Just as many on Wall Street are warming up to bitcoin, one of the lone financial analysts who forecast a surge when the digital currency was just six cents now has an extremely negative view.

“A bearish trifecta — the Elliott wave pattern, optimistic psychology and even fundamentals in the form of blockchain bottlenecks — will lead to the collapse of today’s crypto-mania,” analyst Elliott Prechter wrote in the July 13 edition of The Elliott Wave Theorist newsletter.

“The price activity and manic sentiment that led to present prices have dwarfed even the Tulip mania of nearly 400 years ago,” he said. “The success of Bitcoin has spawned 800-plus clones (alt-coins) and counting, most of which are high-tech, pump-and-dump schemes.”

“Nevertheless, investors have eagerly bid them up,” Prechter added.

He’s the son of the famed technical analyst Robert Prechter, who popularized the Elliott Wave by using it to forecast the stock market crash of 1987 and has published a newsletter since 1979. However, debate over the accuracy of the Elliott Wave has grown after Robert Prechter called the end of the 1990s bull market five years before it actually ended.

The principle is a sophisticated form of technical analysis widely followed by traders that analyzes cycles of sentiment in an attempt to predict market performance — five waves typically signals a coming downturn.

Regarding bitcoin, “under the Elliott Wave model, what we’re seeing, we’re making a final fifth wave from six cents,” the younger Prechter told CNBC in a phone interview Thursday. “It does not imply it will go to zero. It does not imply it will go to six cents. I do think it will happen to the clones [newly formed digital currencies].”

The Elliott Wave for bitcoin

Source: The Elliott Wave Theorist

In September 2010, Elliott Prechter wrote in The Elliott Wave Theorist about bitcoin when it traded at 6 cents. Very few in the financial world seriously considered the digital currency at the time.

“It proved to be the buying opportunity not just of a lifetime, but so far of all time,” Prechter said.

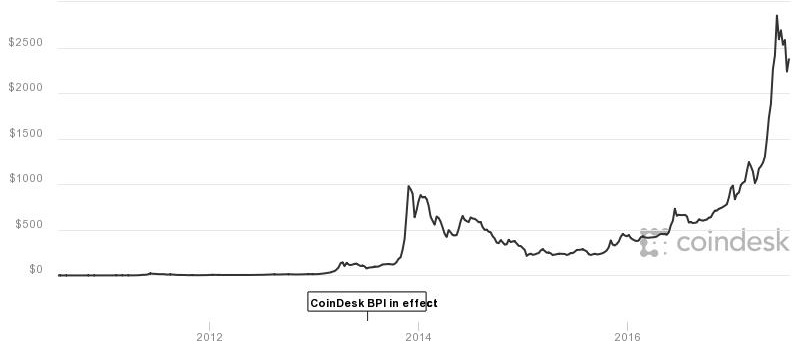

Bitcoin hit a record of $3,025 in June, 50,000 times its price in 2010. The digital currency traded near $2,652 Thursday, more than twice where it started the year.

Bitcoin (July 2010 – July 2017)

Source: CoinDesk

As a result of the meteoric price surge, Wall Street has started paying closer attention to bitcoin in the last several weeks.

For example:

- Standpoint Research’s Ronnie Moas said in early July that bitcoin could possibly reach $5,000 “in a few months.”

- Fundstrat’s Tom Lee issued a reportaround the same time on why bitcoin could soar to $20,000 or $55,000.

- Forbes reported Tuesday that legendary investor Bill Miller bought bitcoin in 2014 and that it’s one of the top holdings in his $120 million hedge fund.

- Also on Tuesday, Josh Brown, CEO of Ritholtz Wealth Management and a CNBC contributor, said in a blog post he used Coinbase to buy bitcoin with a “small amount of money.”

- Goldman Sachs and Morgan Stanley have also discussed bitcoin and the blockchain technology behind it in recent reports.

To Prechter, the forecasts for bitcoin to rise dramatically resemble calls in 1999, just before the burst of the dotcom bubble, for the Dow Jones industrial average to reach 100,000.

He said the excitement surpasses the tulip bulb mania in The Netherlands in the early 1600s.

As Investopedia tells it, tulip bulbs became such a prized commodity that by 1636 they were being traded on many Dutch stock exchanges and “many people traded or sold possessions to participate in the tulip market mania.”

“Like any bubble, it all came to an end in 1637, when prices dropped and panic selling began,” according to the article. “Bulbs were soon trading at a fraction of what they once had, leaving many people in financial ruin.”

“Technology has advanced greatly, but human psychology is still the same”

Source: The Elliott Wave Theorist

Some analysts have also compared the excitement around bitcoin and other digital currencies to the Beanie Babies craze in the 1990s.

Prechter also pointed to the challenges bitcoin and its rival ethereum are facing in order to expand their reach.

Bitcoin faces an Aug. 1 deadline for developers to agree on a system to upgrade the network and prevent the currency from splitting. Meanwhile, transaction fees ran up to $5 in June and are still near $2.

In June, some sales of new digital currencies clogged the ethereum network, creating a backlog of orders. Separately, ethereum prices briefly plunged from above $300 to 10 cents on one exchange before recovering.

To be sure, Prechter told CNBC that a mania “can be both a mania and a revolution at the same time.”

Like many digital currency enthusiasts, he sees significant potential in the cryptocurrencies for automating the banking and legal industries.

“The distant future of crypto is bright,” Prechter said in the report. “Crypto tech is like the internet in 1999: It was poised to take over the world, but the NASDAQ still fell almost 90% during the dot-com bust of 2000-2002.”

But bitcoin may not be part of that future.

“It’s too soon to know if Bitcoin is Facebook or MySpace,” Prechter said.

Source: Tech CNBC

Bitcoin bubble dwarfs tulip mania from 400 years ago, Elliott Wave analyst says