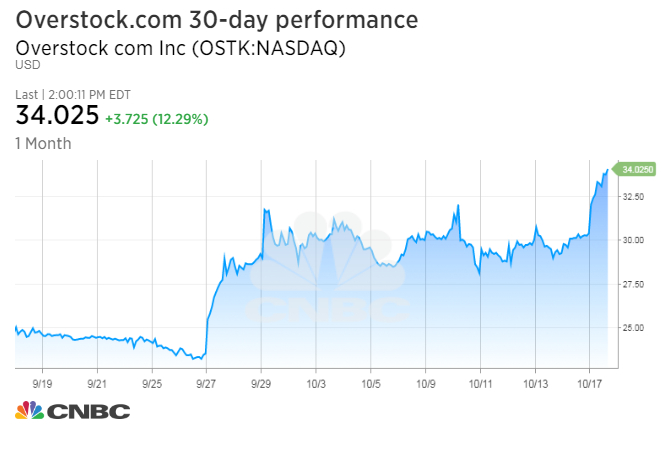

Speculation in digital currency bitcoin is apparently spilling over into an obscure e-commerce stock.

Shares of Overstock.com surged more than 14 percent Tuesday. The stock has hit four-year highs on mounting excitement around the company’s venture into blockchain, the technology behind bitcoin.

“I think the new story for Overstock is that we should anticipate this kind of volatility that historically was limited to when the company reported earnings,” Tom Forte, analyst at DA Davidson, said in a phone interview.

“It is encouraging to see legacy financial services acknowledging the potential of the blockchain to disrupt and transform the financial services industry,” Forte said. “This is adding further fuel to the Overstock fire as investors [see the company’s] early stage investments in blockchain.”

The latest gains in Overstock shares come as major companies announce blockchain-related projects. On Monday, both IBM and JPMorgan Chase announced they are working with banks on separate blockchain-based platforms to improve the efficiency of global payments.

Overstock.com, which primarily sells home goods and clothes online, told CNBC it cannot comment on share price moves. The stock has a market capitalization of around $830 million, versus e-commerce giant Amazon.com‘s $484 billion.

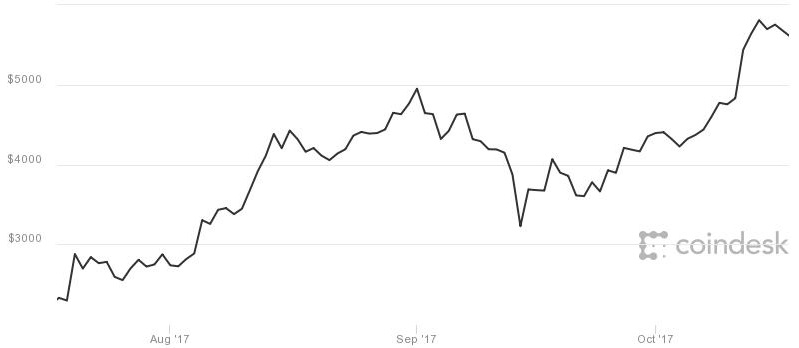

Bitcoin has shot up six times in value to record highs this year, causing a stir on Wall Street. Many banking executives and investors say the digital currency is in a bubble. But the largest banks and technology companies believe in the potential of blockchain. The technology eliminates the need for a third party intermediary within a network by creating a permanent and open record of transactions.

Over the last three years, Overstock’s CEO Patrick Byrne has quietly developed a blockchain-focused division of the company called Medici Ventures. The unit’s majority-owned subsidiary tZero has emerged as a front-runner in applying blockchain technology to trading stocks and digital coins.

Bitcoin 3-month performance

Source: CoinDesk

Long-time short seller Marc Cohodes first heard about Overstock’s blockchain investments in May. He then visited Byrne in June, the first money manager to do so in a decade. The meeting turned Cohodes into a buyer of the stock.

“You’re not paying anything for blockchain and you’re getting retail at a steep discount,” the independent investor said in a phone interview last week. “I think the stock’s going to go to $100,” or 230 percent above Monday’s close.

However, Overstock’s shares swing with a volatility resembling the speculation often seen in digital currencies like bitcoin. A high 14 percent of shares available for trading are also sold short, or in anticipation of a decline in price, according to FactSet.

Shares shot up 23.5 percent on Sept. 27 to their highest since January 2014 after Overstock announced tZero is entering a joint venture with two financial services companies to launch an alternative trading system for trading digital coins. Overstock’s alternative trading system license come from an acquisition of Pro Securities two years ago.

Last Tuesday, shares surged before falling nearly 16.4 percent from session highs as Cohodes presented his positive call on Overstock at an investing conference.

The stock ended last week relatively unchanged, before surging again on Tuesday.

Just as interest in bitcoin has picked up this year, companies’ talk of blockchain has increased over the last 12 months. A CNBC analysis using financial search engine AlphaSense found a rising trend in mentions of “blockchain” and related words in documents from U.S. companies with a market capitalization of more than $5 billion.

The search used AlphaSense’ proprietary algorithm to look at event transcripts, company presentations, press releases and SEC filings, excluding inside ownership forms.

Mentions of “blockchain” and related words for +$5 billion market cap US companies

Source: AlphaSense

Forte expects a traditional financial company to invest in Overstock’s blockchain-development division, to the benefit of the e-commerce company.

To be sure, the business unit that so many investors are betting on is still generating losses. The company reported a pre-tax loss of $3.3 million from its Medici unit in the second quarter, $400,000 more than the same quarter last year.

The company has not yet announced when it will release third quarter results.

Cohodes is unfazed by Medici’s struggles so far. “It’s going to be a loss until it takes off,” he said. He pointed out that in the meantime, Overstock has higher operating profit margins than Amazon.com.

Source: Tech CNBC

Traders bet on obscure e-commerce stock in speculation over bitcoin's blockchain technology