Goldman Sachs expects Boeing, Tiffany and some health care companies to benefit from the diving U.S. dollar.

“The ripple effects of a weaker dollar benefit US stocks with overseas sales,” David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a report published late Tuesday with other analysts.

The U.S. dollar index has fallen more than 9 percent this year and hit a low of 92.548 Wednesday, its lowest since May 2016.

Goldman’s basket of 50 S&P 500 stocks with a high percentage of international sales has climbed 18 percent this year, versus 7 percent gains for Goldman’s basket of stocks with domestically-generated sales. The S&P 500 has risen 10.5 percent this year.

In the Tuesday report, the analysts announced 10 changes to the outperforming group.

In addition to Boeing and Tiffany, the Goldman analysts added two health care stocks, life sciences products manufacturer Danaher and laboratory instruments manufacturer Mettler-Toledo International, to the international sales basket of stocks.

Other stocks the analysts added were Wynn Resorts, risk management firm Aon, International Flavors & Fragrances, perfume giant Coty, energy extraction products and services firm TechnipFMC and semiconductor company KLA-Tencor.

Existing members of the 50-stock basket include United Technologies, Newmont Mining, Priceline, McDonald’s and Aflac.

The median percentage of overseas sales for a stock in the international sales basket is 71 percent, versus a median of 27 percent of non-U.S. sales for the S&P 500, the report said.

A weaker U.S. dollar makes U.S.-produced goods cheaper for overseas buyers, helping sales.

In the first quarter, 41 percent of S&P 500 firms beat the consensus sales estimate by at least one standard deviation, the highest level in six years, the Goldman report said.

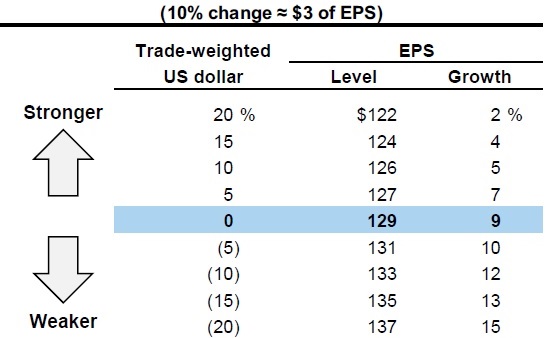

“We estimate that a 10% decrease in the trade-weighted US dollar relative to our baseline expectation should boost S&P 500 EPS by $3/share,” the analysts said.

Sensitivity of S&P 500 earnings per share to U.S. dollar, as of July 28, 2017

Source: Goldman Sachs Global Investment Research

Goldman’s currency strategists expect the U.S. dollar to recover some of its strength, but forecast limited gains. They attribute U.S. dollar weakness to better growth outside the U.S. and softer-than-expected inflation.

The weaker U.S. dollar has also affected sales for European stocks with exposure to the United States, the report said.

Goldman said its basket of European stocks with the highest share of U.S. sales has fallen 2 percent this year, while its selection of European stocks with high exposure to that continent have climbed 10 percent.

The euro has contributed significantly to the weakness in the U.S. dollar. On Wednesday, the euro hit a high of $1.1909, its highest against the U.S. dollar since Jan. 2015.

“The euro’s strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors” due primarily to the defeat of the populist party in France, Marc Chandler, chief currency strategist at Brown Brothers Harriman, wrote in a blog post Tuesday.

That said, Goldman expects the dollar to strengthen against the Japanese yen, British pound sterling and the Chinese yuan in the next 12 months. “A stronger dollar represents a potential headwind to firms with the highest sales exposure to these regions,” the report said.

Stocks the report said could be affected include Applied Materials, Advanced Micro Devices, KLA-Tencor, Lam Research and Xilinx.

Source: Tech CNBC

With the dollar diving, these stocks are set to cash in, Goldman predicts