Bitcoin will likely outperform stocks and bonds the rest of this year, according to the first major Wall Street strategist to issue a report on the digital currency.

“I think bitcoin is an underowned asset with potential for huge institutional sponsorship coming,” Fundstrat co-founder Tom Lee said on CNBC’s “Fast Money” Wednesday.

“It has a lot of characteristics that are very similar to gold that I think will make it ultimately attractive as an alternate currency,” he said. “It’s a good store of value.”

Here’s Lee’s outlook on bitcoin given on the show into year end:

Gold or bitcoin? Bitcoin?

“Yes.”

Would you rather own bitcoin versus a basket of U.S. stocks?

“Between now and year end it’s easily bitcoin.”

Will bitcoin be the best performing asset?

“Yes.”

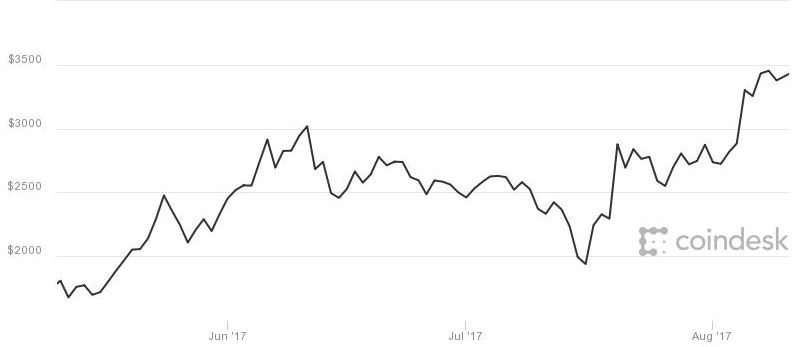

Bitcoin leaped to record highs this week above $3,500, more than tripling in value for the year despite a split in the currency last week into bitcoin and bitcoin cash, an alternative version supported by a minority of developers.

Bitcoin traded 1.5 percent higher near $3,428 Thursday morning, according to CoinDesk. Bitcoin cash steadied after wild swings in its first week of trading to trade slightly lower near $303, according to CoinMarketCap.

Another digital currency, ethereum, rose 1 percent to just under $300, according to CoinDesk.

Bitcoin three-month performance

Source: CoinDesk

Lee published a report in early July outlining the potential for bitcoin to rise above $20,000 and potentially reach $55,000 by 2022. He was the first major Wall Street market strategist to issue a report on the digital currency. Formerly the top stock strategist at JPMorgan and a perennial favorite of big institutional investors, Lee was also one of the few on Wall Street to predict that a Donald Trump win in last year’s election would cause stocks to rally, not fall like most had seen.

There are coming catalysts for bitcoin to rise further, Lee said Wednesday.

“Institutions have to directly buy the coin today through a broker, but both the CBOE and the CFTC have opened up options futures trading so I think it’s going to grow in holdings,” he said.

In the last month, the Chicago Board Options Exchange said it plans to offer bitcoin futures by early next year, while the U.S. Commodity Futures Trading Commission approved a digital currency trading firm called LedgerX to clear derivatives.

Market strategists have noted there are few highly attractive investment opportunities right now with U.S. stocks at all-time highs, bonds steady as the Federal Reserve remains on a gradual pace of monetary policy tightening and gold in a trading range.

The median S&P 500 target of strategists surveyed by CNBC is 2,475, just a point above where the S&P 500 closed Wednesday. Lee happens to be the most bearish among those strategists with a year-end target of 2,275, or 8 percent below Wednesday’s close.

Top Wall Street strategist expects bitcoin to be the best asset through year-end