IN DIFFERENT circumstances the two people could be good friends. Each is rather shy and very smart. And each is passionate about bitcoin, a digital currency. One invented hashcash, which foreshadowed components of the crypto-currency; the other is the author of the first Chinese translation of the white paper in which Satoshi Nakamoto, the elusive creator of bitcoin, first described its inner workings.

Adam Back is the chief executive of Blockstream, a British startup, which employs some of the main developers of the software that defines bitcoin’s inner workings. Jihan Wu is the boss of Bitmain, a Chinese firm, which makes about 80% of the chips that power “miners”, specialised computers that keep the bitcoin network secure, confirm payments and mint new digital coins. But far from being fellow-travellers, each represents one of the two main camps in what has come to be called a “bitcoin civil war”, fought over how, if at all, the system should grow.

-

Few business travellers now take a taxi

-

Foreign investors snap up London’s iconic buildings

-

Australia’s most successful indigenous musician has died

-

How species originate

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

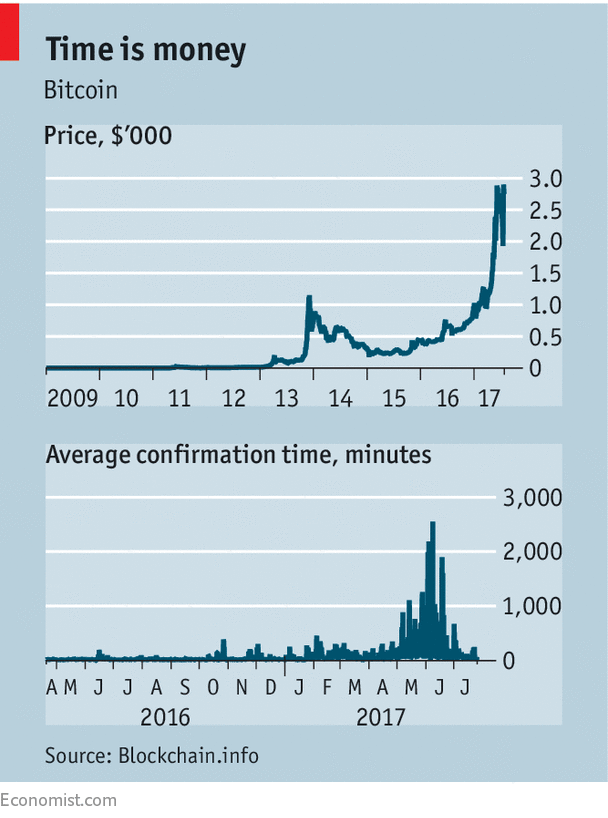

The worst seems to have been avoided. On July 21st a large majority of miners signalled their support for a compromise, reducing the risk of a split of bitcoin into different currencies and driving its price back up towards $3,000 (see chart). But a “fork”, as some call this possible split, may only have been delayed: the issues underlying the dispute have not been truly resolved.

At issue is the size of a “block”, the name given to the batches into which bitcoin transactions are assembled before they are added to a decentralised digital ledger, called “blockchain”, that contains the payment history of all bitcoins in circulation. Mr Nakamoto limited the block size to one megabyte, meaning that the system can only handle a maximum of seven transactions a second. Payment systems like Visa can process thousands in that time. With demand growing steadily, the system started to slow; users had to offer miners fees of several dollars a pop to get their transactions processed speedily.

The answers seem obvious: make the blocks larger or pack transactions more densely. Yet bitcoin’s growing pains are less technical than political. “The big question is who gets to lead an organisation that is supposed to be leaderless,” says Jeff Garzik, the boss of Bloq, a bitcoin startup.

Bitcoin is big business: the combined value of coins in circulation is now $40bn. The number of transactions a day is approaching 300,000 on average, generating a trading volume of $1.5bn. And bitcoin has become a global platform for hundreds of startups, offering services from trading the currency to providing market data and operating bitcoin ATMs.

As bitcoin’s ecosystem has grown, however, so have the divisions within it. Many stem from a fundamental difference in vision: whether bitcoin should be more like gold or more like cash. This echoes a dichotomy between two schools of thought on the nature of money: whether, as “metallists” argue, it is more of a bottom-up affair, emerging naturally as a medium of exchange and a store of value in the same way as gold; or whether, as “chartalists” say, money is mostly a top-down creation by a government to enable it to collect taxes and provide citizens with a user-friendly way to settle their debts.

Unhelpfully, bitcoin is a bit of both. It is bottom-up: people freely opt into the system, to speculate or make payments that governments cannot block. But it is also top-down: Mr Nakamoto set not only the block size but other technical parameters, including the stipulation that there would only ever be 21m bitcoins in circulation.

