The stock market’s strong July performance may ward off some of the negative action that often comes in late summer — and set up 2017 for more sharp gains.

While strategists warn the usually rocky late summer period would be a logical time for a pullback, technicians at Strategas point to a historic trend where the market typically does better than average when the month of July has been strong.

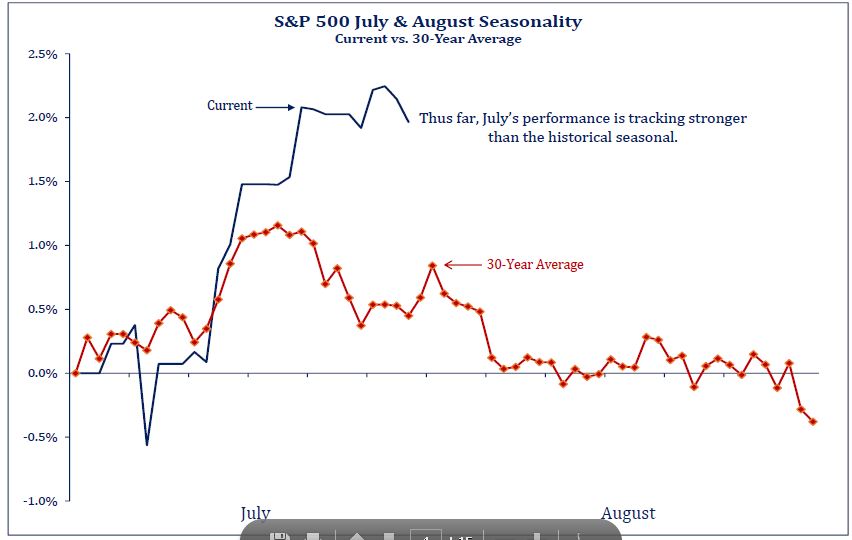

The S&P 500 for July is heading for a 2 percent gain, and the Dow Jones industrial average is up 2.6 percent so far. The Nasdaq, which suffered a slight set back last week, is still up 3.6 percent for the month. Any number of things could rock the stock market, including geopolitical risks, the top concern of which is North Korea.

“It’s something to be mindful of — that there’s a seasonal risk into August. You pair that off with some of the low volatility, that could be a trap for a higher move,” said Stategas Reserach technical analyst Todd Sohn.

In the past 20 years, August has been the worst month of the year for the Dow and the S&P 500, both lower half the time and averaging declines of about 1.5 percent, according to analytics firm Kensho. September has been the third-worst month for stocks, with the Dow down an average 1 percent and negative 55 percent of the time. The S&P has been down an average 0.75 percent and was lower half the time in September.

“The good news is when you’re in an uptrend those returns are skewed higher,” Sohn said.

Source: Strategas

Kensho studied year-to-date performance, finding that if the S&P 500 is up 9 percent or more for the year through July, the August performance was higher in the eight of 14 occurrences since 1980, but the mean return was negative 0.4 percent. But from September to December, the index was higher 12 of 14 times, and the mean return was 5.4 percent. The S&P 500 was up 10.3 percent so far this year.

The S&P 500 has had 29 record closes this year, with five of them in July. The index’s 2 percent gain this month puts it on track for a fourth consecutive positive month and the second-best monthly performance this year, after February’s 3.7 percent gain.

The VIX, which is the CBOE’s volatility index, also follows seasonal trends. It hit record lows in July, but it jumped in the latter part of last week, as tech and other Nasdaq stocks sold off. The VIX was up about 1.5 percent late Monday morning, at 10.45. Stocks were mixed, with Nasdaq down about 0.4 percent and the S&P 500 was slightly lower. But the Dow was higher.

Source: Strategas

“The VIX tends to spike in August, September, October,” Sohn said.

The stock market has not had a correction of any size since the 11 percent sell-off that ended in February 2016.

“When you bring in the historical context, these low volatility markets are reflective of a bullish trend. We’re more inclined to use that as a reference point than a VIX spike over three days,” Sohn said.

Some technicians noted that the abrupt reversal in the Nasdaq Thursday, after it surged to new highs on the open, could be a warning about the market-leading tech sector and the market in general.That was a particular warning as August begins this week, some said.

“It’s something to keep in mind for the next four to six weeks…Once October starts, you usually see the bullish equities seasonals take over,” Sohn said.

Source: Strategas

Disclosure: CNBC parent NBC Universal has a minority holding in Kensho Analytics.

Source: Investment Cnbc

Why July may have set up the stock market for a very good year