JPMorgan Chase CEO Jamie Dimon took a shot at bitcoin, saying the cryptocurrency “is a fraud.”

“It’s just not a real thing, eventually it will be closed,” Dimon said Tuesday at the Delivering Alpha conference presented by CNBC and Institutional Investor.

Dimon joked that even his daughter bought some bitcoin, looking to cash in on a trend that has seen it soar more than 300 percent this year.

“I’m not saying ‘go short bitcoin and sell $100,000 of bitcoin before it goes down,” he said. “This is not advice of what to do. My daughter bought bitcoin, it went up and now she thinks she’s a genius.”

In an appearance at a separate conference earlier in the day, Dimon said bitcoin mania is reminiscent of the tulip bulb craze in the 17th century.

“It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed,” Dimon said at a banking industry conference organized by Barclays. “Currencies have legal support. It will blow up.”

Dimon also said he’d “fire in a second” any JPMorgan trader who was trading bitcoin, noting two reasons: “It’s against our rules and they are stupid.”

Bitcoin fell to its session lows after Dimon’s comments. As of 3:01 p.m. in New York, bitcoin traded at $4,106.23, down 2 percent.

Dimon’s criticism comes at a time when some of the most well-known figures on Wall Street are starting to embrace the cryptocurrency. Fundstrat’s Tom Lee said he sees bitcoin surging to $6,000 next year and value investor Bill Miller reportedly owns bitcoin.

Even Dimon’s own bank, JPMorgan, has reportedly begun a trial project using blockchain as it tries to cut trading costs. Blockchain is the technology behind bitcoin.

Bitcoin has already soared 315 percent this year.

Earlier on Tuesday, Dimon warned about further declines in trading revenue for the banking giant.

Dimon said third-quarter trading revenue will drop about 20 percent on a year-over-year basis. Dimon also said the bank may not give intra-quarter guidance in the future.

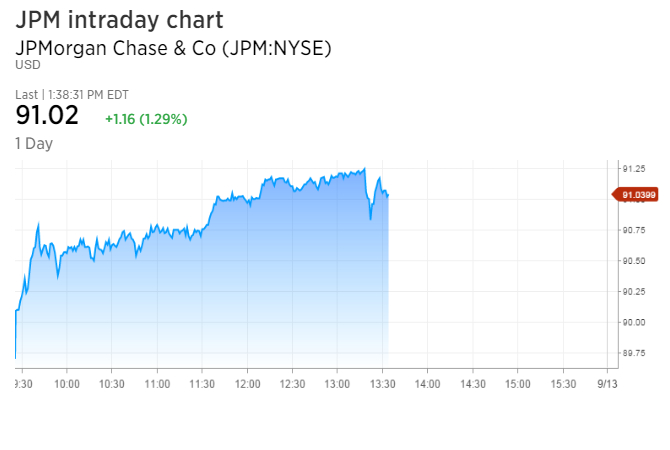

JPMorgan’s stock fell off its session highs on the comments, but remained up 1.4 percent on the day.

This comes just a day after Citigroup CEO John Gerspach issued a similar warning. On Monday, Gerspach said Citi’s trading revenue could fall 15 percent, citing low market volatility.

2017 has been the calmest market in decades. The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, hit its lowest level in more than 20 years earlier this year.

The second quarter was also a weak one for JPMorgan’s trading unit as revenue fell 14 percent during the period on a year-over-year basis.

Dimon will also be speaking later Tuesday at the Delivering Alpha conference in New York.

–With reporting by Wilfred Frost and Jeff Cox

JPMorgan CEO Jamie Dimon says bitcoin is a fraud that will eventually blow up