Shares of Caterpillar were under pressure Friday after a Deutsche Bank analyst downgraded the stock.

Nicole DeBlase lowered her rating on Deutsche to hold from buy and cut the price target to $106 from $121, as she raised questions about whether the Trump administration will be able to move forward with its infrastructure plan. The target implies a 2.1 percent gain from Thursday’s close.

“Without an infrastructure stimulus, we see little prospects for continued [North America non-residential] construction growth,” DeBlase said in a note Friday, adding she has “no idea if/when infrastructure stimulus may materialize.”

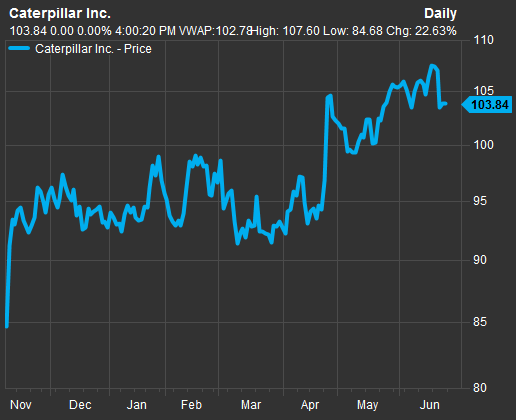

Caterpillar’s stock spiked higher after President Donald Trump‘s election on hopes that the new administration would be able to push through a $1 trillion infrastructure spending plan.

Caterpillar shares since Nov. 8

Source: FactSet

The downgrade pushed Caterpillar shares lower by more than 1 percent before the bell and knocked Dow Jones industrial average futures into negative territory.

“We spent a lot of time considering other potential sources of positive earnings revisions, and were unable to gain conviction in a robust recovery,” DeBlase said.

Source: Investment Cnbc

Caterpillar downgraded as analyst has 'no idea' if a Trump infrastructure plan is even coming