Good earnings and clarity on tax reform will likely send the S&P 500 10 percent higher over the next 12 months, according to Morgan Stanley’s chief U.S. equity strategist Michael Wilson.

“Tax legislation remains the most important political issue for the U.S. stock market as we get later in the year,” Wilson and his team of equity strategists said in a Monday note. “However, we think investors have been willing to give the market a ‘pass’ for now because there is nothing baked into 2017 earnings estimates for a tax cut, making earnings appear very achievable for the remainder of this year,” the report said.

Wilson has a S&P 500 12-month price target of 2,700, the most bullish among 16 equity strategists surveyed by CNBC, and 9.8 percent above Friday’s record close of 2,459. Wilson is also chief investment officer at Morgan Stanley Institutional Securities and Morgan Stanley Wealth Management.

S&P 500 earnings are set to grow for a fourth-straight quarter, up 6.2 percent in the second-quarter, and are setting up for a record 12-month high of $123.61 in earnings per share, CFRA Chief Investment Strategist Sam Stovall said in a July 10 note. His 12-month forecast for the S&P 500 is 2,540, just over 3 percent above Friday’s close.

The second quarter earnings season kicked off Friday as some of the big banks began releasing results. Bank of America, Goldman Sachs, IBM, Morgan Stanley and Microsoft are among the big firms set to report results later this week. The S&P 500 traded little changed Monday morning.

“We believe the market may now be underpricing the most recent move in earnings revisions. Furthermore, we expect another solid earnings beat in 2Q amid low expectations,” Wilson said.

In addition to better earnings, Wilson expects clarity on tax reform will help stocks. The Senate last week shortened its August recess by two weeks to work on health care and other legislation, although the vote has been delayed until after Senator John McCain recovers from a surgery.

“No matter what gets passed in the next few months, we think just moving forward with a decision on the Affordable Care Act and taxes will provide the certainty necessary for companies and individuals to ‘act’ on their higher confidence readings which have remained elevated,” Wilson said.

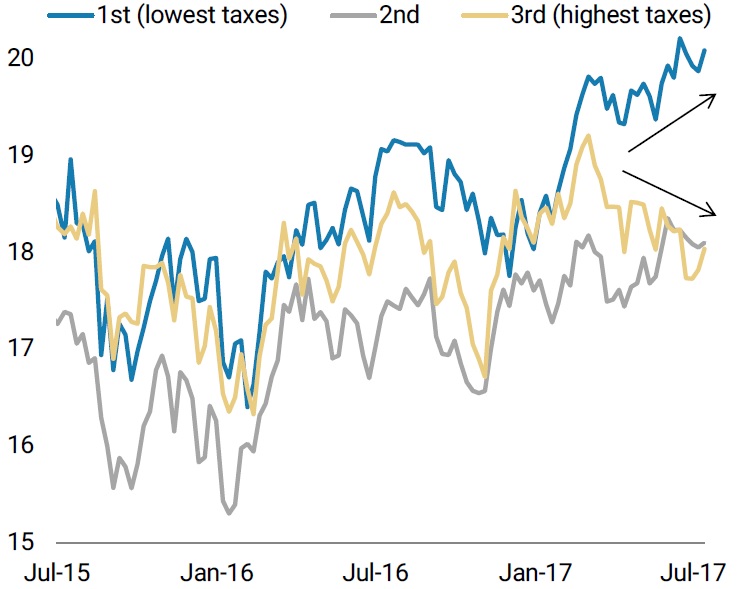

The price-to-earnings ratio for the S&P 500 over the next 12 months “is stuck at approximately 17.5,” he said, but there’s a divergence within the index. Stocks with higher tax rates have seen their price-to-earnings multiples fall, while stocks with lower tax rates have seen their multiples rise, Wilson pointed out.

Median forward price-to-earnings multiple by tax tertile

Source: FactSet, Morgan Stanley Research as of July 14, 2017.

Accordingly, between the election and March 1 — a day after President Donald Trump‘s surprisingly presidential speech to Congress — financials and industrials led S&P 500 advancers. The two sectors are among those in the S&P 500 with the highest weighted average tax rate, according to S&P Dow Jones Indices.

After March 1, the top two performers have been information technology and health care, the sectors with the lowest and third-lowest weighted average tax rate, respectively, according to S&P Dow Jones Indices.

Once markets have clarity on what kind of tax reform may be implemented, the stock sectors with high tax rates will likely recover their gains, helping the overall index rise.

In addition, “policy resolution is not the only reason multiples can expand from here,” Wilson said. “Improving growth in the second half of 2017, modest inflation and a continued accommodative monetary policy stance from central bankers are a pretty good recipe for modest multiple expansion.”

The biggest bull on Wall Street sees earnings, tax reform driving the next leg higher