LAST year California Solar Systems (CSS), a small installer of residential solar panels, decided to “Buy American”. It turned to Suniva, a Chinese-owned firm that makes photovoltaic panels in Georgia and Michigan, rather than use cheap imports. But according to CSS’s boss, Bastel Wardak, Suniva was unable to deliver what it promised, leading to unacceptable delays. He then tried SolarWorld, a more expensive producer in Oregon whose panels could also be marketed as “Made in the USA”. But troubles at SolarWorld’s German parent put a stop to that. Now Suniva and SolarWorld are seeking new protections from America’s International Trade Commission (ITC). On August 15th Mr Wardak was one of many to testify that the two firms did not deserve them.

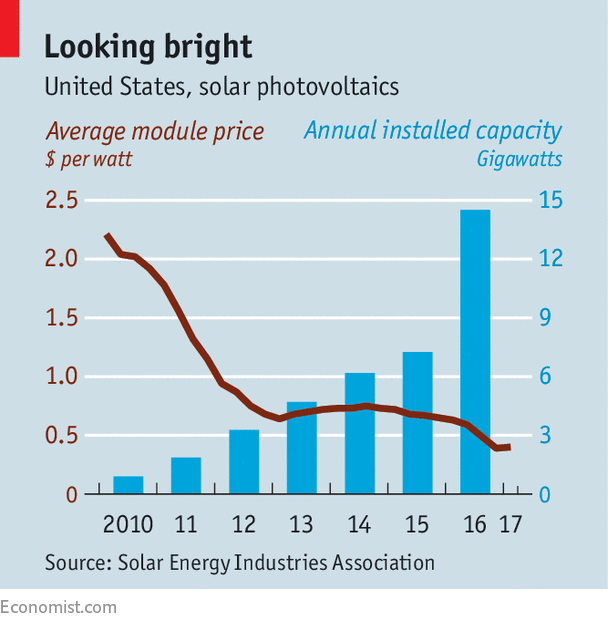

The case pits American solar-cell makers against solar-panel installers. It could have big implications. Solar was the biggest source of power-generating capacity built in America last year, thanks to falling prices (see chart), but protections could push those prices up again. The ITC investigation, which makes use of a rusting bit of trade law called Section 201, is also a test of the Trump administration’s willingness to defend domestic manufacturing.

-

Robert Pattinson has put his teen heartthrob roles behind him

-

Steve Bannon is ousted as the president’s chief strategist

-

Islamist terrorism in Catalonia leaves the Spanish wondering why

-

A year on from Brexit

-

The misplaced arguments against Black Lives Matter

-

Donald Trump blusters, Latin America shrugs

If the ITC decides by a September 22nd deadline that imports are a “substantial cause of serious injury” to the two manufacturers, it could recommend that Donald Trump adopt protective measures, such as import quotas. The president could then decide which remedy, if any, to apply. Opponents of the petition say protectionism would set America’s solar industry back five years, with higher prices clouding solar’s appeal as an alternative to natural gas. Solar installations have ground to a halt since June, after the ITC began its probe.

The ITC’s decision will hinge on whether its commissioners accept that imports are chiefly responsible for the travails of Suniva and SolarWorld. Juergen Stein, SolarWorld’s boss in America, points to a “circle of death” in the industry, with global overcapacity forcing down prices, which compels firms to produce more to gain the benefits of scale, which further lowers prices. SolarWorld and Suniva claim that imports are the main culprits: solar-panel installations in America climbed by 350% from 2012 to 2016, but imports rose by 500%.

SolarWorld has already successfully petitioned for tariffs on imports from China and Taiwan. The company says that Chinese and Taiwanese manufacturers have moved factories elsewhere in Asia to skirt import duties in America, adding to a global glut that has sapped demand for American products. Suniva filed for bankruptcy in April, nine days before launching the petition. SolarWorld laid off 360 workers last month. Nearly 30 other American producers have closed down since 2012. So Suniva and SolarWorld are seeking protections that would apply to all importers.

The plaintiffs’ opponents, including the Solar Energy Industries Association (SEIA), a trade body, argue that the firms’ main woes are self-inflicted. They did not foresee how fiercely solar manufacturers would compete to match the low prices of natural gas. Nor did their products meet demand: the two firms have mostly failed to supply the 72-cell panels that are standard for the large, utility-scale installations that now predominate; they produced smaller, 60-cell panels more suitable for rooftop solar. As a result, those seeking utility-scale installations turned to imports. Several companies also told the ITC that the pair lacked the scale in cell manufacturing to provide the modules they claimed were all-American. Instead, they imported some components.

The SEIA says broader protections against imports could threaten many of the 260,000 Americans employed by the solar industry. Only 15% of that total work in solar factories. Some fear the ITC may be more easily swayed by the bankruptcy of a few than the threat to many. Mr Trump has no love for solar power, but does like appeals from ailing manufacturers. The industry is bracing for the worst.

Source: economist

A trade dispute threatens America’s booming solar industry