Longtime stock researcher Ronnie Moas raised his price target on bitcoin by $2,500 Monday after the digital currency hit an all-time high over the weekend.

“What’s happening is the floodgates are opening,” Moas, founder of Standpoint Research, said in a phone interview with CNBC Monday. “I believe there are hedge funds and very deep-pocketed individuals going into this now, really hundreds of millions of dollars.”

Moas first laid out his views on bitcoin’s potential in early July and issued a formal report at the end of last month with a price target of $5,000 for next year.

He told clients Monday he now expects bitcoin to hit climb nearly 80 percent from the weekend’s records to $7,500, and maintained the digital currency could surge to $50,000 in 2027 — representing a 28 percent annual compounded growth rate.

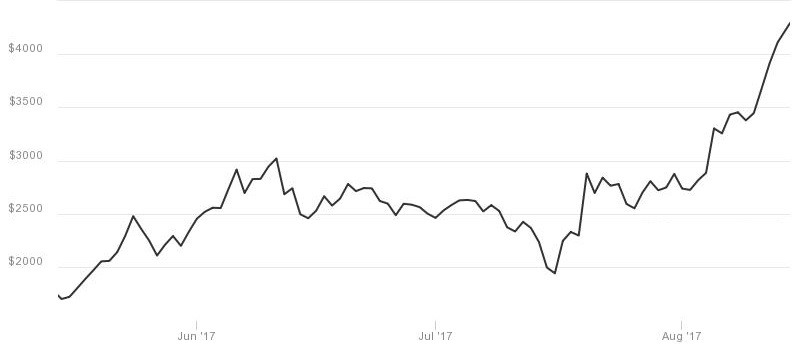

Bitcoin three-month performance

Source: CoinDesk

After bitcoin’s uneventful split into bitcoin and bitcoin cash on Aug. 1, bitcoin has soared more than 40 percent to all-time highs.

Bitcoin climbed 5 percent Monday morning to a record high of $4,321.08, more than quadruple in value for the year, according to CoinDesk. At that price, the digital currency has gained about 50 percent for August.

As institutional investor interest in bitcoin grows, Moas expects digital currencies to become part of “strategic reserves” and “asset allocation models in the near future.” He also said people in foreign countries will likely want to buy digital currencies as a more stable alternative to their national currencies.

“You can’t look at this as a normal situation,” he said. “We’re in an industry that will probably go from $140 billion to $2 trillion and the bitcoin price will probably move with that.”

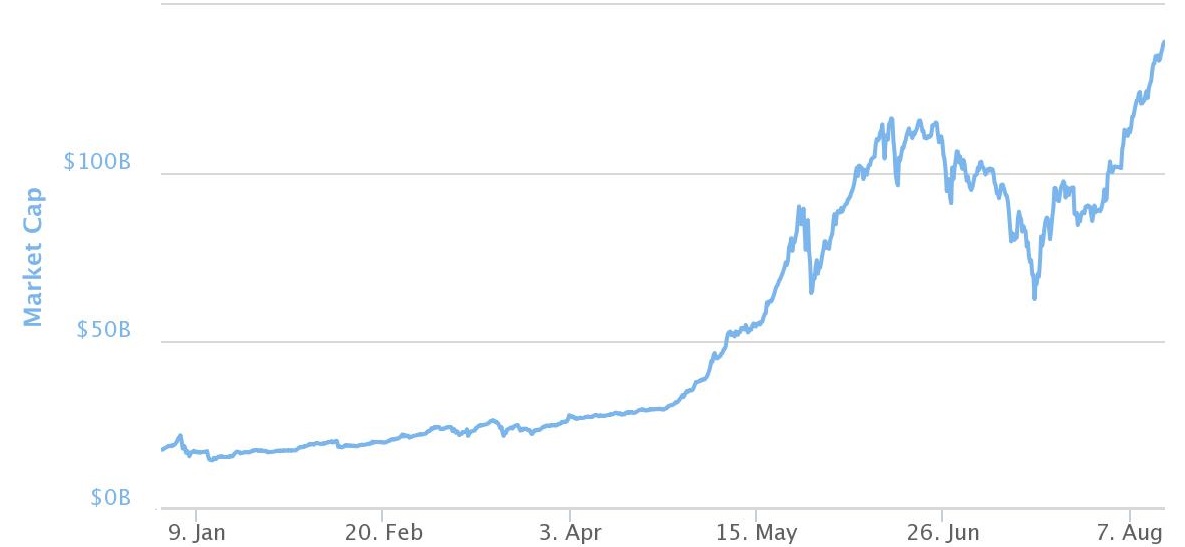

The total market value of more than 800 digital coins listed on CoinMarketCap.com has climbed from around $20 billion at the start of this year to about $140 billion Monday. Bitcoin accounts for about half of that value.

Year-to-date change in global value of digital currencies

Source: CoinMarketCap

Another digital currency, ethereum, traded 1 percent higher near $307, according to CoinDesk. Ethereum has shot up more than 3,000 percent this year.

Bitcoin cash, an alternative version of bitcoin supported by a minority of developers, held steady near $300, according to CoinMarketCap.

Moas told CNBC that 100 percent of his investments are in digital currencies, with the majority in bitcoin and ethereum. He said he never invested in the stocks he issued reports on.

He added in his Monday note to clients:

“Any way that I look at these numbers, my forecasts are looking conservative. It looks to me as though we are at the same point in the adoption curve as we were in 1995 when we went from one million internet users to ten million. The following year the Netscape browser came online and we went from 10 million users to hundreds of millions of users overnight.”

“I expect that within a couple of years we will have between 50 and 100 million cryptocurrency users — up from approximately ~10 million today. We only have 0.15% market penetration right now — if that goes to 2% or 3% we will get to the $50,000 price target that I set at the beginning of July.”

To be sure, many note that bitcoin remains like the Wild West compared to the established Wall Street market.

“People should understand they’re not dealing with the NYSE right now. There’s no regulation, there’s no face that you can attach to these exchanges,” Moas told CNBC, noting his digital currency holdings are spread across five exchanges.

Bitcoin lost more than half its value in 2014 as Mt. Gox, then the largest exchange by far, said it lost about 850,000 bitcoins (worth about half a billion U.S. dollars at the time) and filed for bankruptcy.

This July, the U.S. Department of Justice alleged in an indictment that a “sizeable portion” of the Mt. Gox losses were deposited in accounts controlled, owned and operated by an exchange called BTC-e and a Russian national named Alexander Vinnik. Vinnik was arrested in late July.

— Reuters contributed to this report.

Source: Tech CNBC

After calling latest surge above ,000, Standpoint's Ronnie Moas raises bitcoin forecast to ,500