Best Buy reported second-quarter earnings and sales on Tuesday that topped analysts’ expectations. Looking ahead, the company has also raised its outlook for the full year and is calling for continued consumer “momentum.”

The Minnesota-based retailer said stronger shopper demand for its technology products, such as smartphones and wearable devices, boosted its sales at established stores over the period.

Best Buy shares were last climbing around 4 percent in premarket hours on the news.

Here’s what Best Buy reported compared to what Wall Street was expecting, based on a Thomson Reuters survey of analysts:

- Earnings of 69 cents a share, adjusted, compared with a forecast profit of 63 cents per share.

- Revenue was $8.94 billion versus an estimate of $8.66 billion.

- Same-store sales climbed 5.4 percent, better than the expected 2.2 percent growth.

“We are pleased today to report strong top and bottom line growth for the second quarter of fiscal 2018,” Best Buy CEO Hubert Joly said in a statement.

“Against a backdrop of continued healthy consumer confidence, we believe broad-based product innovation is resonating with consumers and driving higher spend. And, with our effective merchandising and marketing activities, combined with our expert advice and service available online, in-store and in-home — we are garnering an increasing share of those dollars.”

Best Buy’s net income climbed to $209 million, or 67 cents per share, from $198 million, or 61 cents a share, one year ago. Excluding one-time charges, the company earned 69 cents per share.

Total revenue jumped 4.8 percent, to $8.94 billion.

Sales at stores open for at least 12 months — a metric closely watched by Wall Street for retail stocks — popped 5.4 percent in the second quarter. Analysts were calling for overall same-store sales growth of 2.2 percent, according to Thomson Reuters.

International comps meanwhile increased 4.7 percent, fueled by growth in Canada and Mexico, Best Buy said.

Looking ahead, Best Buy anticipates its sales for the full year to grow 4 percent, compared to a prior forecast of 2.5 percent growth.

The retailer’s increased expectations are being driven by “anticipation of continued positive industry and consumer momentum, coupled with the impact of product launches,” CFO Corie Barry explained.

“Best Buy’s Q2 performance was impressive on multiple fronts, with online revenues up over 30% year-over-year, evidencing continued multi-channel success, and total revenues were up over $400 million, reflecting that traction is increasing,” Moody’s lead retail analyst, Charlie O’Shea, said in a note to CNBC on Tuesday morning.

“Appliances continue as a bright spot, and we expect this favorable trend to continue, and Best Buy’s outlook for the back half of the year reflects its view that overall momentum will continue to build,” O’Shea added.

In Best Buy’s fiscal first quarter, the retailer reported an impressive earnings surprise amid a volatile retail environment.

The 1,400-store chain has said it hopes to see a continued boost from selling higher-margin electronics and appliances at a time when traditional appliance sellers, like Sears Holdings, are losing market share.

Like most retailers today, Best Buy faces stiff competition from Amazon, where more and more purchases are being rung up online.

In turn, Best Buy is also shifting investments toward its digital platform. During the second quarter, Best Buy reported e-commerce sales growth of more than 30 percent.

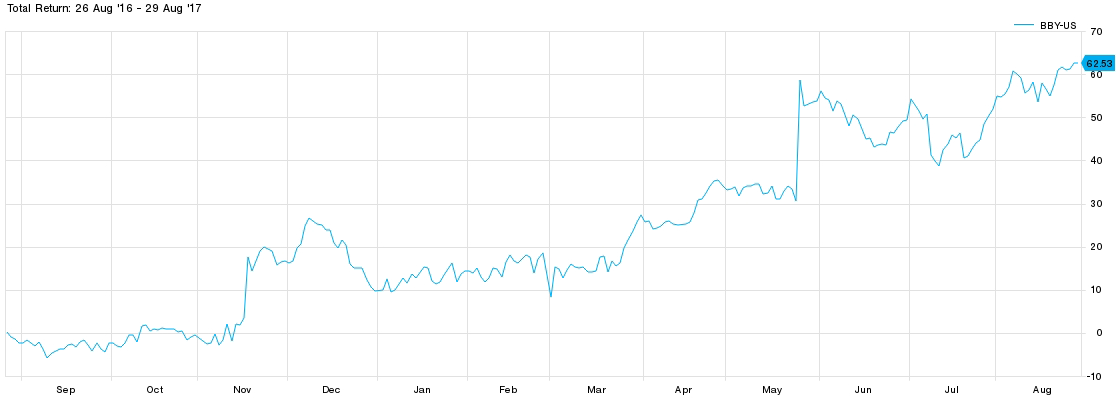

As of Monday’s close, Best Buy’s stock has climbed more than 60 percent over the past 12 months.

Source: FactSet

Source: Tech CNBC

Best Buy earnings, sales top Street estimates; retailer raises full-year outlook