An activist investor has acquired a stake in Barnes & Noble and is calling on the retailer to consider selling itself in order to unlock more value in the brick-and-mortar book business.

“Physical books, and physical bookstores, are not going away anytime soon,” Sandell Asset Management said Tuesday in a letter to the retailer’s board.

Barnes & Noble’s real estate is like “beachfront property” that could provide value to an internet or media company looking to grow its retail presence, Sandell added.

The Wall Street Journal first reported Monday evening that Sandell had recently started buying a stake in Barnes & Noble and that it was already among the retailer’s 10 biggest investors, based on conversations the publication had with people familiar with the matter.

Shares of Barnes & Noble were climbing around 11 percent shortly after market open Tuesday on this news.

Barnes & Noble declined to comment on Sandell’s letter to the company’s board and subsequent reports.

Sandell confirmed Tuesday it had accumulated a “meaningful” stake in Barnes & Noble and said that the bookseller could fetch a price of $12 per share, or possibly higher, in a private deal. Though Sandell has declined to disclose the size of its investment, it would fall below the 5 percent threshold required by the Securities and Exchange Commission to file a 13D, making the investment less than $26 million.

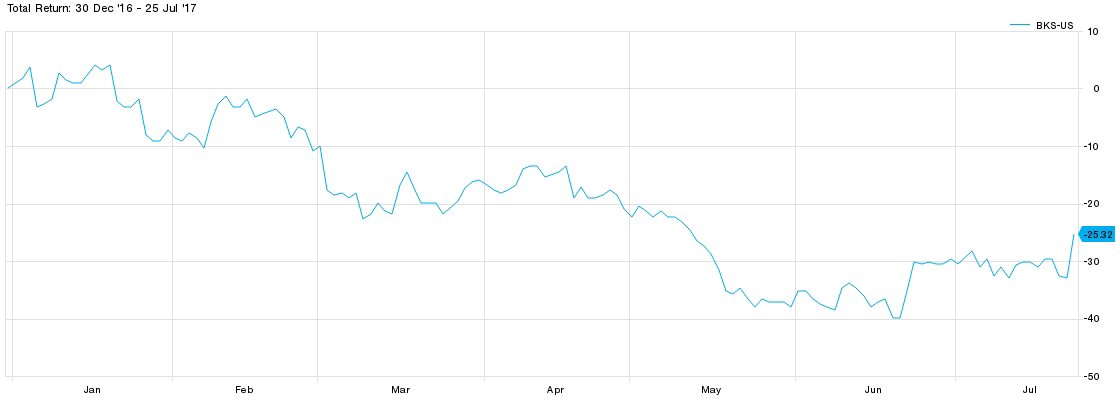

Barnes & Noble’s stock closed Monday at $7.10 per share. The stock is down more than 30 percent over the past year, including Tuesday’s gains.

Source: FactSet

“What makes the under-valuation of Barnes & Noble all the more shocking is that, as opposed to the numerous other national apparel, footwear, grocery, and home furnishing chains abounding in this country, there is but one truly national bookstore chain,” Sandell’s CEO, Thomas Sandell, said.

The firm added that it believes Barnes & Noble’s roughly $520 million market value today is “unconscionably low.” As the public market for retail stocks is inherently “risky” today, this could be one reason for the lower value, Sandell said.

Sandell has called on Barnes & Noble to retain an investment bank to explore strategic alternatives, which aim at “achieving a privatization.” The activist investor doesn’t believe Barnes & Noble should continue to operate as a stand-alone public company.

This wouldn’t be the first time Barnes & Noble was faced with the idea of going private, either.

The retailer has explored deals in the past to sell or break itself up, including a buyout attempt by Barnes & Noble Chairman Leonard Riggio, who remains the bookstore chain’s largest shareholder.

Also, in 2009 another activist investor, Ronald Burkle, began accumulating shares in Barnes & Noble and eventually waged a proxy fight, which he failed to win.

Earlier this year, faced with many questions about the company’s future and amid growing pressure from Amazon‘s book business, Barnes & Noble CEO Demos Parneros told investors, “We’re examining every aspect of the business and our customer value proposition.”

—CNBC’s Leslie Picker contributed to this reporting.

Barnes & Noble shares surge; activist investor urges the bookstore to sell itself