When you see a HELOC, you can probably spend an origination charge. It might be a nominal count, such as for instance $fifty to have an effective $10,100 credit line. With respect to proportions, that is nonetheless .5% for this first year…even if you avoid it.

As well as, possible pay a higher rate than most of your mortgage. This is because the HELOC is a holiday loans on first financial. This means that, in the event the domestic goes into foreclosures, much of your bank is first in range as reimbursed. Your HELOC financial would-be paid back only following the no. 1 financing is paid off. They costs even more for that additional risk.

Likewise, HELOCs usually are associated with the top interest rate. To phrase it differently, just like the interest rates go up, so really does your HELOC speed. This is really important to keep in mind…you cannot think that you may be spending the present rates to own tomorrow’s crisis. While the sort of person who wants to work with brand new numbers, you may find this change alone you may toss you from. Big style.

HELOC Area #2: May possibly not be there when you need it.

HELOCs are linked with…domestic collateral. This might voice user-friendly, however it is an essential thought when you are planning for the near future. Although home prices basically raise over the years, they won’t do it into the a straight line. When pricing get a bump, you to definitely hit individually impacts domestic collateral.

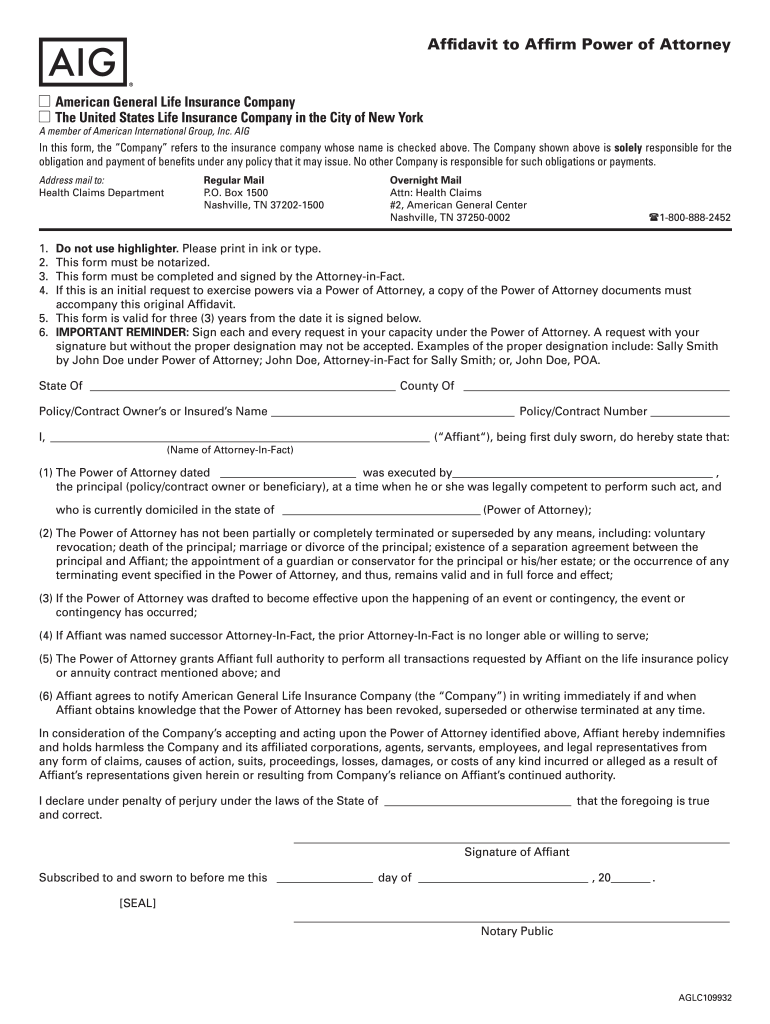

Why don’t we get a typical example of good hypothetical couple, Tap & Morgan. Their number, straight from an effective Bankrate article, is actually lower than:

Pat and Morgan ordered a home in for $172,000. It produced an effective 20% advance payment and you may refinanced they three years afterwards. From inside the , it removed a house guarantee credit line.

One ten% drop home based costs removed $15,200 within the borrowing from the bank fuel! Note: New HELOC age as decrease in home worth as the you are simply credit facing 80% of it ($19,one hundred thousand x 0.8 = $15,200).

HELOC Section #3: Easy come, effortless wade.

Doesn’t it search that in the event that you really works very hard and you may conserve up to own a large buy, you then appreciate it this much a great deal more? Conversely, without having to function because the difficult, then chances are you never value it much.

Believe needing to cut $five-hundred per month getting 60 days to arrive a beneficial $29,100000 coupons objective. You are probably attending just take good proper care of the money which you accumulated more five years. At least, you will likely getting quite traditional in terms of what represent an emergency. As well as the an excellent designs you molded while you are reaching their discounts mission helps to keep your focused.

At the same time, imagine https://paydayloancolorado.net/dakota-ridge/ signing certain documents, and you may 1 month after, you have use of you to definitely exact same $30,one hundred thousand. Today, emergencies’ appear so much more. Settling the financing cards becomes something you should do while the a matter of desire-price arbitrage. Without having a fixed budget, you have to pay what you can’ monthly. This may well not ever before make you pay your own personal debt. Otherwise take care to know in which your finances goes, an excellent HELOC might not be attending help you in the latest longer term.

As to the reasons Emergency Coupons Nevertheless Amount

![]()

You might summy. As the chatted about in my own early in the day liquidity article, a multiple whammy happens when three outside things hit your inside a comparatively limited time. This is people about three things that cover your finances: family members demise otherwise burns, crash, dropping employment, long-name issues, etcetera. For those who have a safe work, you might not love shedding your revenue. However, an unexpected jobs losings may cause financial difficulties… that’s two parts so you can a multiple whammy. All you need is an accident or unexpected disaster to help you throw you away from song. That is where the difference between that have discounts and you may good HELOC really things.