Third Point’s Dan Loeb sold out of Snap shares in the second quarter, one quarter after buying the social media stock, according to a regulatory filing Friday.

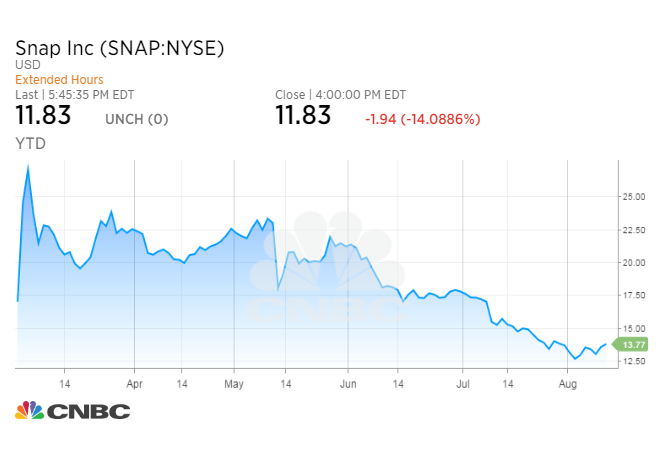

Snap’s shares have lost half their value since the initial public offering in March but they did get a temporary 21.5 percent bump up in May after first quarter filings by hedge funds showed Loeb and others bought the stock. Snap shares are down 33 percent so far this quarter amid the expiration of the lockup period for early investors and a disappointing second quarter earnings report.

Third Point dissolved its holding of 2.25 million shares of the Snapchat parent in the second quarter, Friday’s 13F filing with the Securities and Exchange Commission showed.

Snap since IPO

In the second quarter, the hedge fund also increased its stake in Dow Chemical by 300,000 shares to 16 million, the filing said.

Dow is set to finalize its merger with DuPont on Aug. 31, and spin off units of the combined company within the next 18 months.

On May 24, CNBC reported that Third Point had sent a presentation to Dow Chemical and DuPont calling for changes to the proposed corporate structure that could give $20 billion more to shareholders.

In a second quarter investor letter obtained by CNBC in late July, Loeb said the firm reduced holdings in bank financials and exited reflationary macro trades.

The firm reduced those investments in the “fading Trump Trade” and instead repositioned the portfolio towards companies that “benefit from low inflation,” the letter said.

Friday’s 13F filing showed Third Point dissolved its stake in JPMorgan Chase, but increased its holdings of Bank of America shares by 1.5 million to 15 million.

To be sure, the required SEC filing reflects positions that are more than a month old, and Third Point could have bought or sold shares in the time since.

Third Point said in its investor letter that the firm’s Offshore Fund returned 10.7 percent in the first half of the year, beating the 8.3 percent gain in the S&P 500 through the end of June.

— CNBC’s Leslie Picker contributed to this report.

Source: Tech CNBC

Dan Loeb's Third Point hedge fund dumps Snap shares after just one quarter