Using , Experian, TransUnion and you will Equifax can give most of the You.S. users totally free each week credit reports through AnnualCreditReport so you can include debt fitness within the sudden and you will unprecedented hardship caused by COVID-19.

In this article:

- What is a made House?

- Professionals of purchasing a made Household

- Disadvantages of shopping for a produced Household

- Are you willing to Rating a loan for a made Home?

- Is a created Home Good for you?

An average price of a unique family regarding the You.S speedycashloan.net loans with no job. contacted $five hundred,one hundred thousand in the , with respect to the Federal Set-aside. It has some create-become people provided a cheaper alternative: are manufactured home, which the Are formulated Houses Institute rates so you’re able to prices an average of $87,one hundred thousand.

Were created property can be produced way more affordably because they are tend to mass-built in industrial facilities then moved from a single spot to various other. Prior to purchasing a produced household, although not, you will know its pros and cons, money choices and possible additional costs.

What is a created Household?

Manufactured residential property have been in existence for a long time, nevertheless U.S. Service of Construction and you will Urban Advancement (HUD) did not begin managing them up until 1976. One warehouse-dependent home built just after June fifteen, 1976, that fits HUD structure and safeguards direction is a made home. Factory-based land created before 1976 are usually titled mobile property, even in the event that identity is normally made use of interchangeably having are available property.

Are built residential property have to be built on a great wheeled frame one will get removed in the event that residence is gone to live in their permanent webpages. It distinguishes them regarding standard homes, that are in addition to factory-built, but are manufactured in sections and built into the a long-term basis at the home website. A made house can be put yourself home otherwise into the hired result in a manufactured home people.

The present are built house usually are tough to distinguish of a traditionally built domestic. You can pick numerous flooring arrangements and you will include porches, garages and you may decks. Keeps range from wood-burning fires, health spa restrooms and you may large-avoid kitchens.

Advantages of getting a produced Household

- Cost savings: Typically, are manufactured residential property costs $57 for every single square foot, than the $119 each ft for new usually created residential property. Are created belongings fulfill HUD standards to have energy efficiency, cutting electricity will cost you, also.

- Production rate: Cellular house are formulated for the a factory so you can uniform HUD criteria. In place of usually created residential property, framework will never be delayed of the poor weather or complications with zoning and it allows.

- Mobility: If you’d like to disperse, you might be in a position to bring your manufactured home-along that have your.

- Usage of places: Particular are made domestic areas feature use of amenities for example pools, recreation room or to your-webpages gyms.

Downsides of getting a manufactured Domestic

A created house toward a long-term foundation on the house is also be classified since the real estate and financed that have a home loan. You can loans precisely the house otherwise the house and you will the latest belongings it takes up.

But manufactured house on the rented residential property, particularly mobile home parks, are believed private possessions and really should be funded that have good chattel mortgage. Chattel finance are used to fund movable gizmos, such as for instance tractors or bulldozers; the machine (our home in this situation) serves as security. Chattel loans normally have higher rates of interest and you will minimal user protections compared to mortgage loans. Signature loans, which can be used for your mission, may also funds a produced domestic. Such as for instance chattel financing, signature loans will often have highest rates than simply mortgage loans.

Are available house which can be categorized due to the fact real property and you can see certain almost every other standards meet the requirements having mortgages courtesy Federal national mortgage association and Freddie Mac. They may along with be eligible for are built lenders supported by brand new Veterans Administration, You.S. Service from Agriculture and you will Reasonable Homes Government (FHA). New FHA actually promises mortgage brokers to possess manufactured house classified since personal property.

The credit get must financing a created home varies founded into the lender, the mortgage proportions additionally the worth of the brand new security. As a whole, yet not, it’s harder to invest in are designed property than just old-fashioned house. A survey of the Consumer Finance Security Agency receive less than 30% regarding are manufactured home loan apps is actually recognized, compared to more 70% out of loan applications having website-established homes.

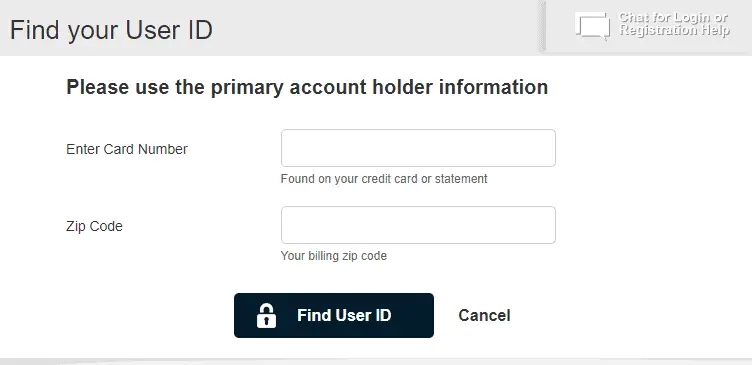

Before money a manufactured house, rating a copy of the credit file off each one of the about three big credit bureaus during the AnnualCreditReport. Look at your credit history and take steps to alter your own get if required, such as for example getting late profile most recent and you will paying down loans. Make sure to look around and you can contrast the loan options in advance of making the decision.

Is actually a made Domestic Effectively for you?

A created household would be an affordable homeownership option, but it’s important to accept the risks. You’ll have even more options for financial support a made house for folks who own or pick belongings to accommodate they. If you intend so you’re able to rent space when you look at the a cellular family park, be sure to learn your financial obligations and have now book plans in writing.