THE president’s tax promise has always been clear: he will reduce the amount middle-earners, but not rich Americans, must pay. Yet every time Donald Trump releases a plan, analysts say it does almost the opposite. The Tax Policy Centre, a think-tank, recently filled in the blanks in the latest Republican tax proposals and concluded that more than half of its giveaways would go to the top 1% of earners. Their incomes would rise by an average of $130,000; middle-earners would get just $660. The White House maintains that tax reform will deliver a much heftier boost to workers’ pay packets. Who is right?

The disagreement boils down to who benefits when taxes on corporations fall. The Tax Policy Centre says it is mainly rich investors. But in a report released on October 16th, Mr Trump’s Council of Economic Advisers (CEA) claimed that cutting the corporate-tax rate from 35% to 20%, as Republicans propose, would eventually boost annual wages by a staggering $4,000-9,000 for the average household.

-

India’s new aviation policies are breathing life into a once-ailing sector

-

The first data from a repository of living human brain cells

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why is the Dutch football team struggling?

-

Zaryadye Park in Moscow is an architectural triumph

The claim has sparked a debate among economists that is as ill-tempered as it is geeky. Left-leaning economists are incredulous. Writing in the Wall Street Journal, Jason Furman, who led the CEA under Barack Obama, pointed out that if the report is right, wage increases would total about three to six times the cost of the tax cut. Larry Summers, a former treasury secretary, wrote that if a student submitted the CEA paper, he “would be hard pressed to give it a passing grade”.

Conservative economists, such as Gregory Mankiw of Harvard University and Casey Mulligan of the University of Chicago, have responded with a barrage of algebra and diagrams. They note that taxes, because they distort incentives, can cost the economy more than they raise in revenues. Economists call the extra cost “deadweight loss”. Once it is reclaimed, tax cuts could benefit workers and firms by more than they cost the Treasury. For instance, investment might rise after corporate taxes fall, sparking competition for workers and pushing wages up. What’s more, standard theory says that, in a small economy integrated with global markets, workers will pay for taxes on capital, because firms can up sticks when levies rise.

Paul Krugman and Brad DeLong, two left-wing economists, have fired back their own Greek and graphs, laced with snark. But Messrs Mankiw and Mulligan showed that the CEA’s prediction is at least logically possible. That does not mean it is reasonable. There are three reasons to doubt it.

First, to calculate its figures, the White House relied on two studies, neither from a peer-reviewed journal, of how wages have varied with corporate-tax rates internationally and across American states. A recent review of such papers, by Jane Gravelle of the Congressional Research Service, found both to be statistically flawed. In any case, Mihir Desai of Harvard Business School, who co-wrote one of them, says that the CEA misinterpreted his work. If you assumed the corporate tax creates a deadweight loss worth ten times the revenue it raises, you might justify the CEA’s numbers, he says. But that is implausible. (As The Economist went to press, the CEA was preparing a second report using other methods to justify the figures.)

Second, the American economy is plainly not small. This makes capital less flighty. And although it may have become more mobile because of globalisation, many investment opportunities in America—in Silicon Valley, say—are hard to replicate elsewhere. This also makes a high corporate-tax rate less likely to send investment abroad.

Third, the White House’s analysis ignores other features of the Republican tax plan, like a proposal to switch to a “territorial” corporate-tax system. Because this would stop taxing the foreign profits of American firms, it might actually encourage investment abroad. And if, as is likely, the tax cut is financed by borrowing, it is likely to push up interest rates and the dollar. That would create an economic drag.

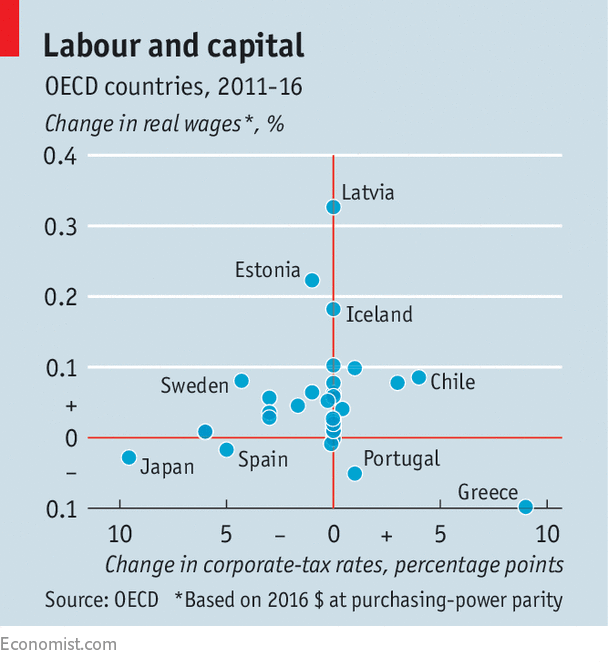

The White House has rushed to include the CEA’s paper in its argument for tax cuts. Yet the estimate is more than a little optimistic. There is no clear relationship between recent corporate-tax cuts and wage growth in rich countries (see chart). Even the Tax Foundation, a think-tank that looks favourably on corporate-tax cuts, predicts a much smaller wage boost. Should Republicans get their way, Americans can expect a pay rise—just not a bumper one.

Source: economist

Will corporate tax cuts boost workers’ wages?