Fund managers see Nasdaq stocks as the most crowded trade in the world, and as a result, they trimmed technology positioning in June and reduced allocations to U.S. stocks to the lowest since 2008.

For three months, Nasdaq has been dubbed the most crowded trade by global fund managers in the monthly Bank of America Merrill Lynch survey. Sixty-eight percent of the managers see global internet stocks as “expensive” and 12 percent see them in a “bubble.”

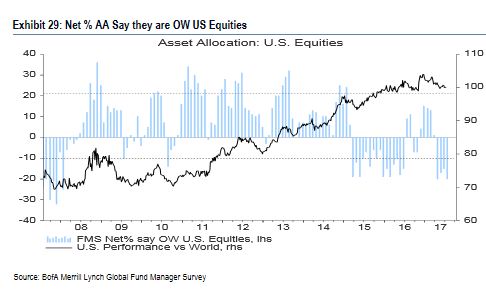

With the S&P 500 also at an all time high, the fund managers reported that their overall allocation to U.S. stocks in June dropped to a net underweight of 20 percent from 15 percent in May. That was the largest net underweight among the managers since January, 2008.

They also shifted their sector allocations. Technology fell from the most overweight sector, as managers moved funds to the banking sector in June. In a 22-month period, July was only the second month that tech was not the top sector, and it was the second time banks held the biggest overweight.

Since the 2009 market bottom, tech has been the largest overweight 80 percent of the time, according to BofA.

Before worrying about the crowded positions in Nasdaq stocks, the fund mangers had seen long U.S. dollar seen as the most overcrowded position. The latest survey was taken July 7 to 13, and included 207 global fund managers with $586 billion assets under management.

Eighty percent of the fund managers in the survey say the U.S. is the most overvalued region, though that is down 4 percent from June. Nineteen percent see Eurozone equities as undervalued and 43 percent see emerging markets are undervalued.

Japan, meanwhile, is benefiting from some of the allocation lost by the U.S. It has suddenly become a stronger overweight, jumping to 18 percent from just 1 percent in May.

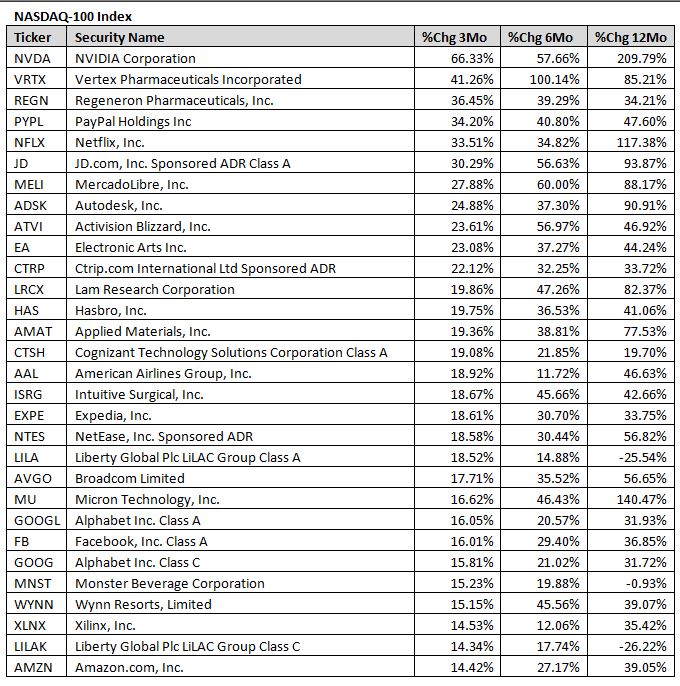

The managers reduced tech’s weighting but the the top performers in the Nasdaq 100 in the last three months were not only technology stocks. Nvidia was the top gainer, up 66 percent, but two pharma companies were second and third. They were Vertex Pharmaceuticals, up 41 percent followed by Regeneron Pharmaceuticals, up 36 percent. Netflix was the FANG name with the biggest gain, up 33 percent.

Source: FactSet

Source: Investment Cnbc

US stocks are the most unloved by global investors in 9 years, survey shows