FEW banks can match the quaint serenity of Banco Delta Asia’s headquarters in Macau. Housed in a pastel-yellow colonial building opposite a 16th-century church, its entrance is flanked by tall vases, depicting sampan gliding between karst hills. In the tiled square outside, men laze under a banyan tree and an elderly woman peels a boiled egg for lunch.

But in 2005 this backwater bank incurred the wrath and might of the world’s financial hegemon. America’s Treasury accused it of laundering money for North Korea, prompting depositors to panic, other banks to keep their distance and the Macau government to step in. The Treasury subsequently barred American financial institutions from holding a correspondent account for the bank, excluding it from the American financial system.

-

The effect on European companies of American sanctions on Iran

-

A record of ancient Rome’s economy turns up in a glacier in Greenland

-

Our relationship with teeth is uneven, messy and grim

-

North Korea reminds the world why past peace talks have failed

-

Legalising sports betting in America has more winners than losers

-

The ironies of George Soros’s foundation leaving Budapest

Macau is over 8,000 miles from Washington, DC. But it is hard to escape the long arm of the dollar. Its dominance reflects what economists call network externalities: the more people use it, the more useful it becomes to everyone else. One person’s willingness to accept dollars from another depends on a third person’s readiness to accept dollars from them.

The dollar also benefits from a hub-and-spoke model for the exchange of currencies, the invoicing of trade and the settlement of international payments, as the late Ronald McKinnon of Stanford University argued. If every one of the more than 150 currencies was traded directly against every other, the world would need over 11,175 foreign-exchange markets. If instead each trades against the dollar, it needs only 149 or so. If you cannot buy the afghani with the zloty, you can still sell one for dollars with which to buy the other.

Likewise, if every international bank keeps an account in New York, any bank can transfer funds to any other through the same financial hub. “The global financial system is like a sewer and all of the pipes run through New York,” says Jarrett Blanc of the Carnegie Endowment for International Peace.

