Now playing on a quote screen near you: “The Divergent Series: Financials vs. Technology.”

Financial and tech stocks – the two largest segments of the market – have been moving in opposition to one another lately to an unusual degree. On a day-by-day basis, when Big Tech has been rallying it’s come at the apparent expense of financial-company shares, and vice versa.

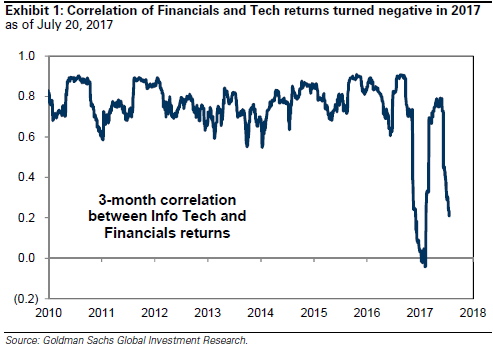

Strategists at Goldman Sachs are among those taking note of this pattern, which is visible here in this chart of the three-month correlation between the two sectors. It shows tech and financials moving the same direction less than 30 percent of the time lately – down from a longer-term norm of about 80 percent. And, for a time early this year, the sector correlation briefly turned negative – meaning tech and financials were on opposite ends of a virtual seesaw.

As with the market as a whole, the daily to-and-fro action between these sectors has an upward tilt – but with starkly varied magnitude. The S&P 500 tech sector, accounting for 23 percent of the index, is up 19 percent year to date and 5 percent in July alone. The financials, with a 14.5-percent index weight, have gained 7 percent this year and just 1 percent month to date. Within financials, banks are actually down fractionally for 2017 so far.

The forces driving the inverse tech-bank action involve investors’ expectations either for accelerating U.S. growth and rise in interest rates – the so-called reflation trade – or more slow-growth/low-rate action that reflects deflationary pressures and accommodative central bankers.

On reflation days, Treasury yields can gain some altitude and lift bank stocks with them. When the economic data are subdued and yields slip, investors crowd into big growth stocks that can expand even when the economy is sluggish. The dominant tech stocks such as the FANG foursome are, in a way, a leveraged play on disinflation, because not only can they grow fast organically but their businesses themselves – digital networks – are drivers of consumer deflation.

This leaves us with a counterintuitive situation: Shares of high-momentum, world-conquering tech giants often trade almost like boring bonds, and the ‘financial utilities’ that modern banks have become are proxies for a racier economy.

Of course, this seesaw dynamic is also happening in the context of an overall market that has become quite selective and eclectic, with stocks and sectors rotating in and out of favor with unusual alacrity. This has helped support the broad indexes, keeping their uptrends intact even when one leadership group tires and pulls back, giving way to some laggard cohort of stocks for a while.

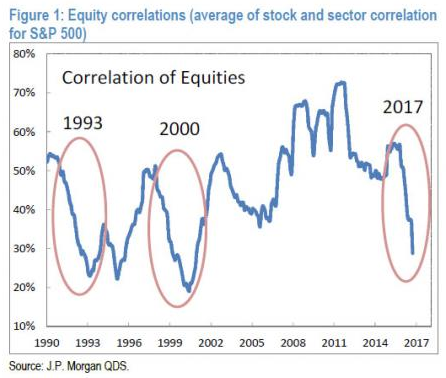

A gauge of this divergent action below the surface of the index is the “implied correlation” of stocks. The CBOE index that tracks this factor is at multi-year lows. And JP Morgan equity derivatives strategist Marko Kolanovic notes that the recent steep drop in inter-stock correlation resembles similar moves in 1993 and 2000.

This was one reason Kolanovic on Thursday warned clients that volatility could soon rebound suddenly from highly compressed levels. It’s generally healthy for individual stocks and sectors to respond independently to incoming fundamental information, when the variation becomes extreme and drives volatility to extreme lows, the market can become unstable and vulnerable to a swift selling storm. Kolanovic thinks today’s conditions more closely resemble the early-’90s experience, with a jumpy yet contained correction sparked by rising rates, rather than the brutal tumble into a bear market seen in 2000.

Goldman’s strategist David Kostin actually thinks the severe split between tech and financials will end over the remainder of the year, and that both groups should outperform the S&P 500 for reasons of their own.

“The tech sector will benefit from robust expected sales growth relative to the rest of the market, while the prospect of higher interest rates and the ability to return capital to shareholders will benefit financials,” says Kostin. “The positive fundamental trends in both sectors will likely result in a more normal positive correlation of returns between financials and info tech.”

Of course, this call for outperformance by tech and financials comes in the context of a fairly neutral market outlook by Kostin. His year-end S&P 500 target is 2400, down about 3 percent from where the index now sits, a cautious forecast informed mostly by the elevated valuation of equities by most measures.

Source: Tech CNBC

Back-and-forth trade between bank and tech stocks shows just how confused investors are right now