A company’s best defense against an activist investor is its ability to improve the business to boost the stock price.

And these companies are evaluated every three months with their quarterly earnings.

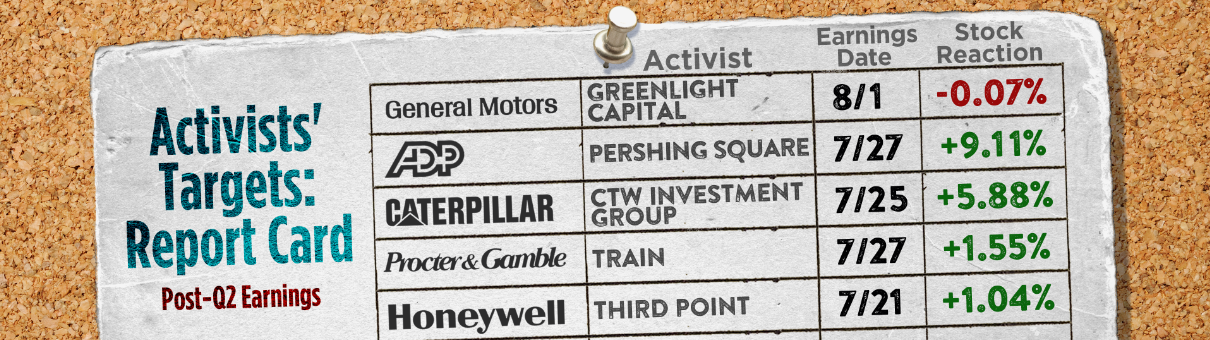

So CNBC took a look at these report cards for the largest targets where activists announced stakes this year. And the results indicate that a majority of these companies may find themselves with some empowered activists.

Of the top 10 targets by market cap, as compiled by 13D Monitor, six declined on the day they reported earnings.

Ericsson and Universal Health Services saw the biggest declines, with CenturyLink not far behind. The other three – Nestle, KKR and General Motors – ticked down only slightly.

On the positive side were Caterpillar, Procter and Gamble and Honeywell. All three of those beat estimates for both their earnings and revenue and gained on the day they reported.

Third Point’s Daniel Loeb is angling for changes at Nestle and Honeywell. Trian’s Nelson Peltz is taking on P&G and seeking a board seat.

ADP reported earnings on the morning of July 27, and its shares were up slightly after that. But then, Bloomberg reported later in the day about Bill Ackman’s stake and the stock surged from there.

To be sure, not all of these situations have reached the point of a proxy fight. Overall, if second-quarter results are any indication, there could be more fuel for activists’ fire in the second half of the year.

Source: Investment Cnbc

Activists empowered this earnings season after big targets underperform