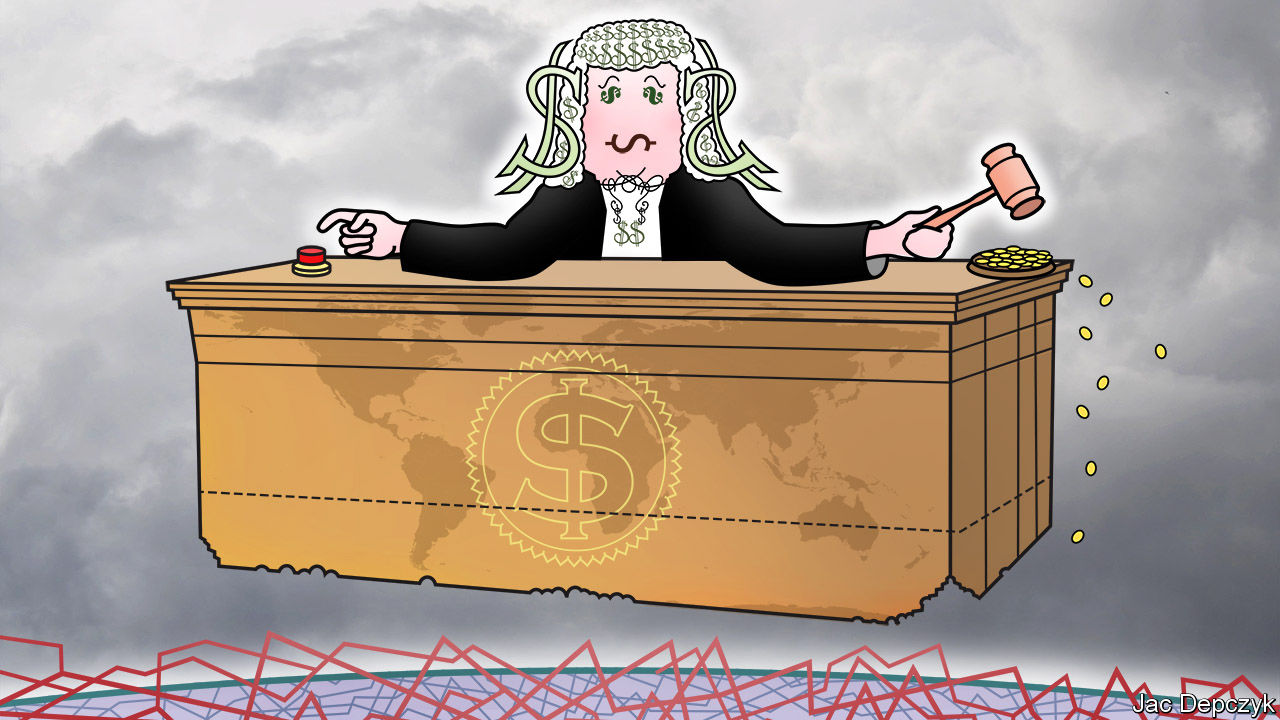

This gives America’s Treasury great punitive power and jurisdictional reach. Many companies that do not buy or sell wares in America nonetheless make or collect payment through New York. Because these transfers pass through American financial institutions, the Treasury can claim jurisdiction on the ground that its banks are exporting financial services to the bad guy. It can also hit companies where it hurts. For many, exclusion from America’s financial system is a more potent threat than exclusion from America’s customers. Last month, for example, the Treasury threatened to seize dollars paid to Rusal, a Russian metals firm that is one of the world’s biggest aluminium producers, crippling it and upending the global aluminium market, until the turmoil forced a rethink.

The Rusal debacle and President Donald Trump’s decision to withdraw from the Iran nuclear deal have raised fears that America might abuse its power. That may prompt foreign governments and financial institutions to think about rerouting the sewer.

Not all dollar settlements are subject to American jurisdiction. It is, for example, possible to clear large dollar payments in Tokyo, Hong Kong and elsewhere. But the pipes are narrow. America’s two big payments systems, Fedwire and CHIPS, handled transactions worth $4.5trn a day in 2017. Hong Kong’s system (which runs through HSBC, a private bank) dealt with only 0.8% of that amount. Moreover, the ability of offshore dollars to enter and leave the American financial system if necessary is vital to their appeal. The liquidity of Hong Kong’s system, for example, is buttressed by HSBC’s ability to handle dollars in New York.

China is nurturing its own international payments system, based on its own currency. It might ask Iran to accept the yuan in exchange for its oil. Certainly, America’s withdrawal from the Iran deal has increased trading in the yuan-denominated oil futures contract that China recently launched in Shanghai. Likewise, Russia and China are increasingly paying each other for goods in their own currencies, rather than America’s. Russia paid for 15% of its Chinese imports with yuan last year, according to Russia’s central bank (as cited by Russia Today, a broadcaster).

China’s capital controls and Europe’s fiscal balkanisation weaken their currencies’ claims to rival the dollar. But since China’s economy seems destined to overtake America’s, it would be strange if its currency forever lagged far behind. And although neither economic bloc is yet ready to match America’s position in the financial system, they might be able to build a set of financial pipes big enough to sustain trade with blacklisted Russian companies or a country like Iran. Previous treasury secretaries took the danger seriously. “The more we condition use of the dollar and our financial system on adherence to US foreign policy, the more the risk of migration to other currencies and other financial systems in the medium term grows,” said Jacob Lew in 2016.

Closing the sluice gate

Steering clear of American jurisdiction is not quite the same as escaping American power. Even if no payments cross American territory, America could still impose extraterritorial or “secondary” sanctions, refusing to do business with a company that does business with a blacklisted party. To blunt that threat, foreign governments would then have to foster banks, suppliers and customers that can live entirely without America.

Banco Delta Asia, for its part, has survived America’s onslaught, with the help of Macau’s government. It has yet to convince the Treasury to lift the ruling that stops it gaining access to America’s financial system. But it is not completely cut off from the dollar. At one of its bigger branches, your correspondent was able to sell 820 patacas for a crisp $100 note, bearing the signature of a former secretary of the Treasury.

Source: economist

The long arm of the dollar