexes stayed in a frustrating range for some 10 months.

There’s also a perverse comfort to be found in the ever-shifting story lines offered to explain the market weakness. First it was an inflation scare driving up Treasury yields, then an implosion of “short volatility” trades, then fears of a trade war and more recently worry over a peak in corporate-earnings growth. All of these concerns are plausible and do present possible restraints on the market. But the shifting explanation hints that this is mostly a valuation and sentiment adjustment to a world of slightly tighter monetary policy.

Julian Emmanuel, equity and derivative strategist at BTIG, thinks investor psychology is now subdued enough, with the market looking cheap enough, for some upside progress to begin soon. He writes in his new weekly dispatch:

“Whether measured by (lack of) bullish sentiment, spikes in put/call ratios, obsession with recession, inflamed inflation thoughts or the underwhelming response to a superb earnings season, investors are worrying. A lot… The ‘Wall of Worry’ has been a key to the market’s climb since 2009. That Wall crumbled in a rush of enthusiasm in January 2018. We believe the Wall has been rebuilt and may be fortified by geopolitics in the months ahead.”

The process of “fortifying” a wall of worry means finding more things to fret over, of course, which could include the summer segue to the mid-term elections. But ultimately, with the economy and credit markets in decent shape, such a strong wall becomes the foundation for another market advance.

The market late last week offered some tentative hope, with the Dow rebounding more than 700 points from a Thursday-morning selloff through Friday. The indexes have now spent most of the past few weeks in the very lower end of their 2018 range, yet refuse to buckle. The Cboe Volatility Index has remained quite tame, suggesting firmer footing underneath the tape. Technology has remained a leadership group.

Even taken all together, these encouraging factors don’t carry the market out of the woods. It has become a less-generous, more selective market, easier to rattle and harder to please than the 2017 version was.

Still, for all the anxiety and confusion kicked up in this drawn-out correction, the market is simply back to levels first hit last Thanksgiving and is still clinging both to its long-term uptrend and —for now, barely — the benefit of the doubt.

Source: Investment Cnbc

How the market's choppy, churning phase should give way to another climb