Mr Back says it all comes down to a trade-off: let bitcoin grow too large too quickly and it will turn into a more centralised payment system that governments can interfere with. That is because, if the blockchain becomes too big, individual holders will no longer be able to use their own computers to check whether a transaction is valid. Consequently, Mr Back wants to keep the blocks relatively small and change the system in other ways, such as bundling smaller transactions before they are confirmed (an approach known as “lightning”). To alleviate the system’s congestion, Mr Back and other leading coders, collectively called “Bitcoin Core”, have developed a solution to pack blocks more densely, using a technique known as “segregated witness”, or SegWit.

If Mr Black is the theorist, Mr Wu is the pragmatist. He sees no trade-off between scale and security, at least not in the foreseeable future. To him, bitcoin is held back by a decision on block size that Mr Nakamoto only made for practical reasons. Not changing it would “kill the golden goose”. He has thrown his weight behind those who want to double the block size as quickly as possible and increase it even more later on.

Behind these differences in philosophy lurk divergent economic interests. Bitmain is not only selling mining hardware, but minting bitcoin for its own account (Mr Wu claims he controls about 10% of the system’s computing power). It also operates big “mining pools”, to which smaller operators can connect. He is also said to have amassed a sizeable amount of bitcoins. All these assets provide a strong incentive for him to keep the system growing but intact.

In the case of Mr Back and his fellow coders the mix of interests is more complex. Blockstream is not the same as Bitcoin Core: only a few of the group’s developers work for the firm. They are in it partly for the intellectual challenge and because of their libertarian ideology. But Blockstream, as well as the venture capitalists backing it, would clearly benefit if bitcoin develops in the way preferred by Mr Back. It wants to make money from versions of lightning and other blockchain-scaling software.

In its early days the internet itself saw similar fights. It developed institutions to overcome them, such as the Internet Engineering Task Force. Bitcoin has an IETF-like “improvement process” of its own, but agreeing on changes to a protocol that directly manages billions of dollars has proved hard. The growing power of the miners had added to the difficulty in reaching a consensus. Their main source of revenue is the “block reward”: every ten minutes miners engage in a race over who gets to update the blockchain; the winner is awarded 12.5 bitcoin, about $30,000 at the current exchange rate.

Mr Nakamoto had planned for mining to be a very fragmented activity, done by individual bitcoin holders. But because bigger mining operations have an advantage over smaller ones, the industry has quickly become highly concentrated. More than 60% of mining power is thought to be generated in China, where electricity is cheap and data centres easy to build. This gives their operators a veto: only if enough of them implement changes do they become the rule.

The dispute over how to scale bitcoin is now best described as a conflict between Chinese miners and Western developers. Whereas Mr Wu and Mr Back are surprisingly polite when talking about each other, the foot-soldiers in this fight haven’t pulled punches: mining farms have been attacked and the bitcoin system spammed to worsen congestion. Several attempts have been made to force the issue to a vote, using blocks as ballots.

This wrangling could have gone on for ages. But bitcoin is no longer the only kid on the crypto block; it is facing competition, in particular from Ethereum, a new type of blockchain. It was launched only a couple of years ago, and has grown fast. It has also given rise to a wave of “initial coin offerings” (ICOs), a novel way of crowdfunding. “While bitcoin is stuck in a stalemate, the competition has moved on,” says Emin Gun Sirer of Cornell University.

Worries about competition prompted the July 21st decision. A group of bitcoin activists earlier this year launched what was, in effect, an attempt to fire miners if they don’t implement SegWit. In response, Mr Wu in June released a “contingency plan” that amounts to getting rid of the developers: should the other side force his hand, he would extend a blockchain of his own and move to a block size of two megabytes—which would have led to a bitcoin split.

To avert that outcome, a group of bitcoin businesses came up with a compromise called “SegWit2x”, which provided for the implementation first, in mid-August, of SegWit and then, three months later, a block size of two megabytes. It is this compromise that won the official support of almost all miners.

A split has been averted—for now. Whereas SegWit seems a given, it is not clear whether the second step will be taken. Developers have already said that the timeframe is too ambitious—a deadline of 12-18 months is more realistic. If things drag on, a schism could become inevitable. And if that happens, expect an epic battle over who can lay claim to the bitcoin brand.

Whatever the outcome, one lesson of this conflict is clear. Decentralised crypto-currencies and other blockchain-based systems need robust governance mechanisms if they want to be able to evolve and stay relevant. Otherwise they risk ossification. Since crypto-currencies “were created to replace institutional decision-making,” argues Andreas Antonopoulos, the author of “Mastering Bitcoin”, they will have to find other ways to evolve.

Tezos, another blockchain, will soon test one such mechanism: it will not only have regular votes on competing proposals for how to change the system, but a more scientific approach to evaluating them and a way to compensate the developers for coming up with ideas. If their proposals are accepted, they will get paid in Tezos coins. The approach appears to have resonated within the crypto world: when Tezos closed its ICO earlier this month, it had raised a record $232m.

Even if bitcoin does not split, therefore, the fight over block sizes marks a fork in the road for crypto-currencies. The era of bitcoin’s dominance is ending; the future belongs to many competing digital monies. And the winners among them will be those currencies that can adapt their rules without having strong rulers.

Source: economist

Making Bitcoin work better