Amazon stock was lower on Prime Day and some of the retailers it has been crushing were moving higher Tuesday, but the longer term trend shows its competitors hitting rock bottom.

Amazon’s own stock was down about 0.7 percent Tuesday, as the company offered shoppers hundreds of deals on the shopping holiday it concocted to promote its Prime membership and other products. Prime membership provides shoppers with free shipping, Amazon TV programming and other services and deals.

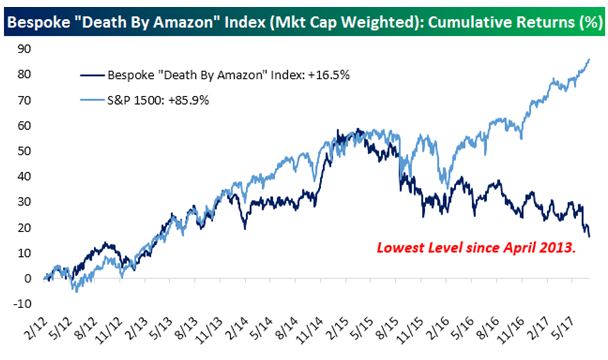

But Amazon, trading 2.6 percent off its all-time high, has made lofty gains compared to its brick-and-mortar rivals. For the year so far, its stock is up 32 percent, while many store chains, like Macy’s and JC Penney are down more than 40 percent. Bespoke created an index of the major retail names it thought would be most hurt by Amazon, called “Death by Amazon,” and it was trading at a four-year low, as of Monday.

Some of the 54 retailers in the index edged higher, including Macy’s which was offering free shipping to its customers Tuesday. Kohl’s, Costco, TJX, Kroger and Target were also all slightly higher Tuesday. Rite-Aid and Walgreen Boots Alliance were lower.

Most of the stocks on the list are sharply lower for the year, with a few exceptions. HSN, which is in a merger with QVC, was up 14 percent year-to-date. Wal-Mart, which battled back against Amazon with its purchase of Jet.com, was up about 6 percent so far this year.

“I think it [Wal-Mart] got a big bounce from that move. The Jet.com acquisition was taken as a sign the company was going to get serious about online. That was one of the reasons the stock rebounded,” said Paul Hickey, co-founder of Bespoke. “It pulled in a little, and it hasn’t regained its footing since the Whole Foods news was announced.”

Amazon announced a merger last month with grocer Whole Foods Markets, rattling retail stocks, as well as some food companies. Some of those companies were selling off Tuesday, including Kellogg and General Mills.

Analysts expect Amazon, with supermarket distribution, to affect pricing for a whole raft of packaged foods. It could also be a strong booster of the Whole Foods 365 brand, creating a bigger rival for some name brands.

“There’s two factors there. I think consumer loyalty towards brands is evaporating…this isn’t because of Amazon for these companies specifically. Consumers don’t necessarily equate quality with these old style brands anymore,” Hickey said. Another factor is a rally in the agricultural commodities, which means costs for cereal makers and other food companies will be higher, he said.

As for the “Death by Amazon” index, Hickey said many more things could have been added, such as mall REITs, which have been hurt by online shopping.

But when Bespoke created the index, it chose to include only the most vulnerable retailers. The range of categories shows how broad the Amazon effect has spread. From Vitamin Shoppe to Foot Locker, Bed Bath and Beyond and Dick’s Sporting Goods, Amazon has spread pain across the retail spectrum.

Hickey said some retailers were excluded from the list because they either sold Amazon-proof products or had their own developed web strategy, like Home Depot.

Other stocks were merged away and are no longer part of the list, like Safeway, which combined with Albertsons.

“These are the companies we think are most ‘Amazonable,'” he said. “Prime day is on 7/11, and that’s probably the only store that isn’t Amazonable.”

Hickey said Prime Day is a boon for Amazon, in part because of the Prime membership. “It’s the business they are building up. It’s the recurring revenues,” he said.

For other retailers, it just means future pain.

“In the U.S. retail environment, compared to other countries, there’s a ton of overcapacity in terms of square footage in stores,” Hickey said. “Until you see see some of the spare capacity worked off, it’s just not a good environment for the retail sector- and the fact that Amazon is coming after them.”

Of the stocks in the index, the worst performing year to date are Stein Mart, off 75 percent and Rite-Aid, down 71 percent. Fred’s, Tuesday Morning and Ascena Retail are all off more than 60 percent. Hibbett Sports, Zumiez, Genesco, and Smart and Final, are all down more than 40 percent so far this year.

Stocks that are down just single digits this year are Nordstrom, PriceSmart, TJMaxx, Williams-Sonoma, Costco, Big Lots and Walgreen.

Source: Investment Cnbc

The 'Death by Amazon' index is at a four-year low as e-commerce giant hosts Prime Day