Veteran analyst Dick Bove is about to put some skin in the game as an activist investor in the banking industry.

After a career in financial services that has spanned some 53 years, his new adventure will see him switch to strategist for a Hilton Capital Management effort that seeks to capitalize on what he sees as a major opportunity.

That comes amid a friendlier regulatory environment and a shift in monetary policy that will see the flow of money slow and interest rates rise. The result, he said, will be a big opportunity for deal-making as well as other chances to make money in a new phase of growth for real estate.

“All the people who are enormously anti-bank and pro-regulation are gone,” the Florida-based Bove said during an interview at the New York offices of Rafferty Holdings, the holding company for Hilton Capital. “We are going into a golden age of banking.”

This is not, however, a golden age for bank analysts.

A turn to passive investing, in which investors use exchange-traded funds to track indexes rather than individual stock selection, has made times tougher for sell-side professionals on Wall Street. Many big institutions have dramatically cut what they’re paying for analysis, and the trend is likely to continue.

For Bove, that climate presents an opportunity to put his long-held ideas to work.

Normally bullish on the banking sector, Bove in recent years has complained that investors are misunderstanding what drives the industry.

While many in the market have focused on the benefits that rising interest rates should bring to banking, Bove sees that as misplaced. Rather, he expects the best opportunities coming for banks that will be able to provide funding at a time when the money supply will be tightening.

He also is against banks using large portions of their earnings toward share buybacks, advocating instead that they should be investing in their businesses and focusing in selling rather than financial engineering.

“I’ve got all these ideas and theories about how money should be invested in the banking industry,” he said. “I’m always flipping out about what I think are incorrect views in investing in banks. I want to prove that these theories are correct in a very tangible fashion.”

That philosophy will drive the activist position that he and Hilton will take. He doesn’t envision taking hostile positions or trying to pack boards with appointments, but rather will look for cooperative arrangements to improve performance.

“I’m going to be putting my money where my mouth is,” Bove added.

Specifically, they’ll be looking for both acquirers and institutions ripe to be taken over. Banks that have been active in takeovers have largely outperformed their peers during this decade, and the action hasn’t always come from the industry’s most well-known names.

For example, Pinnacle Financial Partners, which has completed 12 acquisitions, has seen a compound annual growth rate of 28.6 percent from 2012-17, third-best in the industry. Another, Glacier Bancorp, has done nine deals and boasts CAGR of 21.8 percent.

Those are the kinds of companies Bove’s new venture will seek.

“There are way too many banks in the U.S.,” said Abbott Cooper, senior portfolio manager at Abbott and part of the Bove venture. “There are chances to buy great banks for great prices.”

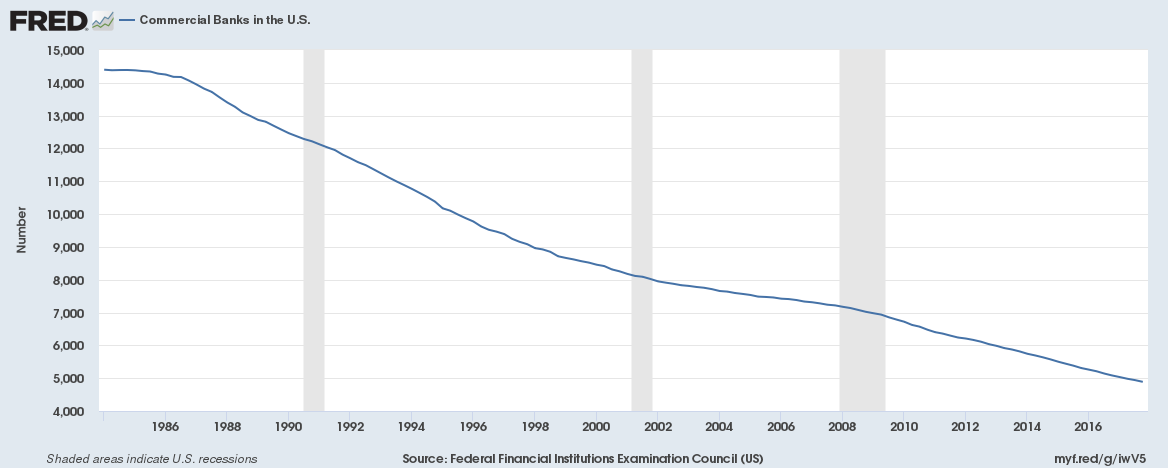

That philosophy comes even though the total number of commercial banks in the U.S. has fallen by about a third since the beginning of 2008, when the financial crisis hit in full force. There currently are 4,888 banks, down from a peak of more than 14,000 back in 1984.

In addition to looking for acquirers, Bove said focusing on geography has worked well, with banks in the Southwest and Midwest also performing especially well. That approach, too, will be part of the activist investing thesis for the Hilton team.

Bove and Cooper are out raising money now to put that thesis to work. They don’t plan to start a fund right away, though that could happen later.

“What is actually shocking here is that the attitude towards acquisitions has completely changed in the past generation,” Bove wrote in a presentation to investors. “No longer do pundits argue that acquisitions do not work. No longer do they suggest that households do not want to do all off their financial transactions in one place. No, now the game is buy the buyers.”

Source: Investment Cnbc

Longtime analyst Dick Bove is now an investor in what he calls a 'golden age of banking'