Stocks have been surprisingly resilient in the face of bigger picture risks around the world, though some would argue that it isn’t all that surprising.

There hasn’t been a significant pullback in the U.S. markets since the end of 2015 into early 2016, when the S&P 500 fell by around 14 percent between early November and mid February. Since then, traders and investors have been rewarded for buying stocks on any kind of a pullback, but could it finally be time for that larger pullback that so many have been trying to forecast?

While there aren’t any real ways to reliably predict the future, some traders are looking for signs of changing market sentiment in some of the stocks that have been success stories as of late. One way to try and identify stocks that could act as “tells” on the broader market is to screen for them using certain parameters.

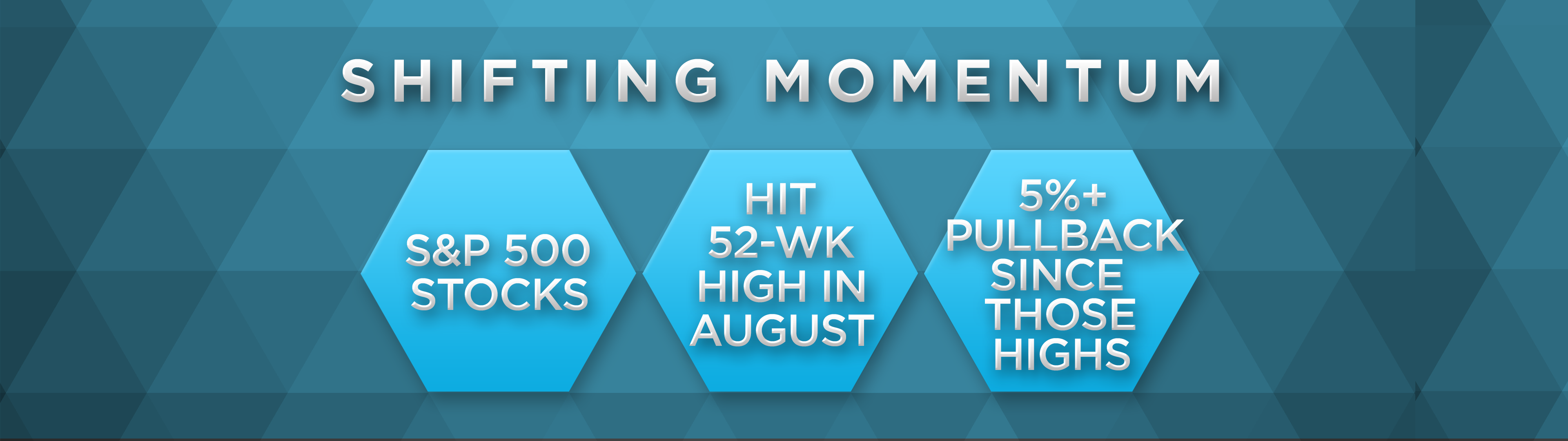

In order to illustrate this point, we ran a simple screen to look for stocks that have been relative winners in recent trading, but have been showing some signs of weakness. The parameters are as follows:

- S&P 500 members

- Recent highs hit in August month-to-date

- Greater than 5 percent pullback from those highs

The search found 109 stocks in the S&P 500 that have hit 52-week highs this month. Of those, 23 stocks have pulled back by at least 5 percent from those recent highs.

