The early bitcoin mining pioneers are giving way to giant organizations operating on multiple continents.

Nearly a decade after an online user named Satoshi Nakamoto published a paper describing how “Bitcoin: A Peer-to-Peer Electronic Cash System” does not need to rely on trusted institutions, individual bitcoin mining is growing more difficult, while large enterprises have emerged.

Today, mining bitcoin is “such a specialized activity,” said Jonathan Mohan, founder of an enthusiast group called Bitcoin NYC. He said he’s never actually mined bitcoin himself. “I wouldn’t go about doing that without partners.”

“It used to be something that non-specialized hardware could do and non-specialized individuals could do,” Mohan said. “If you’re looking for exposure into bitcoin, it’s more cost effective to buy.”

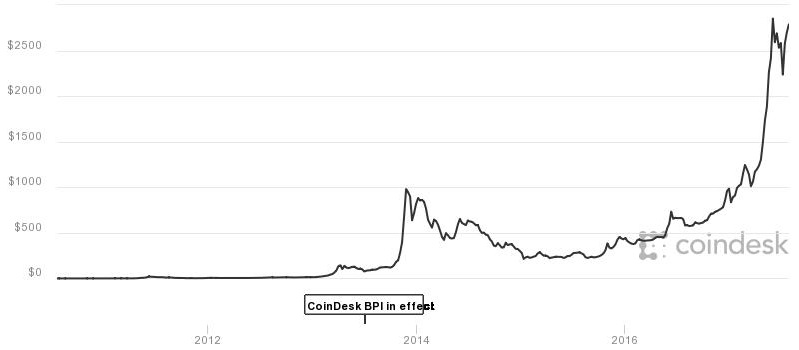

Sometimes called “digital gold,” bitcoin has leaped exponentially from 6 cents seven years ago to a record $3,025 this June, according to CoinDesk. At $2,700 Tuesday, the digital currency remains more than double its value at the beginning of the year. The currency held its gains amid a split, supported by a minority of bitcoin developers, that took effect Tuesday morning.

Bitcoin (2010 – 2017)

Source: CoinDesk

The meteoric rise in price has not only attracted bitcoin buyers, but also resulted in a surge of interest in digital currency mining. Mining bitcoin requires high computing power to solve a complex mathematical equation, proving that an anonymous miner used the process the network agreed upon to build the blockchain record of transactions. Miners then get bitcoin in reward for successfully completing the equation.

Miners used to be able to use ordinary video graphics cards to process the computations profitably. But in 2013, a Chinese-based company sold the first application-specific integrated circuits, or asic, computer chip cards that mined bitcoin 50 times faster than traditional video graphics cards.

Today, those specialized mining sets can cost anywhere from a few hundred to more than $1,000. It’s often also more cost-effective for miners to join mining pools and collaborate on solving the equation, often for a small fee.

“The fact graphics card manufacturers are making special cards, cryptocurrency mining cards, I think it’s a pretty big turning point for the crypto[currency world] in general,” said Roger Ver, an early investor in bitcoin and sometimes outspoken figure in the digital currency community.

Ver now heads bitcoin mining hardware seller and mining contracts firm Bitcoin.com. “The demand is just incredible,” he said.

Some models of AMD and Nvidia graphics cards have sold out in the last few months due to high demand from digital currency miners. Through their partners, the companies are now planning to sell cards specifically for mining bitcoin, ethereum and other digital currencies.

Advanced Micro Devices topped earnings expectations in the second quarter, and AMD raised its sales forecast for the current quarter, implying $1.5 billion in sales, or about $100 million more than Wall Street forecast. Nvidia is scheduled to report earnings on Aug. 10.

Other firms also sell software that allow miners to switch between different currencies, depending on which is more profitable to mine that day.

Bitcoin mining hardware and software company Bitfury generated nearly $100 million in revenue for fiscal year 2017, according to a July 24 report from CoinDesk, citing documents it obtained.

Bitfury declined to confirm the report. “We are incredibly optimistic about Bitfury’s growth both today and in the years to come because we know that our expertise, hard work and determination are second to none,” the firm’s global chief communications officer, Jamie Smith, told CNBC in a statement.

The company said it has expanded from “a handful of people” to more than 250 employees working in more than 20 countries. Meanwhile, its customers have grown from “bitcoin enthusiasts buying hardware” to “governments, companies and organizations,” Smith said.

