A hedge fund run by legendary investor Bill Miller now has about 30 percent of its assets in bitcoin, up from 5 percent last year, The Wall Street Journal reported Friday, citing an interview with Miller.

The fund, MVP 1, bought its bitcoin for an average $350 each, the Journal said, citing a letter to investors released last week. With bitcoin trading around $6,100 Monday, that means the fund’s digital currency investments have soared more than 1,600 percent.

Miller managed a fund at Legg Mason that beat the S&P 500 for 15 straight years through 2005, until the downturn of the recession. He left Legg Mason in August 2016 after a 35-year career there and has since founded his own investment firm, Miller Value Partners.

When asked for comment by CNBC, Miller Value Partners referred CNBC to the Journal article.

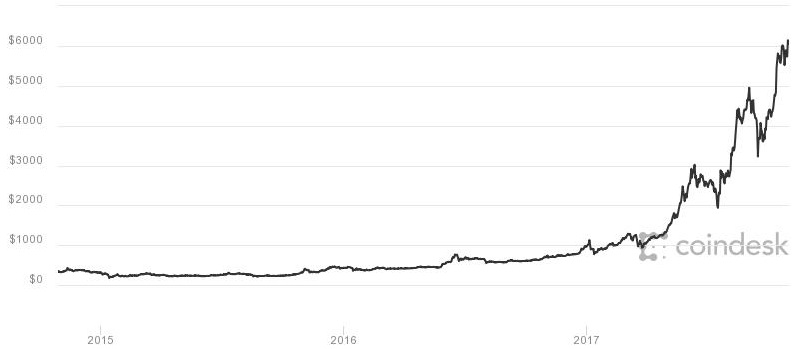

Bitcoin performance (2014 – 2017)

Source: CoinDesk

Miller told the newspaper he isn’t buying more bitcoin for the fund at current prices, but he would be willing to “put 1% of my liquid net worth in it here” if he didn’t already own bitcoin in his personal account.

Forbes reported in July that Miller put 1 percent of his net worth into bitcoin in 2014.

The MVP 1 fund, which has $154 million in assets under management, is up 72.5 percent this year, Miller told the Journal.

The S&P 500 is up about 15 percent this year. A measure of hedge fund performance, the HFRI Fund Weighted Composite Index, was up 5.9 percent through the end of the third quarter.

Bitcoin has sextupled in price for the year. As the price of bitcoin and other digital currencies have soared, the number of funds focused on digital assets has grown to 124, according to financial research firm Autonomous Next.

However, several prominent investors and banking executives have strongly criticized bitcoin. Oaktree Capital’s Howard Marks told investors in September that bitcoin is a “speculative bubble.”

Read the full Wall Street Journal story here.

Source: Tech CNBC

Bitcoin makes up nearly a third of Bill Miller's market-crushing hedge fund, report says