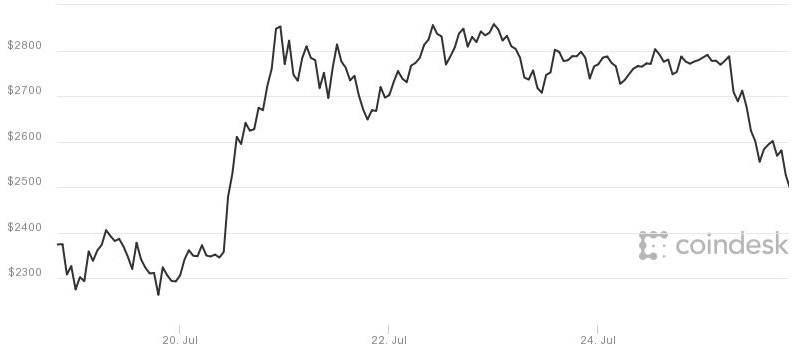

Bitcoin fell to its lowest in five days Tuesday amid uncertainty over whether the digital currency will still avoid a split.

Bitcoin dropped more than 10 percent to $2,487.13, its lowest since last Thursday when it hit a low of $2,276.16, according to CoinDesk.

The digital currency last traded just below $2,500, unchanged for the month but still more than double in value for the year.

Bitcoin one-week performance

Source: CoinDesk

Last Thursday, more than 80 percent of developers signaled support for BIP91, a bitcoin improvement proposal intended to resolve differences between the Aug. 1 User Activated Soft Fork and SegWit2x.

Now, there’s worry that activation of SegWit2x might not go smoothly.

“I believe the market is currently somewhat torn between the optimism around BIP 91 locking in, which could lead to SegWit activating if all goes smoothly, and the fear of the second half of SegWit2x proposal, the 2MB block size hard fork, still being contested,” Alex Sunnarborg, research analyst at CoinDesk, told CNBC in an email.

Developers must unanimously agree on the 2MB block size by its scheduled November implementation, otherwise bitcoin will split.

Meanwhile, another preventative measure to the User Activated Soft Fork, Bitcoin Cash, said this weekend it would still go ahead with a split in bitcoin on Aug. 1.

“Big names like ViaBTC, Houbi, Bithumb, and potentially Roger Ver and others supporting Bitcoin Cash either from August 1 or if Segwit2x fails to activate has made the future thought of two blockchains more of a real fear for many in the community,” Sunnarborg said.

Bitcoin Cash is also known as the User Activated Hard Fork.

“Should the UAHF activate on August 1, Coinbase will not support the new blockchain or its associated coin,” Coinbase said on its frequently asked questions. “You will not be able to withdraw the UAHF version of any Bitcoin from Coinbase.”

Separately, a technical analysis report from Goldman Sachs Tuesday said that bitcoin is “still within the limits of a well-defined range.”

“At this point, it seems reasonable to assume that the market is in a corrective process until there’s been real evidence of an impulsive advance.”

Bitcoin has traded in a range after it hit a record high of 3,025 in mid-June.

Ethereum also traded lower, falling more than 12 percent to below $200 and hit a low of $193.71, according to TradingView charts of Coinbase data.

Hackers stole $8.4 million worth of tokens from a firm called Veritaseum, according to an online posting Monday from the firm’s founder Reggie Middleton.

The news followed a July 19 report that about $32 million was stolen from three ethereum-focused wallets.

— CNBC’s Michael Bloom contributed to this report.

Source: Tech CNBC

Bitcoin slammed by more than 10% to below ,500; Ethereum down big too