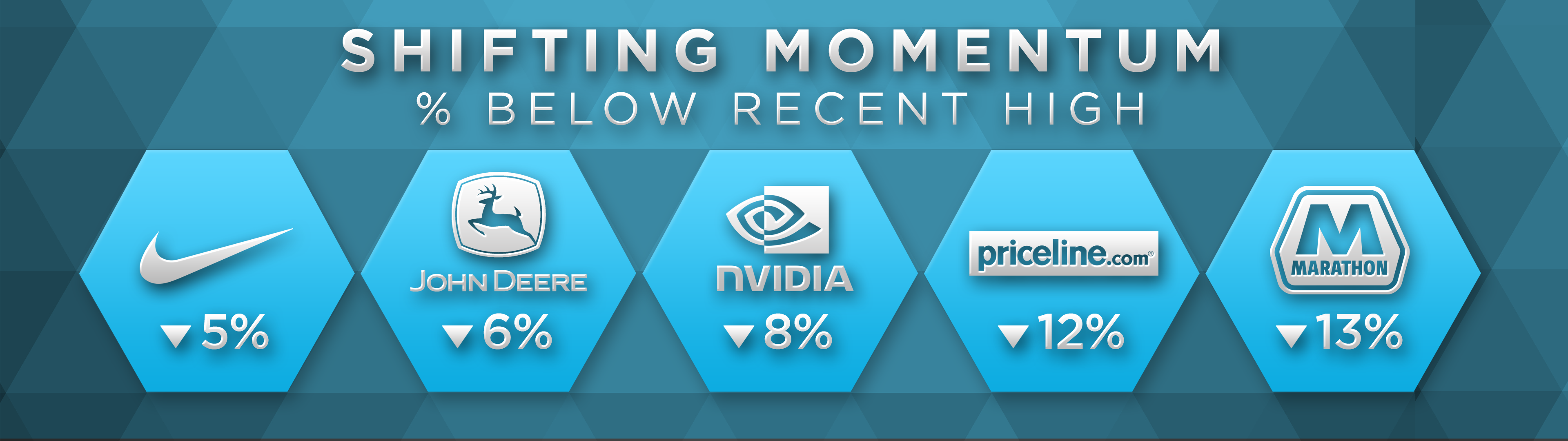

Some notable stocks passed those screening parameters, including athletic apparel giant Nike, farm equipment maker Deere, semiconductor maker Nvidia, and online travel site Priceline Group.

And some continue their fall. Nike is down 4.7 percent on Friday morning and Deere is down 8.4 percent.

Some of these stocks have been much more of a momentum play than others. For example, Nvidia shares have already gained 51 percent in 2017, and 164 percent over the last 12 months. They are nearly 8 percent below recent highs. Meanwhile, Prudential Financial hit a high on August 2, and has fallen 11 percent since then, resulting in a 2 percent drop on a year-to-date basis.

Screens like this are one of the many ways that some traders are identifying shifting momentum. This is by no means a perfect way to measure a turn in the market, but some of these screening methods could help in identifying emerging trends.

|

Ticker |

S&P 500 |

Last |

52Wk High |

52Wk High Date |

% Below 52WK H |

|

|

1 |

MPC |

Marathon Petroleum Corporation |

49.7 |

56.81 |

1-Aug-17 |

12.52% |

|

2 |

PCLN |

Priceline Group Inc |

1812.97 |

2067.99 |

8-Aug-17 |

12.33% |

|

3 |

PRU |

Prudential Financial, Inc. |

102.66 |

115.26 |

2-Aug-17 |

10.93% |

|

4 |

WYN |

Wyndham Worldwide Corporation |

96.15 |

106.5 |

3-Aug-17 |

9.72% |

|

5 |

ALB |

Albemarle Corporation |

112.11 |

123.48 |

7-Aug-17 |

9.21% |

|

6 |

LNC |

Lincoln National Corporation |

68.89 |

75.78 |

8-Aug-17 |

9.09% |

|

7 |

ANDV |

Andeavor |

92.72 |

101.52 |

1-Aug-17 |

8.67% |

|

8 |

VRSK |

Verisk Analytics Inc |

80.9 |

88.17 |

1-Aug-17 |

8.25% |

|

9 |

MS |

Morgan Stanley |

45.09 |

48.9 |

8-Aug-17 |

7.79% |

|

10 |

AMG |

Affiliated Managers Group, Inc. |

173 |

187.08 |

1-Aug-17 |

7.53% |

|

11 |

NVDA |

NVIDIA Corporation |

161.47 |

174.56 |

8-Aug-17 |

7.50% |

|

12 |

AMP |

Ameriprise Financial, Inc. |

138.74 |

149.99 |

8-Aug-17 |

7.50% |

|

13 |

MSI |

Motorola Solutions, Inc. |

87.13 |

93.75 |

4-Aug-17 |

7.06% |

|

14 |

TDG |

TransDigm Group Incorporated |

274.69 |

295 |

8-Aug-17 |

6.88% |

|

15 |

DE |

Deere & Company |

123.98 |

132.5 |

9-Aug-17 |

6.43% |

|

16 |

FISV |

Fiserv, Inc. |

121.09 |

129.35 |

1-Aug-17 |

6.39% |

|

17 |

UNM |

Unum Group |

48.16 |

51.43 |

8-Aug-17 |

6.36% |

|

18 |

CTAS |

Cintas Corporation |

131.19 |

139.74 |

1-Aug-17 |

6.12% |

|

19 |

EL |

Estee Lauder Companies Inc. Class A |

98.32 |

104.5 |

9-Aug-17 |

5.91% |

|

20 |

ALGN |

Align Technology, Inc. |

169.36 |

179.76 |

16-Aug-17 |

5.79% |

|

21 |

CINF |

Cincinnati Financial Corporation |

77.65 |

81.98 |

3-Aug-17 |

5.28% |

|

22 |

NKE |

NIKE, Inc. Class B |

57.46 |

60.53 |

3-Aug-17 |

5.07% |

|

23 |

HRB |

H&R Block, Inc. |

30.2 |

31.8 |

15-Aug-17 |

5.03% |

Source: FACTSET

Nike, Nvidia and other failing stocks could be signaling market shift everyone trying to forecast