Snap shares could fall below its IPO price in coming weeks, if historical trends hold true.

Shares of the Snapchat parent closed Monday 29 cents above the stock’s initial public offering price of $17 a share. The move comes about a month before many insiders who hold shares of the Snapchat parent can begin selling their shares at the expiration of the first lockup period on July 31.

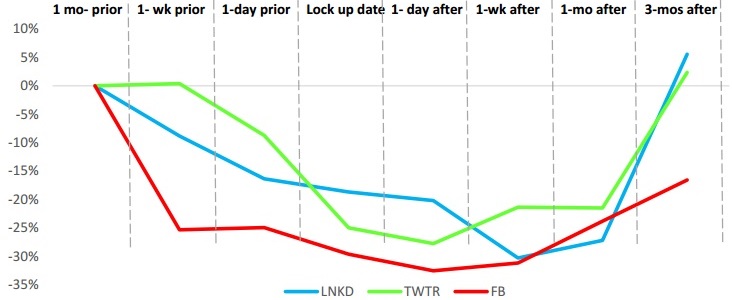

Looking at other social media giants, Facebook, Twitter and LinkedIn each fell an average of 24 percent in the 30 days ahead of their lockup expirations, MKM Partners managing director Rob Sanderson said in a Monday report.

In contrast, the Nasdaq composite fell an average 0.4 percent over that time, he said.

Performance of comparable IPOs into their lockup periods

Source: MKM Partners, FactSet

Losses typically accelerated in the week ahead of the lockup expiration. Facebook, Twitter and LinkedIn declined an average 14 percent, while the Nasdaq rose 1.1 percent on average, Sanderson said. Microsoft bought LinkedIn last year.

MKM did not participate in Snap’s IPO and does not have any recommendation on Snap shares.

Snap short interest, or bets that shares will decline, has increased by more than 65 percent in the latest two-week reporting period ended May 31, Sanderson said.

Similarly, short interest increased in Facebook, Twitter and LinkedIn in the two weeks ahead of their lockup expirations, according to the report:

Facebook — 43 percent increase in short interest.

LinkedIn — 29 percent increase in short interest.

Twitter — 7 percent increase in short interest, following rise of 112 percent four months ahead of the lockup expiration.

That said, declines around the lockup expiration could mark a turning point for Snap.

Facebook and Twitter shares began climbing the day after their lockup expirations, while LinkedIn reached a low the week after, according to Sanderson.

Previous MKM analysis of Snap showed that big social media stocks like Facebook and Twitter fell an average of 14 percent one day after their first public earnings report.

That report proved accurate as Snap shares plunged 21 percent on May 11, after the firm reported its first post-IPO earnings. Snap posted first-quarter net losses of $2.2 billion, due primarily to $2 billion spent on stock-based compensation expenses after its March 2 initial public offering. Quarterly revenue of $150 million missed expectations by $8 million.

Disclosure: NBCUniversal, the parent company of CNBC, is an investor in Snap.

— CNBC’s Anita Balakrishnan contributed to this report.

Snapchat has a new feature called ‘Snap Map’-here’s how it works

Snap shares may be unable to stay above IPO price as big insider selling looms