Wal-Mart‘s story as a retailer is “fresher than it’s been in years,” according to Oppenheimer & Co. analyst Rupesh Parikh.

And much of the latest momentum around the big-box retailer stems from Wal-Mart’s position to take an even larger share of the grocery market, Parikh wrote in a Wednesday note to clients.

Already, groceries comprise more than 55 percent of Wal-Mart’s U.S. sales. And by adding e-retailer Jet.com to its portfolio in 2016, Wal-Mart has set itself up to go “toe to toe” with any competition — both offline and online — today, Parikh said.

“In our view, in acquiring eCommerce operators, WMT is much more focused upon purchasing key, unique capabilities and technologies, rather than upon simply adding sales.”

Oppenheimer has initiated an outperform rating on the stock, with a $90 price target. Wal-Mart’s stock closed Tuesday at $80.50, up about 6.4 percent from a month ago.

It’s no surprise the grocery wars have been heating up in the U.S., with internet giant Amazon announcing plans to acquire Whole Foods, German grocer Lidl entering the market, rival Target quietly making changes to its supermarket strategies, and other companies, like Kroger, trying to do more with its private-label brands.

Being the behemoths of companies that they are, though, Wal-Mart and Amazon stand out above the rest. Oppenheimer said the worries over private-player Lidl’s expansion and encroachment are especially “overblown.”

“It feels as if the battles have only started between WMT and AMZN,” Parikh said. Looking ahead to the Amazon-Whole Foods deal, “we still do not know AMZN’s intentions, and it is still unclear how the company plans to sell conventional products in a brick & mortar setting. … This remains a big unknown and an area of intense focus for us.”

That being said, Wal-Mart has made great strides in the grocery department of late and continues to evolve, as evidenced by a shake up of its food leadership team. Reuters reported the news recently, citing an internal memo. Wal-mart didn’t immediately respond to CNBC’s request for comment.

Some of Wal-Mart’s key changes include one for Shawn Baldwin, senior vice president and general merchandise manager for produce and global food sourcing, who will focus on a new initiative for Hispanic customers. Wal-Mart will also split leadership in its bakery and deli departments, the memo said.

Meantime, Wal-Mart’s main initiatives in grocery — as pointed out by Oppenheimer — include improving its “fresh” offerings, making online grocery pick-up services more accessible, growing SKUs on Jet.com, increasing focus on private-label brands — especially at Sam’s Club, and continuing to invest in keeping prices low.

After completing comprehensive store checks, it also appears Wal-Mart is trying to improve customer service and the overall experience for shoppers picking up groceries at its stores, Parikh said.

Notably, Wal-Mart’s expansive U.S. brick-and-mortar footprint also sets the company up to benefit from the many other retailers — such as Sports Authority, Gymboree, Sears and RadioShack — announcing store closures this year. According to Oppenheimer, there is now more than $18 billion in sales up for grabs, with shoppers being forced to ring up purchases elsewhere.

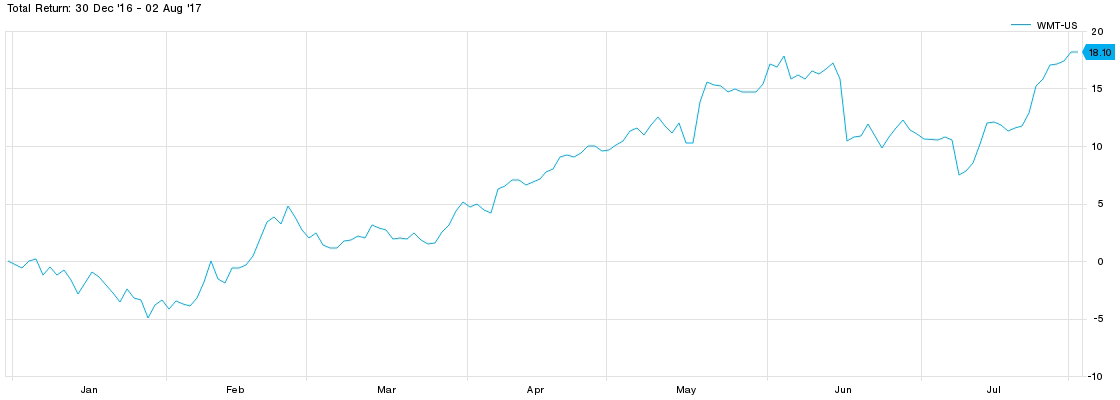

Wal-Mart shares have climbed 10 percent over the past 12 months, and the stock is up more than 16 percent since the start of the year. These gains far outpace the S&P 500 Retail ETF’s (XRT‘s) loss of about 6 percent for the year-to-date period.

Source: FactSet

Notably, Wal-Mart is set to report second-quarter earnings before the bell on Thursday, Aug. 17. Oppenheimer & Co. has said it expects Wal-Mart to “at least match Street forecasts.”

“Key metrics such as traffic and comp sales have picked up lately. We look toward FY18 as the first year of more meaningful positive [earnings] growth for WMT since [2013].”

Wal-Mart stands to win the grocery wars with Amazon, Lidl, Oppenheimer says