Morgan Stanley’s internet analyst expects Twitter shares to lose half their value due to lack of spending from advertisers.

On Thursday, a team led by equity analyst Brian Nowak maintained a price target of $10 a share on the social media stock, down 50 percent from Twitter’s close at $20.12 Wednesday.

The shares are up 14 percent so far in July.

“We remain [underweight] TWTR as we have not heard of any material change in advertiser intent to spend in the near term and continue to see negative revision risk to [the second half of 2017] and 2018,” Nowak said in a report.

He expects Twitter’s advertising revenue to fall about 17 percent this year and 10 percent next year, to about $2.53 billion in 2018.

Nowak’s negative outlook on advertising contrasts with an optimistic report from boutique equity research firm Cleveland Research that said in late June that advertisers gave their “best relative feedback” in more than two years on Twitter. Shares popped after the report.

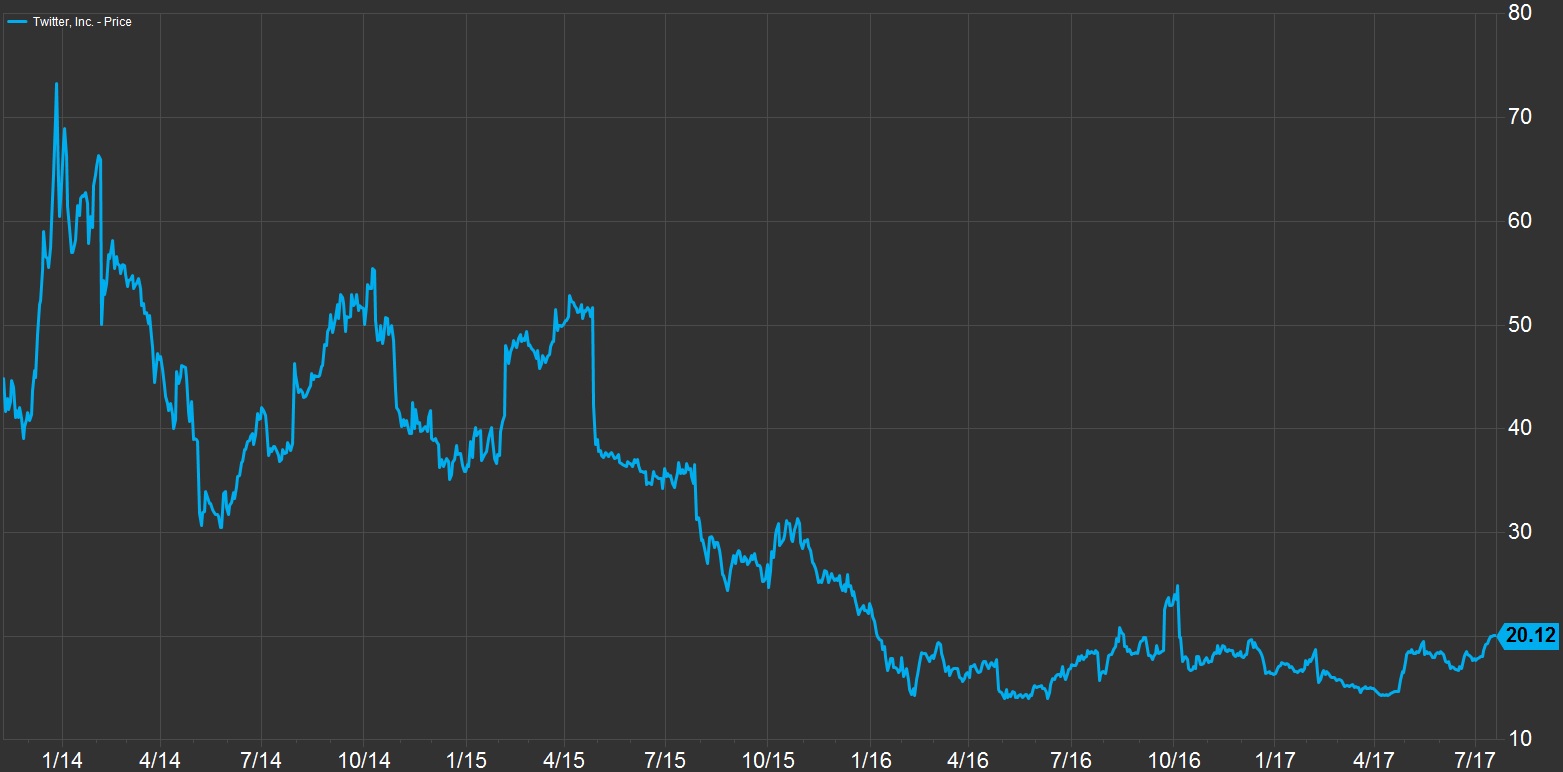

Twitter shares are up 43 percent from a 52-week low hit April 17 but haven’t been able to top the initial public offering price of $26 a share for more than a year and a half.

Falling to $10 a share would mark a record low for Twitter.

Twitter performance since 2013 IPO

Source: FactSet

“While we acknowledge TWTR has taken steps to improve its user offering (adding Bloomberg Media, BuzzFeed, the WNBA, PGA, etc), we still are not hearing about the advertiser value proposition or reason to spend more on TWTR in our industry conversations,” Nowak said.

Twitter is scheduled to report second-quarter results next Thursday before the U.S. market open.

The social media stocks’ outlook is clearly dependent on the advertisers’ interest, and it looks like Facebook may be winning out.

“Buying Facebook when Twitter IPO’d (even as the little blue bird initially soared over 150% from IPO) has been a fantastic trade, with a grinding, consistent rally over the past 3.5 years,” Bespoke Investment’s George Pearkes said in a July 13 note. He also pointed out Twitter’s underperformance relative to LinkedIn ahead of its acquisition by Microsoft.

“It seems,” Pearkes said, “that when new social media IPOs hit the street, investors are best served by looking at who they compete with rather than the new company!”

Source: Bespoke Investment Research

The social media giant, which owns Instagram and WhatsApp, has surged more than 40 percent this year.

On Thursday, Nowak said he expects Facebook to rise about 7 percent the next 12 months to his price target of $175, noting he expects “Instagram to continue to be a key driver of ad revenue growth.”

— CNBC’s Michael Bloom contributed to this report.

Source: Tech CNBC

Don't buy the Twitter comeback, stock to drop 50%, Morgan Stanley predicts