BMO Capital Markets upgraded Caterpillar Monday on expectations the company will benefit from a global recovery in construction and a management more focused on profits.

“We believe that when an upturn arrives, buyers will still prefer its products,” analyst Joel Tiss said in a note. Caterpillar’s main brand is the maker of construction equipment such as backhoe loaders and excavators.

He also raised his price target by $15 to $125 a share, 17 percent above Friday’s close of $106.59. The upgrade came a day before Caterpillar is scheduled to report earnings.

Tiss laid out three reasons for his positive view on the stock:

1. Recovery in demand for Caterpillar’s construction products.

Tiss noted “building evidence” that companies need to repair or upgrade their construction equipment and that Caterpillar’s parts and service orders have already risen in the last four quarters. Caterpillar sold about 1,700 large mining trucks at the peak of a recent economic cycle, and “we see significant upside from the roughly 80 units sold last year,” Tiss said.

Also, recent strength in the U.S. dollar, which allowed foreign competitors to sell more cheaply and created other challenges in global construction markets between the second half of 2015 and the end of 2016, has “subsequently abated.”

The U.S. dollar index fell Friday to 93.854, its lowest in more than a year, and reached a near two-year low against the euro.

Meanwhile, growth is stabilizing in China, a key market for Caterpillar’s business. One measure of construction activity, fixed-asset investment, rose 8.6 percent in the first half of this year, according to the National Bureau of Statistics of China.

“The big driver here continues to be Asia Pacific, where China excavator sales remain strong, up 100% YTD through June per China Construction Machinery Business Online (CMBOL),” Tiss said.

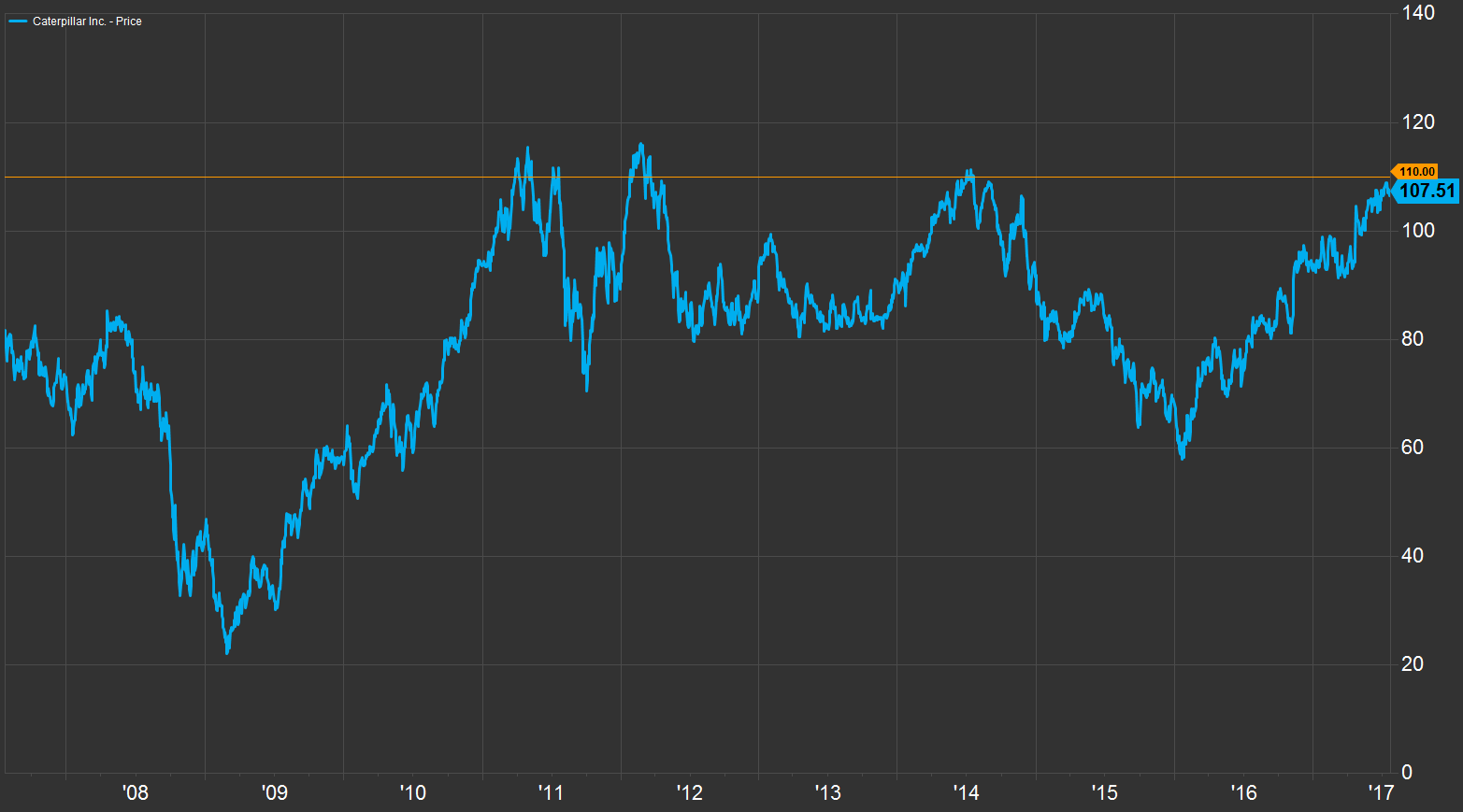

Caterpillar shares have tried to hold above $110 several times in the last decade. They opened more than 1 percent higher Monday, around $107.70 a share.

Caterpillar shares 10-year performance

Source: FactSet

2. Cost cuts to save Caterpillar billions of dollars.

“We imagine there is more runway for Caterpillar’s cost-cutting initiatives of lowering headcount (about 95K employees at year-end 2016 versus 132K in 2012), improving sourcing, and shuttering or consolidating more than 30 factories since management began a large-scale restructuring plan in 3Q15,” the report said.

Tiss expects those actions to reduce Caterpillar’s fixed costs by nearly $2 billion annually.

3. Management more focused on profits.

“The hints from management are that new CEO Jim Umpleby will focus on profitability, free cash flow, and returns versus the prior CEO, Doug Oberhelman,” Tiss said.

Caterpillar did not immediately respond to a CNBC request for comment.

The company is scheduled to hold its first investor day in four years in September, and Tiss said he expects management to lay out a five-year plan that includes an earnings growth forecast near his $16 per share estimate.

For 2017, Tiss expects earnings per share to grow $4.80 after rising $3.42 in 2016.

Reaching $125 would mark a record high for the stock, which fell from an all-time high of $116.95 in 2012 to below $60 in early 2016.

Caterpillar shares hit a 52-week high of $110 on July 12 and are up about 15 percent this year.

Source: Investment Cnbc

Global construction comeback to lift Caterpillar's stock to new record, BMO says