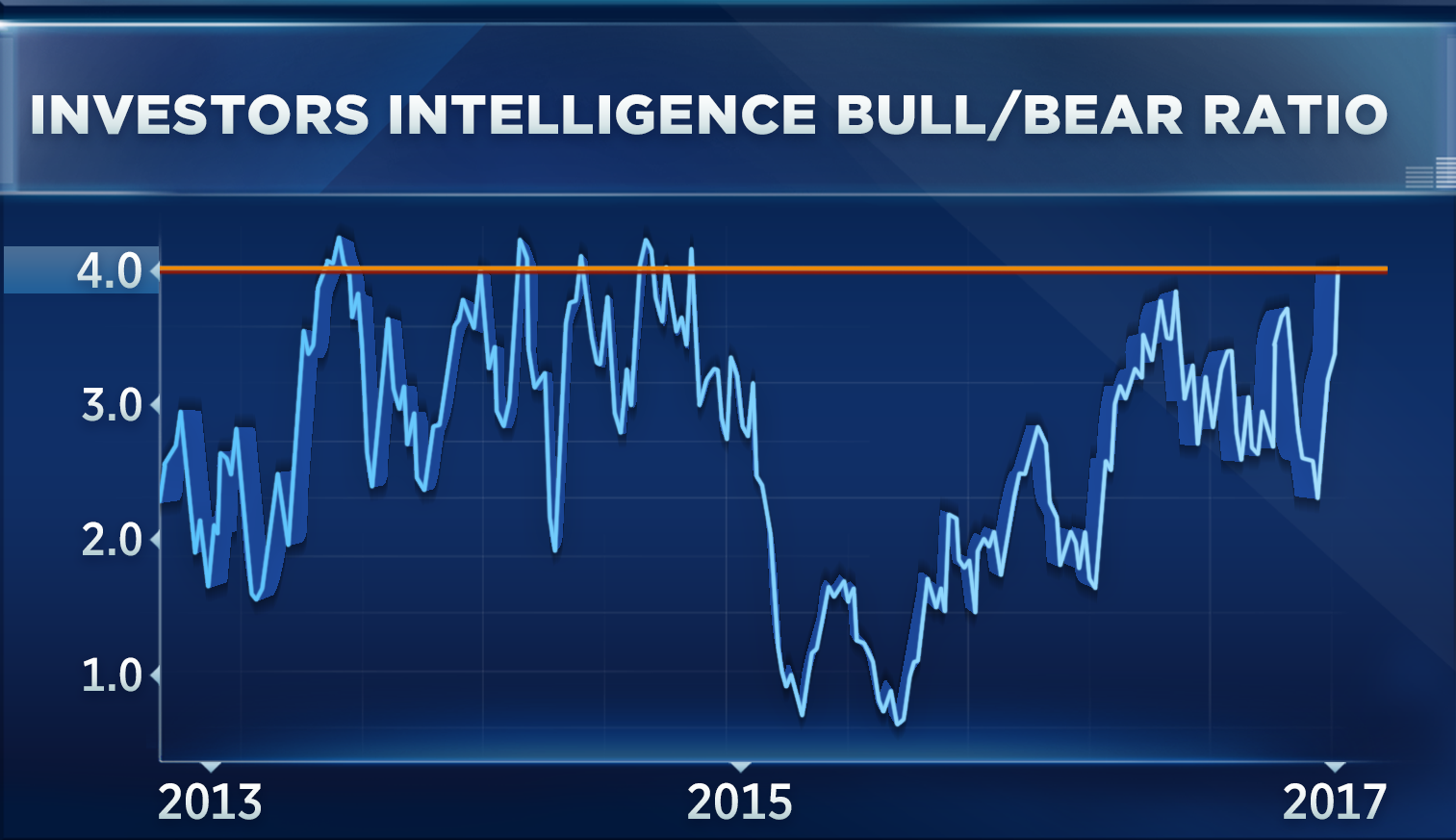

The Investors Intelligence Bull/Bear ratio has climbed back above 4 for the first time since April 2015 — which ironically may serve as a bad sign for the market.

“It does make me nervous, because we’re getting very, very frothy on these social indicators,” trader and strategist Boris Schlossberg of BK Asset Management said Monday on CNBC’s “Trading Nation.”

The traditional thinking is that a rising share of bulls indicates that a hearty share of good news is already priced into stocks. In addition, from a practical perspective, the fact that four investors are bullish for each who is bearish could indicate that there are more potential sellers of stocks than buyers.

To be sure, this is not exactly unprecedented territory for the indicator. The Bull/Bear ratio peaked above 4 at several points in 2014 — and the S&P 500 has risen considerably since then.

But Schlossberg contends that this, in addition to other soft indicators — such as a rising number of Google searches for the term “buy the dip” and a proliferation of bullish magazine covers — collectively serve as “really, really strong indicators that some kind of a countertrend move is going to happen sooner rather than later.”

“I’m very cautious at this point,” he added. “We’re getting into territory that is very much flashing yellow at this point.”

But Oppenheimer technical analyst Ari Wald says that investors ought to suppress their desire to take any gains they may happen to have.

“By itself, these high-optimistic readings are not a very good timing indicator,” Wald said Monday on “Trading Nation.”

He adds that a benevolent credit environment and strong market breadth point to a positive long-term outlook for stocks. Specifically, he is encouraged by the low differential between corporate yields and Treasury yields, and the fact that the number of NYSE-listed stocks hitting 52-week highs is rising.

While granting that “tactically, it’s not the time to be loading up on stocks,” Wald’s bottom line is that “if you do get a pullback, you want to buy it.”

“We don’t think this is a major market top,” the technical analyst said.

Source: Investment Cnbc

Bad news for the bulls: There are now more bulls