As the Trump administration looks to take a tougher stance against Beijing, Chinese investments into the U.S. have more than halved this year, according to Dealogic.

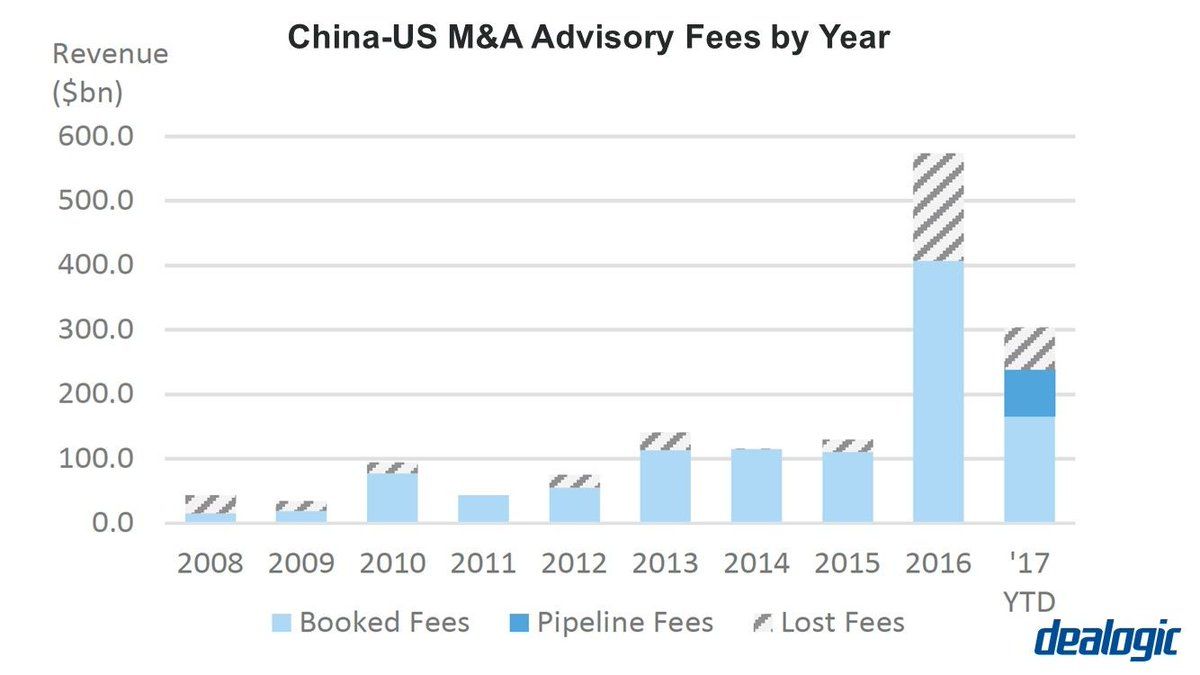

“Amid growing regulatory scrutiny of China outbound M&A targeting the U.S., volume has seen a 65 percent year-on-year decline in 2017 year-to-date,” Nicholas Farfan and Karl But of Dealogic Research said in an Aug. 8 note. “In comparison, such deals peaked at $65.2 billion last year, with high-profile deals including HNA’s acquisition of 25 percent of Hilton Worldwide.”

“With tightening restrictions, Chinese buyers may look to stop pursuing or shelve potential acquisitions in the U.S.,” the note said.

The pressure and uncertainty is coming from both countries. On Beijing’s side, authorities are reportedly targeting some of the largest Chinese dealmakers to try to keep capital from fleeing the country and contributing to yuan weakness. On the American side, reports indicate the Committee on Foreign Investment in the United States is looking to use national security concerns to prevent more Chinese purchases of U.S. firms, especially in technology.

Anecdotally, Gregory Husisian, chair, export controls and national security group at law firm Foley & Lardner, noted that an increasing number of clients are concerned about working with Chinese buyers due to the potential for regulatory intervention.

The dealmaking industry could also suffer some significant business setbacks.

The Dealogic analysts estimate about $9.7 billion in pending Chinese deals to buy U.S. firms could fall under regulatory scrutiny, potentially putting $75 million in advisor fees at risk.

To be sure, other lawyers and analysts said Chinese investment in U.S. real estate and industries outside of sensitive areas like technology may not be as affected by the Trump administration. Increased trade barriers could also incentivize Chinese firms to build more factories directly in the U.S., some analysts said.

For now, delays in actual policy announcements only add to uncertainty.

“There is lots of confusion,” said Siva Yam, president of the Chicago-based U.S.-China Chamber of Commerce. “The U.S.-China trade relationship will continue to be tense.”

Source: Investment Cnbc

Chinese takeovers of US companies plummet this year amid tough Trump talk