Some tiny stocks are taking a wild ride as traders look for ways to bet on bitcoin’s blockchain technology.

Since bitcoin doesn’t trade on a traditional exchange like the Nasdaq, traders have latched onto any stock claiming some connection to the world of digital coins and blockchain.

Bitcoin is a highly volatile digital currency that has multiplied six times in price this year. The blockchain technology behind bitcoin eliminates the need for a third party like a bank by creating a permanent, open record of all transactions. Many major banks are developing blockchain projects.

Proponents often draw comparisons to the 1990s, when technologies developed in that decade paved the way for Facebook, now a $515 billion market-cap company.

There appears to be another similarity to the 1990s market before the tech bubble burst: speculation in micro-cap stocks that have added “blockchain” to their names, similar to the surge in “dot-com” penny stocks.

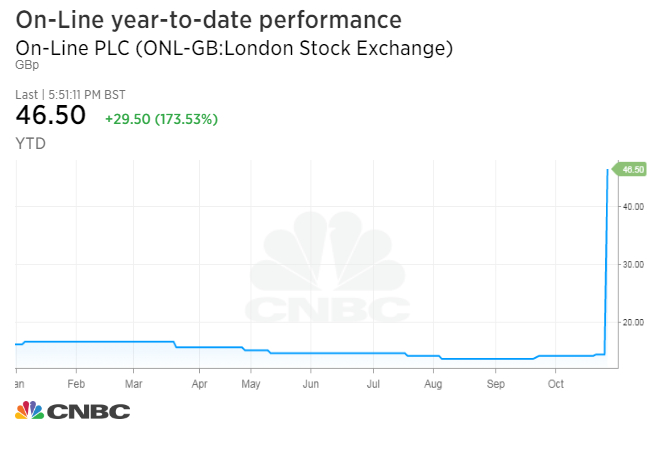

Shares of London-traded On-Line leaped a whopping 173.5 percent Friday after the company said it plans to change its name to “On-Line Blockchain” at its next general meeting. On-Line has a market capitalization of just £3.6 million ($4.7 million) and an archaic website.

On-Line’s home page

Source: CNBC screenshot

An announcement on the website Friday about the share price move said, “the Company’s development of a Block-chain product is still at an early stage of investigation and development.” Testing of the first application is not expected until early 2018, the statement said.

On-Line is just the latest stock to attract traders with the word “blockchain.”

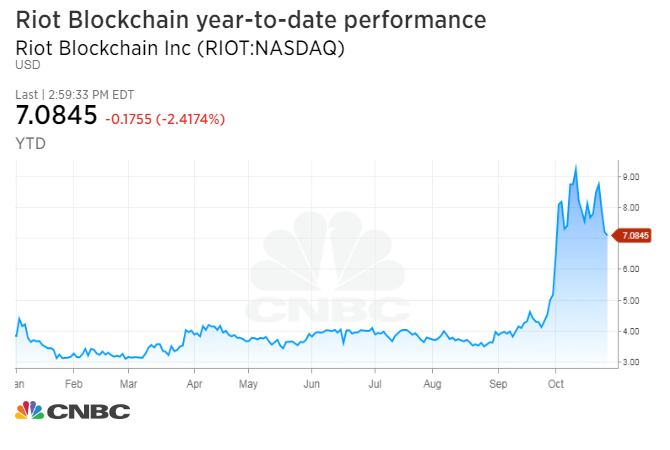

Shares of a Colorado-based biotechnology company leaped nearly 125 percent around its Oct. 4 announcement that it would change its name from Bioptix to Riot Blockchain. The stock, which changed its Nasdaq ticker from BIOP to RIOT, has a market cap of about $37 million.

The company used to focus on blood testing and animal health care. While Riot says on its website that it maintains its Bioptix business, the company now “intends to gain exposure to the blockchain ecosystem through targeted investments in the sector, with a primary focus on the bitcoin and Ethereum blockchains.”

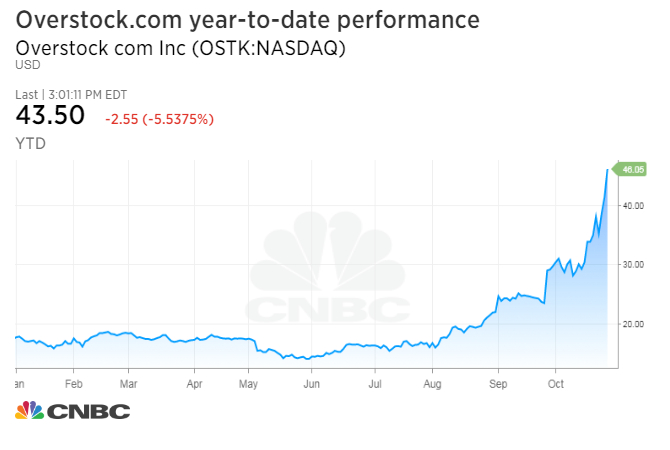

Shares of Overstock.com have also swung wildly amid news of how the company’s majority-owned subsidiary tZero is developing a blockchain-based trading platform. Overstock’s primary business is selling furniture and clothing online, but in 2014 the company launched a division called Medici Ventures focused on blockchain.

The stock has nearly doubled in the last four weeks, helping its market cap just crack $1 billion. In comparison, the leader in e-commerce, Amazon.com, has a market value of $480 billion.

Overstock also has a license for an alternative trading system through an acquisition and this week announced plans for the largest initial coin offering ever at $500 million. An initial coin offering is a way of raising funds by selling digital coins.

Authorities definitely have the high-flying “blockchain” stocks on their radar.

In August, the U.S. Securities and Exchange Commission temporarily suspended trading in three stocks due to questions about the companies’ claims regarding investments in initial coin offerings or other token-related news. As of Friday, the three companies had market capitalizations ranging from $52,000 to $302 million.

The SEC also published an investor bulletin in July warning investors about the risks of participating in initial coin offerings.

Source: Tech CNBC

Want to make your company's stock soar? Here's the quick, easy thing you can do