Investors should sell Chipotle Mexican Grill shares given a lack of clear innovation in the near-term, according to one analyst, and limit any upside for the already recovered stock.

Mizuho downgraded the burrito chain’s stock to underperform from neutral Tuesday, encouraging clients to curb exposure until it’s clear chief executive Brian Niccol can replicate the success he had at Taco Bell.

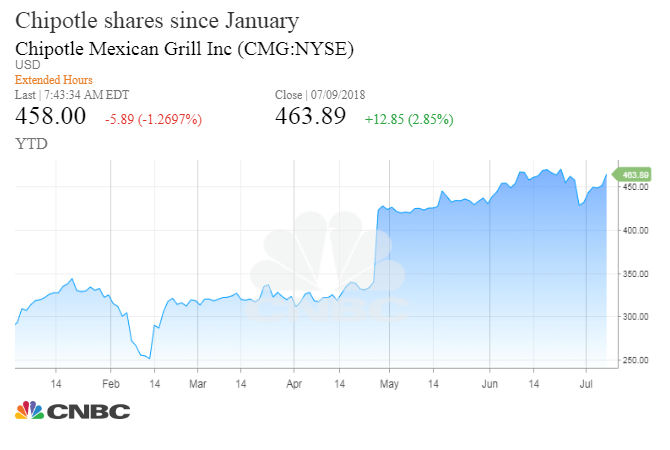

“While it is our view that Niccol is the best choice to lead Chipotle from here, in the absence of clear catalysts that can justify significant earnings upside, we’re compelled to recommend investors reduce their risk,” analyst Jeremy Scott said in a note Tuesday. “After an 80 percent run since Niccol’s appointment as CEO, we believe the stock currently prices in an aggressive recovery in both comps and margins.”

Chipotle did not immediately respond to a request for comment.

Niccol, whose appointment as Chipotle CEO earlier this year caused a one-day spike in the company’s stock, arrived at company fresh from three years at the helm of Taco Bell. Many in the Chipotle board room hope the new executive can recapture millennial diners with inventive menu options and digital innovation, having previously introduced mobile ordering and payment across Taco Bell’s 7,000 locations in the U.S.

Niccol, whose appointment as Chipotle CEO earlier this year caused a one-day spike in the company’s stock, arrived at company fresh from three years at the helm of Taco Bell. Many in the Chipotle board room hope the new executive can recapture millennial diners with inventive menu options and digital innovation, having previously introduced mobile ordering and payment across Taco Bell’s 7,000 locations in the U.S.

Much of that hope may already be reflected in the stock’s 80 percent rally since Niccol’s appointment, Mizuho’s Scott argued, with new management facing a tough research and development process and a customer base still wary after the company’s “jumpy” roll-out of queso last year.

“We’re certainly not downplaying Niccol’s impressive track record in his three years leading Taco Bell, where much of his success can be attributed to his embrace of experimentation,” Scott added. “However, a ramp in innovation will likely raise concerns around long-term margins due to incremental investment in labor, training, marketing and technology upgrades.”

Scott did note the company’s plans to launch a loyalty program in 2019 and that management has a temporary “hall pass” with investors on comparable sales and profit margins at least through 2018, two positive factors that could pose a risk to his downgrade.

He also added that there are “few clear short-term downside catalysts” and that the new management could still surprise Wall Street with novel ideas and a strong marketing campaign.

Still, shares of the Denver-based chain fell 1.2 percent Tuesday following the Mizuho downgrade, though shares remain up more than 58 percent so far this year. Chipotle is scheduled to report second-quarter earnings on July 26.

Scott expects the company to post non-adjusted earnings per share of $2.83 for the quarter and $8.40 for 2018.

Chipotle shares fall after downgrade to sell