The bitcoin offshoot, bitcoin cash, soared Friday after indications the alternative digital currency could achieve its goal of speeding up transactions.

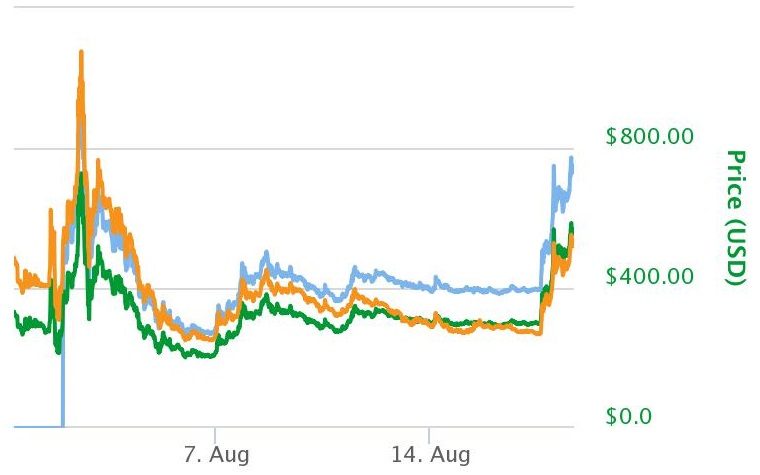

Bitcoin cash rose 40 percent from Thursday’s close of $460.53 to briefly hit $655 Friday afternoon, according to CoinMarketCap. That’s the highest since bitcoin cash touched $756.93 on Aug. 2, the day after bitcoin split into bitcoin and bitcoin cash.

However, the volatile surge was even greater when considering bitcoin cash hit an intraday low of $293 Thursday before climbing to $460.53, according to CoinMarketCap.

On Wednesday morning, bitcoin cash “miners” successfully demonstrated that the digital currency could support an eight megabyte block, versus the original bitcoin’s one megabyte. Blocks are part of the blockchain technology behind digital currencies like bitcoin that limit transaction speeds.

Bitcoin cash (Aug. 1 – 18)

Source: CoinMarketCap

The eight megabyte block “has proven that bitcoin cash is working,” said Charlie Hayter, CEO of digital currency information website CryptoCompare.

He added that gains in bitcoin cash’s price made it more profitable and easier for miners to mine bitcoin cash versus bitcoin, contributing to further gains in the offshoot currency’s price.

Investors in bitcoin at the time of the Aug. 1 split should have received equal amounts of bitcoin cash.

The original bitcoin traded 2 percent lower Friday near $4,220 after hitting an all-time high of $4,522.13 Thursday, according to CoinDesk. At Friday’s prices, bitcoin had a market value of about $70 billion and remained more than four times higher for the year.

Another digital currency, ethereum, traded 3 percent lower near $292, according to CoinDesk. Ethereum has the second-largest market capitalization among cryptocurrencies at $28 billion, according to CoinMarketCap.

With Friday’s gains, bitcoin cash ranked third by market value at around $10 billion, according to CoinMarketCap.

— CNBC’s Arjun Kharpal contributed to this report.

Source: Tech CNBC

'Bitcoin cash' surges 40% in single day as investors bet on its faster processing speeds