A FEW years ago, the news about the euro-zone economy was uniformly bad to the point of tedium. These days, it is the humdrum diet of benign data that prompts a yawn. Figures this week show that GDP rose by 0.6% in the three months to the end of September (an annualised rate of 2.4%). The European Commission’s economic-sentiment index rose to its highest level in almost 17 years. Yet when the European Central Bank’s governing council gathered on October 26th, it decided to keep interest rates unchanged, at close to zero, and to extend its bond-buying programme (known as quantitative easing, or QE) for a further nine months.

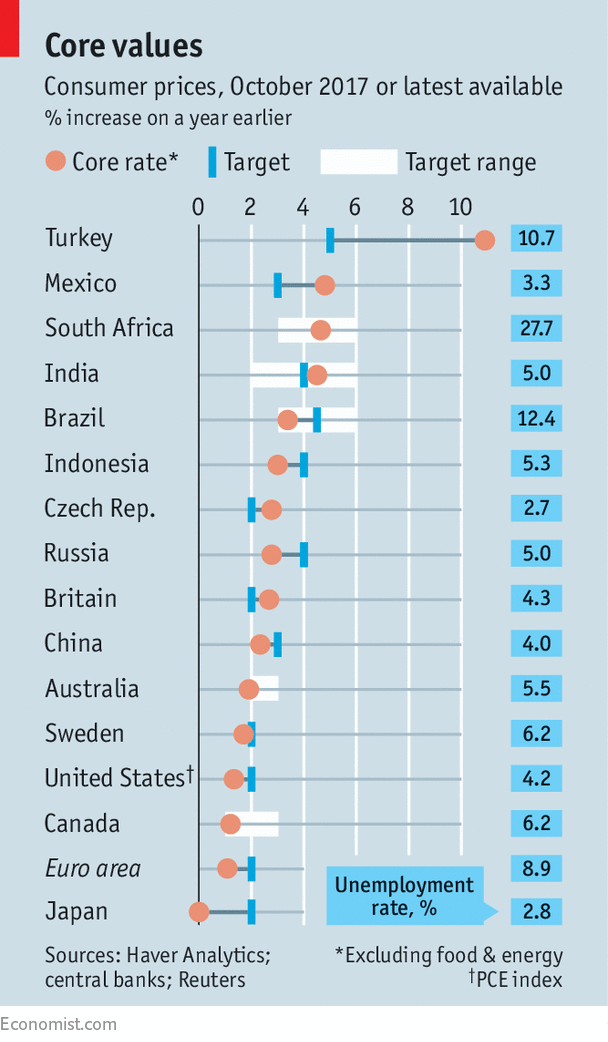

The central bank said it would slow down the pace of bond purchases each month, to €30bn ($35bn) from January. But Mario Draghi, the bank’s boss, declined to set an end-date for QE. A hefty dose of easy money will be necessary, he argued, until inflation durably converges on the ECB’s target of just below 2%. It shows few signs of doing so, despite the economy’s strength. Underlying, or core, inflation, which excludes the volatile prices of food and energy, fell from 1.1% to 0.9% in October, according to data published a few days after the ECB meeting. The euro zone’s miseries of 2010-12 were unique. But in its present, happier state of vigorous activity, low inflation and easy monetary policy, it is like many other big economies (see chart).

-

The making of the “Psycho” shower scene

-

Donald Trump dominates Virginia’s tight governor race

-

Interest rates rise in Britain for the first time in a decade

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why QR codes are on the rise

After a decade of interest rates at record lows, those central banks that are inclined to tighten policy naturally attract attention. The Bank of England’s monetary-policy committee raised its benchmark interest rate from 0.25% to 0.5% on November 2nd, the first increase since 2007. On the same day, the Czech National Bank raised interest rates for the second time this year. The Federal Reserve kept interest rates unchanged this week, having raised them in March and June, but a further increase is expected in December.

In Turkey, perhaps the only big economy that is obviously overheating, the central bank—which has been browbeaten by the president, Recep Tayyip Erdogan, who believes high interest rates cause inflation—opted on October 26th to keep interest rates on hold. Yet in most biggish economies, underlying inflation is below target (see chart) and monetary policy is being relaxed. Brazil’s central bank cut interest rates on October 25th from 8.25% to 7.5%. Two days later, Russia’s central bank trimmed its main interest rate, to 8.25%. This week the Bank of Japan voted to keep rates unchanged and to continue buying assets at a pace of around ¥80trn ($700bn) a year. These economies are gathering strength. It is a puzzle that, in such circumstances, global inflation is stubbornly low.

To figure out why, consider the model that modern central banks use to explain inflation. It has three elements: the price of imports; the public’s expectations; and capacity pressures (or “slack”) in the domestic economy. Start with imported inflation, which is determined by the balance of supply and demand in globally traded goods, such as commodities, as well as shifts in exchange rates. Commodity prices have picked up smartly from their nadir in early 2016. The oil price, which fell below $30 a barrel then, has risen above $60.

This has put upward pressure on headline inflation: in the euro zone it is 1.4%, half a percentage point higher than the core rate. Where inflation is noticeably high, it is generally in countries, such as Argentina (where it is 24%) or Egypt (32%), that have withdrawn costly price subsidies and whose currencies have fallen sharply in value, making imported goods dearer. In Britain, rising import prices linked to a weaker pound have added around 0.75 percentage points to inflation, which is 3%.

A second influence on inflation is the public’s expectations. Businesses will be more inclined to push up their prices and employees to bid for fatter pay packets if they believe inflation will rise. How these expectations are formed is not well understood. The measures that are available are broadly consistent with the central bank’s inflation target in most rich economies. Japan is something of an outlier. It has struggled to meet its 2% inflation target in large part because firms and employees have become conditioned to expect a lower rate of inflation. Japan’s prime minister, Shinzo Abe, recently called for companies to raise wages by 3% in next spring’s wage round to kick-start inflation.

Leave aside the transient effects of import prices, and inflation becomes a tug-of-war between expectations and a third big influence, the amount of slack in the economy. The unemployment rate, a measure of labour-market slack, is the most-used gauge. As the economy approaches full employment, the scarcity of workers ought to put upward pressure on wages, which companies then pass on in higher prices. On some measures, Japan’s labour market is as tight as it has been since the 1970s. America’s jobless rate, at 4.2%, is the lowest for over 16 years. Inflation has nevertheless been surprisingly weak.

In other words, the trade-off between unemployment and inflation, known as the Phillips curve, has become less steep. A paper last year by Olivier Blanchard, of the Peterson Institute for International Economics, found that a drop in the unemployment rate in America has less than a third as much power to raise inflation as it did in the mid-1970s.

The central banks that see a need for tighter monetary policy are worried about diminishing slack. There are tentative signs of stronger pay pressures in Britain and America, and firm evidence of them in the Czech Republic, where wage growth is above 7%. Even so, with inflation expectations so steady, the flatter Phillips curve suggests that the cost for central banks in higher inflation of delaying interest-rate rises is rather low. The ECB is quite a way from such considerations. The unemployment rate is falling quickly, but remains high, at 8.9%. There is still room for the euro-zone economy to grow quickly without stoking inflation. The dull routine of good news is likely to continue.

Source: economist

As the global economy picks up, inflation is oddly quiescent