As China‘s financial markets mature, major non-Chinese financial firms increasingly want to open funds in the country and tap the multitrillion-dollar institutional investor market there.

This summer, UBS Asset Management received a license for private fund management in mainland China, and BlackRock said it plans to set up its first private fund in the country. Vanguard launched a subsidiary in Shanghai in late May, while Fidelity International announced in January it became the first global asset manager to receive a Chinese license for a private fund.

“You can no longer ignore China. You have to plan on being there,” or have a good reason if you’re not, said Chantal Grinderslev, senior advisor at Shanghai-based investment management consulting firm Z-Ben, told CNBC.

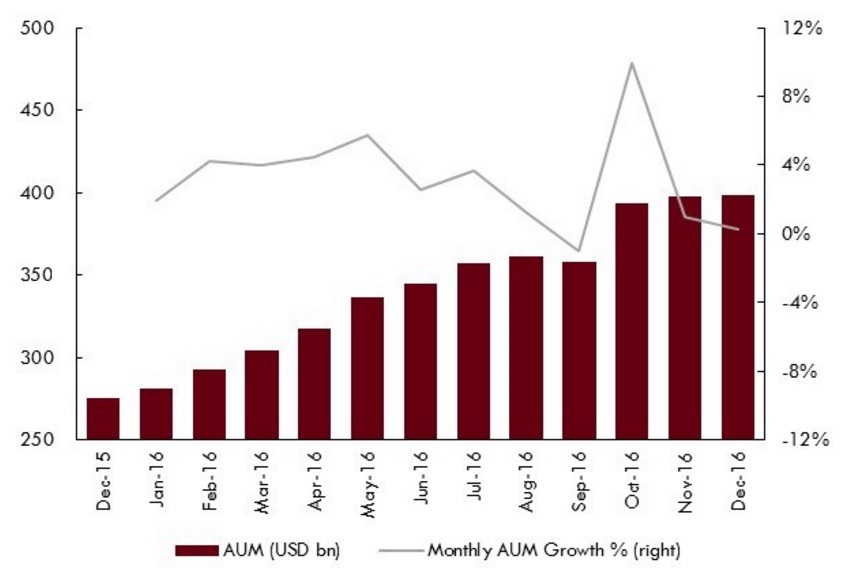

Chinese private fund assets under management

Source: Z-Ben

Chinese private funds’ assets under management grew 54.6 percent last year, to $398 billion, according to Z-Ben. Institutional assets across the country leaped 500 percent from $1.1 trillion to $7.1 trillion between 2005 and 2015, and could hit $10.8 trillion by 2021 with global asset managers taking an increasing proportion, according to Z-Ben estimates.

“China is a key growth market for UBS Asset Management. Our goal is to be a leading asset manager in China for both onshore and offshore investors,” Aries Tung of UBS Asset Management told CNBC in an email. “The license allows UBS Asset Management to start managing money for mainland institutional and high-net-worth investors in the world’s second-largest economy for the first time.”

Tung, who is UBS’ managing director and head of strategy and business development for China, added the firm plans to increase its staff in China from about 20 to more than 30 by the end of the year.

A friendlier regulatory environment is encouraging interest by U.S. firms to introduce funds in China. Since last summer, the Asset Management Association of China has gradually opened up the private fund market to foreign asset managers who open local subsidiaries known as wholly foreign-owned enterprises, or WFOEs.

Previously, foreign fund managers had to rely on joint ventures majority-owned by Chinese companies. Foreign ownership of public investment funds is still restricted.

The push into China’s financial markets also comes as more strategists emphasize the importance of global exposure in traditional portfolios, especially to fast-growing Asia.

The Boston Consulting Group in a July report highlighted China as a “promising” new market and one of five likely sources of “significant” gain in coming years for the asset management industry, whose active management business is pressured by outflows and technological developments.

“The Chinese market and its investors are becoming more sophisticated,” the report said. “An aging population and the growth of wealth are expanding demand for dedicated products, including target-dated funds and ETFs.”

Other foreign fund managers that have recently expanded in China include Neuberger Berman, which announced the opening of an investment management wholly foreign-owned enterprise in Shanghai in April and added a new investment team in China in July.

Private equity firms are also expanding in China. KKR announced on Aug. 10 it opened an office in Shanghai, its third office in Greater China. Warburg Pincus announced on Aug. 2 it is set to acquire a 49 percent stake in Chinese asset manager Fortune SG Fund Management, becoming the first global private equity firm to gain exposure to China’s retail mutual fund industry and the richest deal in dollar terms to receive approval, according to Z-Ben.

From China’s side, the country’s firms are increasingly interested in U.S. financial services as well.

On July 10, China International Capital Corporation announced it agreed to acquire a majority stake in KraneShares, a U.S.- based seller of China-focused exchange-traded funds such as KWEB. The news followed an announcement in March that China Energy Company, or CEFC China, will buy a 20 percent stake in U.S. brokerage Cowen.

China is also growing its own financial firms.

The country already has the third-largest hedge-fund industry in Asia Pacific at $19 billion and could soon surpass the larger hedge-fund industries of Hong Kong and Australia, according to a July Preqin report.

“China could very well be number two or number three in hedge funds and private equity within the next two to three years” in the world, said Timothy Speiss, partner at accounting firm EisnerAmper and chair of the firm’s Asia practice. Between the U.S. and Chinese financial industries, “You’re going to see this tremendous integration.”

Source: Investment Cnbc

Global funds expanding into massive Chinese investment market