Of all the industry groups that make up the stock market, retail is the most hated based on the amount of money hedge funds and other investors are betting against the stocks.

Bespoke Investment Group highlighted “the most hated stocks in the world” in a report published this week analyzing the names being sold short by the most money. A short sale is when an investor borrows shares of a stock from a broker and sells them, in the hope of buying them back at a lower price and returning them to the broker for a profit.

The most reviled are the so-called multiline retail stocks, which Bespoke describes as suffering from “death by Amazon.” Multiline retail includes owners and operators of department stores and stores offering diversified general merchandise.

Members of the S&P index tracking this group had, on average, almost a quarter of their shares available for trading sold short. That’s nearly double the amount seven months ago.

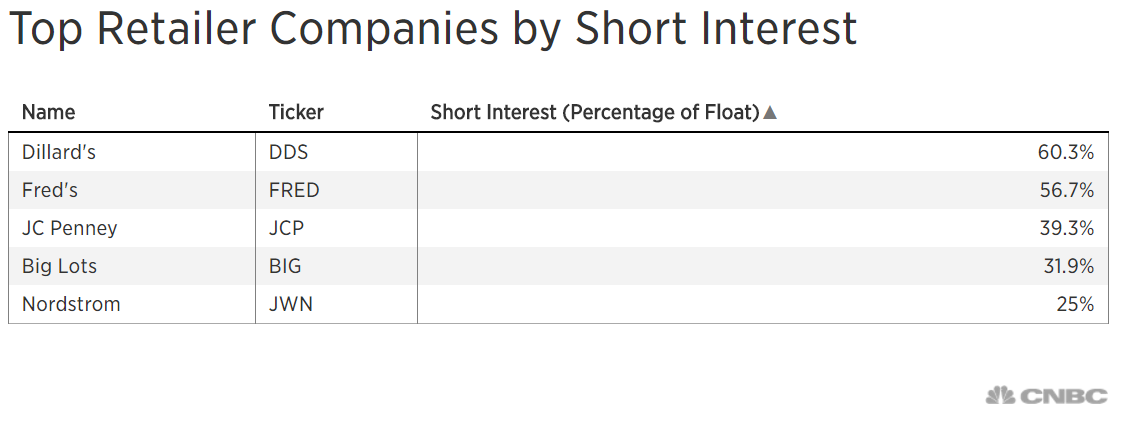

JC Penney and Nordstrom are among the names with the highest amount of short interest relative to their float, or shares available for trading.

Source: Bespoke Investment Group

The sales gap between Amazon and brick-and-mortar store-based retailers has widened over the past year, as internet retail convenience and competitive pricing crush foot traffic to malls and physical stores. Amazon shares, however, traded lower on Friday after announcing a second-quarter profit that fell short of Wall Street estimates.

To be sure, just because a stock has big short bets against it doesn’t mean it’s guaranteed to go down further. In fact, some traders seek out the most-hated stocks on purpose in the hope there will be a so-called short squeeze. This is when a rise in the stock causes short sellers to rush in and buy back the stock to cover their short, further goosing its price.

Source: Investment Cnbc

Thanks to Amazon, the most hated stocks on Wall Street right now are retail