For Nchinda Nchinda, a graduate student at the Massachusetts Institute of Technology, he said a roughly half-year bitcoin mining stint at home was “definitely not profitable.”

Now he helps run his university’s bitcoin club, which he said bought mining equipment for about $9,000 and works with the school data center to mine bitcoin. That operation at least breaks even, he said, while “at home, I was like losing everything.”

The biggest mistake new bitcoin miners make when calculating costs is using the current price of bitcoin to estimate returns, Nchinda said. “Instead of mining hardware, you should have just bought bitcoin,” he said. “If we just used that $9K and bought bitcoin, we would have had more.”

Despite the emergence of bigger players in bitcoin mining, some regions of the world still provide an edge for individual miners. Since the process is very energy intensive, low or essentially free electricity in China and Venezuela make the two countries relatively attractive places to mine bitcoin today.

Political turmoil and soaring inflation in Venezuela also give locals more incentive to mine bitcoin, which has more than doubled in value against the U.S. dollar this year.

One Venezuelan bitcoin miner and university student named Alberto – last name withheld for security reasons – told CNBC that foreigners often come to Venezuela specifically to set up bitcoin mining shops.

Alberto said he started mining bitcoin more than two years ago after he heard about the digital currency on Facebook. Equipped with some Advanced Micro Devices and Nvidia cards, as well as two air conditioners to keep the operation cool, Alberto said he makes about $3,300 a month.

But “It’s give and take. On the one hand, electricity is cheap, but you also have to be discreet,” he said. “It’s as if you were trafficking drugs.”

The Washington Post reported in March how the Venezuelan government has arrested several bitcoin miners in the last few months.

Meanwhile in China, the Communist Chinese government started cracking down on bitcoin exchanges earlier this year. As a result, the share of global bitcoin trading in yuan dropped from above 90 percent to below 10 percent in January, according to CryptoCompare.

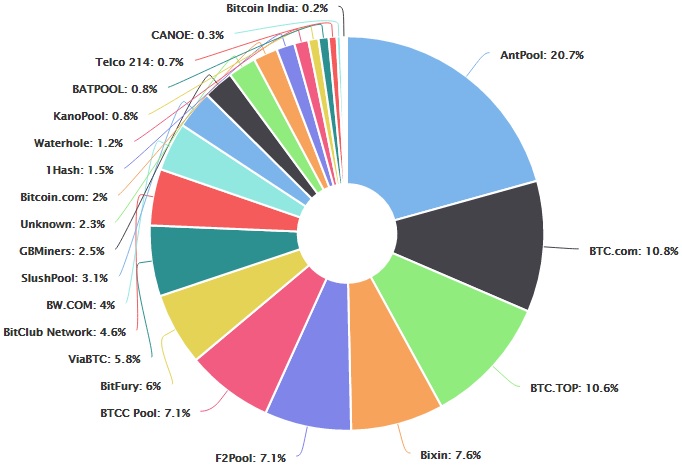

However, Chinese bitcoin miners still dominate the bitcoin network. The top six mining pools by global processing power are Chinese, and make up more than half of all that hashrate, according to blockchain.info.

Bitcoin mining pools by share of global activity over the last four days

Source: blockchain.info

One of the key Chinese figures in the bitcoin world, Jihan Wu, told CNBC he got involved with the digital currency in 2011.

“I read some blogs about bitcoin and at that time I felt very excited and saw the potential,” Wu said. “I put all my savings” in bitcoin.

Now, he’s a successful bitcoin entrepreneur and an influential voice in the digital currency community. After studying finance at Peking University, one of the top colleges in China, Wu co-founded Bitmain, one of the largest sellers of bitcoin mining hardware and the owner of major mining pools.

Bitcoin may also be moving further away being the currency of the internet black market.

Buyers in that market who wanted to add a layer of privacy to their transactions previously could pay Bitmixer to do so. However, the company announced in an online post on July 23 that it was closing despite “huge profit,” and that it hoped to make the “Bitcoin ecosystem more clean and transparent.”

“I believe that Bitcoin will have a great future without dark market transactions,” the Bitmixer post said. “You may use Dash or Zerocoin if you want to buy some weed. Not Bitcoin.”

— CNBC’s Fred Imbert contributed to this report.

Bitcoin 'mining' goes from enthusiasts to giant enterprises as digital currencies surge