It’s a valuation call that catapults stocks by 32 percent.

Based on the latest calculations by PNC Asset Management’s Bill Stone, the S&P 500 could hit 3,368 in 2018. And he has a chart that proves it could happen.

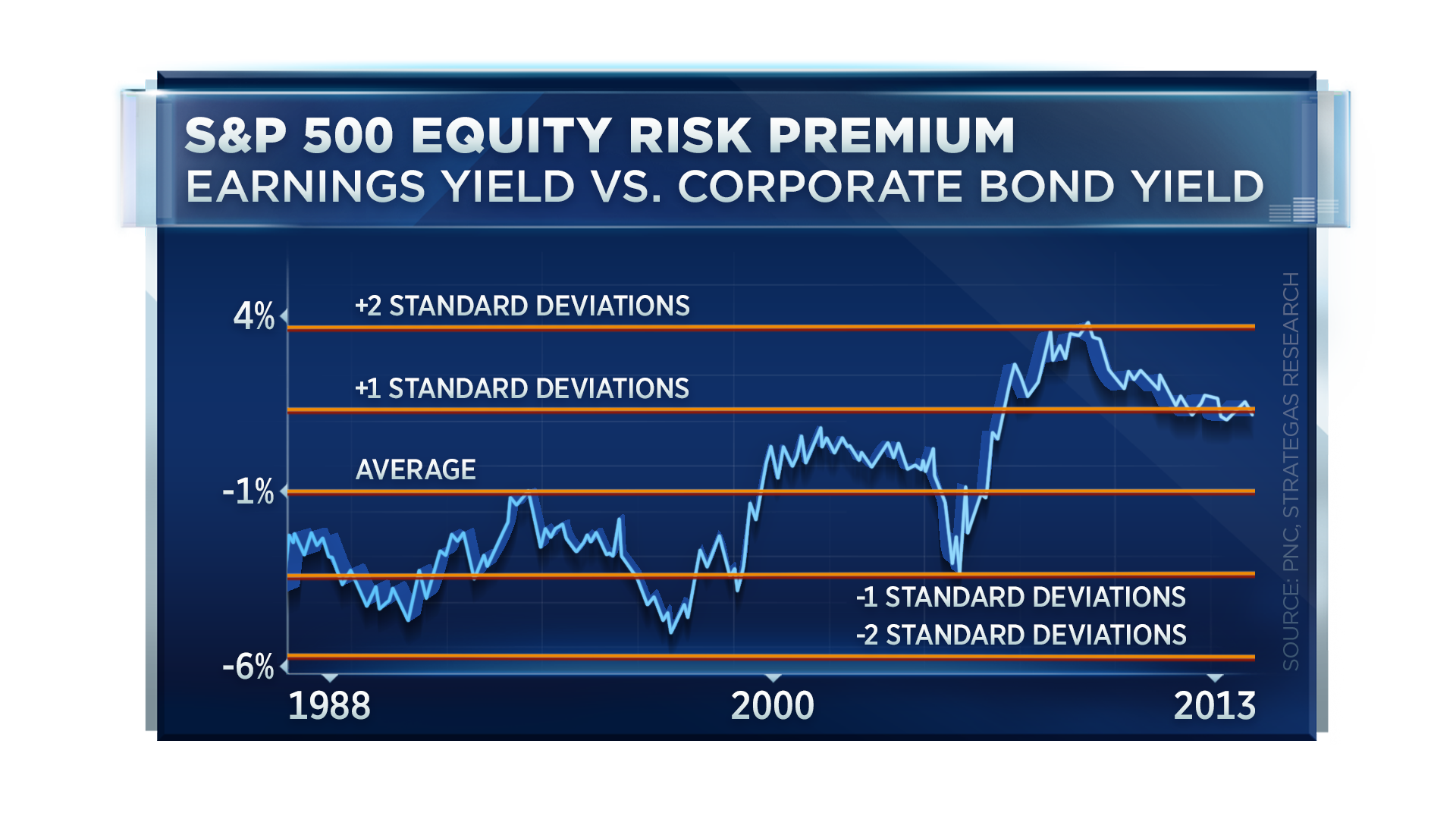

“Part of it came to me watching Warren Buffett on CNBC [Tuesday] really talking about the fact that interest rates matter for valuing stocks,” said Stone on Wednesday’s “Trading Nation.” “All I did is look at what the consensus earnings were for 2018, take a look at where corporate bonds were yielding right now and then assume corporate bond yields move up about one percentage point.”

After Stone did that, he looked at the historical difference between the two.

“That gets you to about a 30 percent upside, believe it or not, for stocks,” added Stone.

Stone, who is the firm’s global chief investment strategist, acknowledges the odds are very low that this scenario would materialize. He said a lot of his assumptions, such as consensus earnings being up 10 percent over 2017, would have to be correct.

But he also makes it clear a 32 percent jump isn’t impossible.

“It at least tells you that stocks are not wildly overvalued, certainly relative to interest rates,” he said.

“It was an exercise to say, you know to people who say, ‘There’s really no upside left in this market. It can’t go up anymore.’ I think, frankly, they just have to realize they’re wrong on that.”

That’s been a bearish argument gaining traction on Wall Street.

On “Trading Nation” last week, former Morgan Stanley Asia Chairman Stephen Roach warned “frothy” markets reminded him of 2007 and the odds are higher than 50 percent that stocks will plunge 10 percent in the final months of the year.

Wells Fargo also turned negative. It’s predicting stocks could fall as much as 8 percent before Jan. 1.

Stone doesn’t appear to be letting the bearish chatter affect his forecast. He’s nailed the stock market so far this year.

On CNBC on Jan. 19, he said the Trump rally was intact and just suffering from “indigestion.” Stone argued stocks still had the ability to hit new highs just as market sentiment was going negative.

Since that interview, the S&P 500 has rallied nearly 12 percent and recorded 41 record high closes.

Stocks are cheap and could rally 32 percent next year — here's the chart that shows why