U.S. Treasury Secretary Steven Mnuchin may have cautioned that the stock market will drop if tax reform is not passed, but CNBC’s Jim Cramer isn’t buying it. “Look, I appreciate [that] he’s trying to get Congress motivated, but just on the facts, I think he’s quite wrong. The truth is, most executives don’t believe tax […]

Read moreVoters worried that Congress and the White House can’t tame federal borrowing may be overlooking another big debt bomb closer to home. States are falling further behind in the money they owe public employee pension funds, leaving taxpayers on the hook, according to the latest analysis from S&P Global Ratings, which tracks state debts. Despite […]

Read more

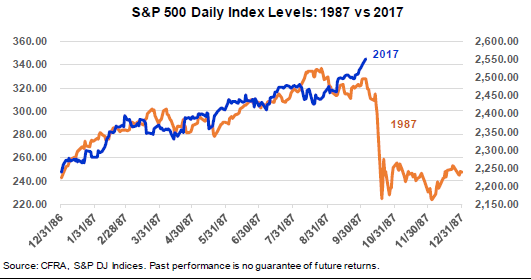

The S&P 500’s daily price chart this year looks “eerily” like that of 1987, but that’s about the only similarity between the market then and now, one of Wall Street’s longtime market strategists pointed out. “Indeed, when comparing the daily index levels for the S&P 500 in 1987 with the progression thus far in 2017, […]

Read more“Big Blue” is having a big week. Shares of IBM surged over 9 percent on Wednesday after the company reported better-than-expected earnings. The move lifted the Dow to record highs and would represent the most positive earnings reaction for the tech giant since 2002. It would also mark only the third time in the last […]

Read more

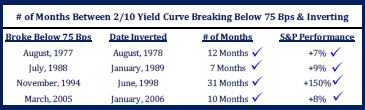

The bond market is warning that trouble could be on the horizon, either from an economic slowdown or an eventual recession. The yield curve, a set of interest rates watched closely by bond market pros, has gotten to its flattest level since before the financial crisis. The spread between 2-year note yields and 10-year yields […]

Read moreThe slippage in the U.S. 10-year Treasury yield may reflect investors’ expectations of slower long-term domestic economic growth rather than looser financial conditions, Dallas Federal Reserve President Robert Kaplan said on Wednesday. “That is not a sign of easy financial conditions,” he said of the benchmark U.S. yield which has fallen nearly 10 basis points […]

Read moreWith stocks notching new highs like clockwork — and some experts calling the market “frothy” and pointing to signs of a market top — some investors might be considering taking money off the table. Not so fast, advisors warn. “People make bad decisions when they go to cash,” said Scott Bishop, head of financial planning […]

Read moreOPEC members are reportedly forming a consensus around extending their production cutting deal with other crude exporters by nine months, a move that would help to put a floor under oil prices. That would prolong the agreement among OPEC, Russia and other oil-producing nations to keep 1.8 million barrels a day off the market through […]

Read moreThe difficult year for Under Armour shareholders will improve due to a new sneaker launch, according to one Wall Street firm. Jefferies reiterated its buy rating for the sports apparel company’s shares, predicting Under Armour’s latest Stephen Curry product will be a big hit. “A phased launch, tighter allocations, fewer colorways and easy comps versus […]

Read moreAnalysts at Citi upgraded shares of Dow-component Merck to buy from neutral, noting they expect strong sales from its Keytruda drug. Keytruda is an immunotherapy drug used in cancer treatments. Citi increased its peak Keytruda sales forecast on the drug to $16 billion from $9 billion. “Merck’s success with Keytruda has clearly outperformed our initial […]

Read more