Bitcoin has gotten a lot of fanfare lately but not from Howard Marks, a legendary value investor on Wall Street.

Marks told CNBC’s “Halftime Report” on Thursday that’s because he doesn’t understand what is the actual value of Bitcoin.

“It’s not a medium of exchange, it’s a medium of trading, so I can’t see any intrinsic value,” Marks said. “I don’t understand what’s behind Bitcoin.”

“For me, there is only one kind of investing: When you look at something, you don’t think ‘is it going up or down tomorrow?’ … you say ‘what is the intrinsic value?’ and then you say ‘can I buy it for less?'” Marks added. “There is no intrinsic value in Bitcoin.”

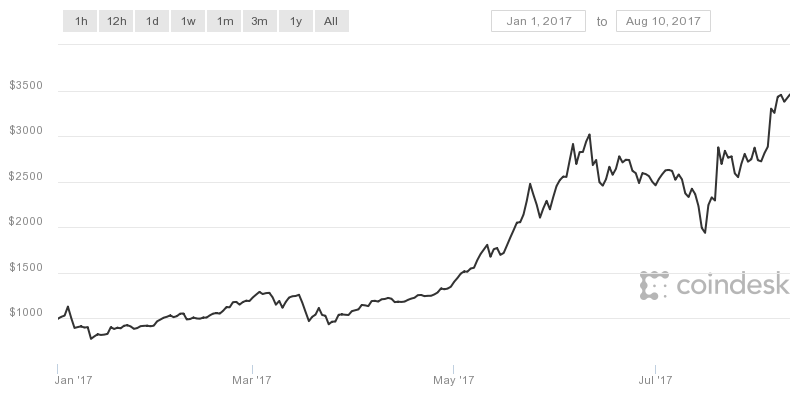

Bitcoin has surged nearly 250 percent this year alone, prompting many to hop on the cryptocurrency’s bandwagon.

Bitcoin in 2017

Source: Coindesk.com.

Fundstrat co-founder Tom Lee told CNBC’s “Fast Money” on Wednesday he thinks the cryptocurrency will be the best-performing asset class through year-end. Investing legend Bill Miller reportedly owns Bitcoin and Josh Brown, CEO of Ritholtz Wealth Management, said last month he used Coinbase to bitcoin.

“Maybe I’m just too old and too much of dinosaur to understand Bitcoin,” Marks said jokingly.

The co-chairman of Oaktree Capital is widely known for his investment memos, which predicted the financial crisis and the dotcom bubble implosion.

The manager in a memo last month compared cryptocurrencies to the Tulip mania of 1637, the South Sea bubble of 1720 and the internet bubble of 1999.

–With reporting by Tae Kim

Disclosure: Josh Brown is a CNBC contributor.

Source: Investment Cnbc

Howard Marks, who's called past market bubbles, says 'I don't understand what's behind bitcoin'