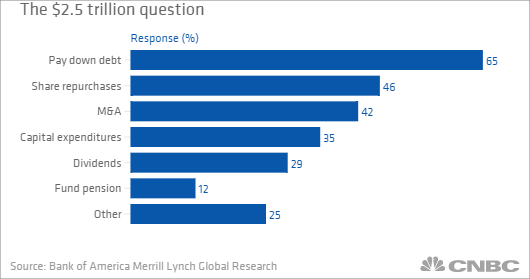

U.S. companies in line to bring home trillions in cash stored overseas would use the windfall primarily to pay down debt, return cash to shareholders and do deals, according to a survey released this week.

A central part of President Donald Trump‘s tax reform plan is to allow companies to repatriate profits earned abroad without having to pay the highest-in-the-world corporate tax rate. Estimates are that U.S. firms are holding about $2.5 trillion in cash abroad.

If tax reform is passed and the overseas cash gets taxed at a much lower rate, 65 percent of companies say they would pay down debt, according to the 2017 Bank of America Merrill Lynch corporate risk management survey. American business debt stood at $13.7 trillion through the first half of 2017, according to the Federal Reserve.

After paying down debt, the next most likely use at 46 percent is share repurchases, followed by mergers and acquisitions, and only then capital expenditures. [The figures do not add to 100 percent because BofAML instructed recipients to check all uses that would apply.]

Opponents of the repatriation plan worry that instead of dedicating the money to equipment, workers, and research and development, companies will spend most of the cash on shareholders. That’s what happened the last time the government gave a break on overseas profits in 2004. Back then, the biggest recipients not only shoveled the cash back to investors but also in many cases cut jobs.

A tax reform proposal earlier this year from the Trump administration was short on details. Treasury Secretary Steven Mnuchin said then that the plan would include “a very competitive rate that will bring back trillions of dollars.”

However, BofAML credit strategists say companies may not wait until the administration finally pushes its tax plan through Congress. Some companies may wish to use commercial paper or lines of credit to start cutting debt costs before the expected new corporate tax rates and removal of interest deductions make current high-coupon debt undesirable.

The firm believes technology and pharma companies, with their high levels of debt, will be the biggest beneficiaries of tax breaks for overseas cash. Those sectors also received the most benefits in the 2004 repatriation.

Source: Investment Cnbc

Companies have big plans for trillions in overseas cash — if tax reform ever happens